TANK meets Diaz-Alejandro

Household heterogeneity, non-homothetic preferences & policy design

Abstract

This paper studies the role of households’ heterogeneity in access to financial markets and the consumption of commodity goods in the transmission of foreign shocks. First, I use survey data from Uruguay to show that low income households have poor to no access to savings technology while spending a significant share of their income on commodity-based goods. Second, I construct a Two-Agent New Keynesian (TANK) small open economy model with two main features: (i) limited access to financial markets, and (ii) non-homothetic preferences over commodity goods. I show how these features shape aggregate dynamics and amplify foreign shocks. Additionally, I argue that these features introduce a redistribution channel for monetary policy and a rationale for fear-of-floating exchange rate regimes. Lastly, I study the design of optimal policy regimes and find that households have opposing preferences a over monetary and fiscal rules.

Keywords: Monetary policy, international economics, inequality, household heterogeneity, commodity prices.

1 Introduction

The impact of foreign shocks on aggregate outcomes and inequality in small open economies is a classic question in international macroeconomics, starting with the seminal work of Díaz Alejandro [1963], Fleming [1962] and Mundell [1963]. Furthermore, the design of the optimal policy mix in response to foreign shocks is still an open question.222For instance, Camara et al. [2021] study the cost and benefits of foreign exchange rate interventions. Also, García-Cicco and Kawamura [2015] study optimal fiscal policies in response to commodity price shocks in the presence of heterogeneous households and learning-by-doing frictions. Also, Cugat et al. [2019] study optimal exchange rate policies in the presence of heterogeneous households in a two-sector economy. Recent literature has argued that household heterogeneity plays a crucial role in shaping aggregate dynamics in response foreign shocks (see Cugat et al. [2019], De Ferra et al. [2020] and Auclert et al. [2021]). In this paper, I argue that accounting for households heterogeneity in access to financial markets and in consumption bundles is crucial for understanding both aggregate dynamics and the design of optimal policies in small open economies

To begin with, I use survey data on Uruguayan households to characterize key dimensions of household heterogeneity. First, I argue that households differ significantly in their access to savings technologies. In particular, more than half of the households do not have access to banking accounts, less than a third report having any savings and less than 10% hold any financial assets. In addition, I show that low income households are less likely to have access to these financial tools. Second, I present evidence of Engel’s law or non-homothetic preferences, i.e., low income households spend a significantly higher share of their income in nourishment than high income households. Consequently, low income households are less likely to smooth consumption across time and are more exposed to changes in the price of food.333Furthermore, I argue that for the case of Uruguay, the domestic price of food is significantly correlated with international food and agricultural commodity prices. In consequence, I argue that domestic households are exposed to changes in international food prices.

Then, I construct a Two Agent New Keynesian (“TANK”) small open economy with two main features (i) limited access to financial markets across households (Ricardian and Hand-to-mouth); and (ii) non-homothetic preferences over commodity goods. Thus, Hand-to-mouth agents endogenously spend a higher share of their income in commodity goods than Ricardian households, especially during periods of low income. I show how aggregate and household specific dynamics in response to foreign interest rate and commodity price shocks depend on these novel model features. I argue that non-homothetic preferences exacerbate the impact of foreign shocks, particularly of Hand-to-mouth households which do not have access to consumption smoothing technologies.

Finally, following the description of the model I evaluate the design of optimal policy mixes. First, I argue that under this structural framework monetary policy affects households through a distributional channel. On the one hand, a monetary tightening reduces the consumption of Ricardian households through an intertemporal substitution channel and a reduction of economic output. On the other hand, a monetary tightening appreciates the nominal exchange rate, reducing the domestic price of commodity goods and thus increasing the consumption of Hand-to-mouth households. Additionally, I introduce a fiscal rule which depends on the commodity income. Ricardian and Hand-to-mouth households have opposing preferences over policy mixes. Lastly, I show that households have opposing preferences over monetary and fiscal policy regimes. A monetary policy rule which stabilizes the nominal exchange rate, and consequently the price of Hand-to-mouth’s consumption bundle, provides a new rationale for Central Banks’ fear-of-floating.

Related literature. This paper relates to three different strands of international macroeconomics. First, it relates to a literature which studies the sources of fluctuations in small open economies. Seminal papers in this literature are Mendoza [1991], Neumeyer and Perri [2005] and Garcia Cicco et al. [2012] (emphasizing the role of foreign interest rate shocks), Medina et al. [2007] (emphasizing the role commodity price shocks) and Gali and Monacelli [2005] (in a New Keynesian set up). These papers study how shocks to international interest rates and to commodity price impact small open economies. Additionally, this literature emphasis that these foreign shocks explain a significant share of aggregate fluctuations. For instance, Drechsel and Tenreyro [2018] estimate a medium scale DSGE model for Argentina and show that commodity price shocks explain close to 40% of fluctuations in GDP and consumption. This paper contributes to this literature by introducing a structural framework where households have non-homothetic preferences over the consumption of commodity goods. Consequently, commodity goods explain a significant share of both consumption and export bundles. I argue that these features exacerbate the impact of foreign shocks.444Other papers have introduced non-homothetic preferences to analyze foreign or international shocks. For instance, Do and Levchenko [2017] study the role of non-homothetic preferences in the design of optimal trade policies. More recently, Rojas and Saffie [2020] study the role of non-homothetic preferences during Sudden Stop crises in a tradable and non-tradable setup. This paper differs from the latter paper as it focuses on the role of commodity goods and the design of optimal monetary and fiscal policies.

Second, this paper relates to a literature which studies the impact of agent heterogeneity in small open economies in propagating shocks. For example, Cravino and Levchenko [2017] study the distributional effects of large exchange rate depreciations. Also, De Ferra et al. [2020] develop a Heterogeneous Agent New Keynesian (HANK) model to study the role of household heterogeneity during a current account reversal episode. More recently, Auclert et al. [2021] use a HANK model to quantify the real income channel, i.e., the fall on real income due to a rise in import prices from a depreciation. More closely to the present paper, Cugat et al. [2019] argues that household heterogeneity played a significant role during the 1995 Mexican financial crisis. To quantify the role of this heterogeneity she introduces Ricardian and Hand-to-mouth households and sector specific labor to a New Keynesian set up. This paper contributes to this literature by focusing on households’ heterogeneous exposure to commodity consumption through non-homothetic preferences. I show that this dimension of household heterogeneity amplifies the impact of foreign shocks, but even more so when combined with limited access to financial markets.

Third, this paper relates to a literature which analyzes the design of optimal policies in small open economies. The seminal papers in this literature are Parrado and Velasco [2002] and Gali and Monacelli [2005] which focus on interest rate rules and Camara et al. [2021] which focus on exchange rate interventions. However, these papers focused on representative agent models. For two-agent economies, the work of García-Cicco and Kawamura [2015] and Cugat et al. [2019] stand out. The former paper studies optimal fiscal and macro prudential policies to deal with the “Dutch disease” generated by commodity price shocks in a small open economy populated by Ricardian and Hand-to-mouth households. The latter paper studies optimal monetary policies in an economy populated with Ricardian and Hand-to-mouth households which are also sector-specific (tradable and non-tradable). In line with these two papers, I find that households differ in their preferences over policies mixes. This paper contributes to the literature by providing a novel rationale for the “fear of floating” phenomenon in which Central Banks prefer less flexible exchange rate regimes.555For details on the discussion of “fear of floating” see Calvo and Reinhart [2002]. Hand-to-mouth households prefer Taylor rule regimes which react to exchange rate depreciations as it stabilizes the domestic price of commodity goods (the significant component of their consumption bundle). The welfare gains for less flexible exchange rate regimes is increasing in the degree of non-homothetic preferences.

Organization. This paper consists of 6 sections, starting with this introduction. Section 2 describes the data sets used in the paper and presents micro level stylized facts. Section 3 presents the key model features and Section 4 describes how these features matter for the transmission and amplification of foreign shocks. Section 5 studies the design of optimal policy mixes. Section 6 concludes.

2 Data Description & Households Stylized Facts

In this section of the paper I describe the household level data and present stylized facts which characterize key patterns of income, savings and consumption. I argue that two key dimensions of household heterogeneity are the access to savings technologies and the importance of commodity based goods in consumption baskets.

To start, I describe my micro level data set. I use survey data on Uruguayan households coming from the ”Encuesta Financiera de los Hogares Uruguayos”. This survey was carried out by the Facultad de Ciencias Sociales of the Universidad de la Republica in three stages: 2012, 2014 and 2017. The design of the sample of this survey is based on Uruguay’s 2011 population census. The survey collects cross-sectional socio-demographic and economic-financial information on households, revealing in detail the possession, composition and value of assets and liabilities, income and expenditure, as well as proxy variables to measure access to financial markets and use of means of payment. In total, the survey presents data on 3490 households.

Next, I turn to introducing stylized facts on the Uruguayan households’ patterns of savings and consumption. I focus on describing households’ access to different savings technologies. In argue that low income households have a lower probability of holding savings, owning financial assets or owing financial debt. Additionally, I show that consumption patterns exhibit Engel’s law, i.e., the share of income spent on food and nourishment is decreasing on income.

Fact 1: The share of households which report savings or access to financial tools is low, approximately 20% and 36% respectively. Additionally, the probability of having savings or access to financial tools is strongly correlated with income.

To start, Fact 1 argues that in the cross-section of Uruguayan households there is significant heterogeneity in access to saving technologies.

Binary Response Indicators

First, Figure 1 shows the households’ response to binary survey questions on the access to savings technology. Column (1) shows that only half the households in the sample have at least one member having a bank account (savings or checking account). Column (2) shows that only 20% of households answer “Yes” to having any kind of savings. Column (3) shows that close to 34% of households have some kind of debt. Columns (4) and (5) show that households’ debt is not primarily explained by housing mortgages or debt to carry out home reparations. Column (6) shows that only 2% of surveyed households answer “Yes” to owning financial assets. Overall, the main message this figure conveys is that a significant share of households in the survey have no access to saving technologies. This is line, with a previous literature which has found that significant shares of households in Latin America do not have access to financial markets (see De Ferranti [2004], for instance).

Next, I show that the probability of a household reporting savings, debts or holding financial assets is highly correlated with income. To do so, I carry out a cross-sectional regression analysis of the form

| (1) |

where are binary variables in response to the following set of questions: (i) Any member of the household has a bank account (savings or checking account)?, (ii) Household has any kind of savings?, (iii) Household has any kind of debt?, (iv) Household has any kind of financial asset?, (v) In the last 5 years, has any member of the household had a credit denied? which take the value of one if the answer to the question is “Yes”. Parameter represents the relationship between these binary variables and log total household income, is a set of household controls which include main income earner’s educational level and age.666The survey is designed to be answered by the household’s main income earner. Consequently, I assume that the person who answers the survey or “Person of Reference” is the main income earner. As a robustness check I carry out empirical exercises such as the one in Equation 1 by using the average educational level and age of the “Person of reference” and his/her partner if they have one. Results are robust.777Educational level is defined as the last education level the person started. The different educational levels are: never attended any educational level, elementary school, middle school, high-school or equivalent, technical secondary degree, tertiary degree, professorship degree, non-college tertiary degree, college degree, postgraduate degree.888Age is controlled through a quadratic function to capture a life-cycle component. Table 1 presents the results of estimating Equation 1 using a linear probability model.

| Bank Acc. | Savings | Debt | Fin. Assets | Credit Denied | |

| (1) | (2) | (3) | (4) | (5) | |

| 0.208*** | 0.142*** | -0.00817 | 0.0211*** | -0.0137** | |

| (0.0102) | (0.00918) | (0.0119) | (0.00366) | (0.00550) | |

| HH. Controls | YES | YES | YES | YES | YES |

| Observations999While 3,490 households participate in the survey, 3 households do not report valid ages. This explains the lower number of observations in these regressions. | 3,487 | 3,487 | 3,487 | 3,487 | 3,487 |

| R-squared | 0.286 | 0.212 | 0.010 | 0.058 | 0.018 |

| Robust standard errors in parentheses | |||||

| *** p0.01, ** p0.05, * p0.1 | |||||

Except the binary variable denoting debt holdings, all other variables are highly correlated with the households’ level of income. Consequently, the evidence seems to suggest that low income households have limited access to savings technologies. This result is in line with several papers in the literature.101010For instance, Hong [2020] compute marginal propensities to consume for Peru and show that households are significantly more credit constrained than American households.111111Given the lack of a time-series dimension to the dataset is impossible to test whether the lack of access to savings, debt or financial assets by low income households is cyclical (e.g. a household going through a temporary unemployment spell) or permanent (low educated households being systematically rationed out of financial markets). Furthermore, an incomplete market model with uninsured idiosyncratic risk a la Aiyagari [1994] predicts a positive correlation between income and household savings under standard parametrizations.

Fact 2: Low income households spend a greater share of income in food and beverages than high income households.

The second fact highlights differences in the consumption basket of low and high income households. In particular, low income households spend a significant share of their income on nourishment.121212The survey question asks: “Approximately how much does the household spend on nourishment?(alimentación).” This is a long standing stylized fact in economics usually referred to as Engel’s law.

\floatfoot

\floatfoot

Note: The red line is computed as the cubic fit which produces the best fit (in a least-squares sense).

Figure 2 presents the relationship between the share of expenditure on nourishment and log income. This graph presents strong evidence in favor of Engel’s law.131313In the left tail of the distribution, several households report spending more on nourishment than their total income. This could be driven by measurement error or households using accumulated savings or relying on formal or informal credit/debt during periods of low income/unemployment spells. This is, there seems to be a non-homothetic relationship between income and expenditure in nourishment. On the one hand the average share of income spent on nourishment for households under the median reported income is 55,2%. On the other hand, households above the median on average spend 32.3% of their income on nourishment. In consequence, low income households are more exposed to changes in food prices than high income households. This is of significant importance as Uruguay’s export bundle is highly skewed toward agricultural or food commodity products.141414For more evidence on this, see Appendix A.2.

Finally, I present evidence which connect “Fact 1” and “Fact 2” by arguing that households with lower access to savings technologies spend a higher share of their income on nourishment.

| Question: Household has access to or holds ___ ? | |||||

| Bank Acc. | Savings | Debt | Fin. Assets | Credit Denied | |

| Answer | (1) | (2) | (3) | (4) | (5) |

| No | 50.8% | 47.2% | 42.6% | 44.1% | 43.4% |

| Yes | 36.5% | 30.1% | 45.8% | 27.4% | 48.9% |

| t-test. | 11.36 | 11.05 | -2.38 | 3.75 | -1.87 |

| \floatfootNote: The two entries of each column of the table present the average share of income spent on Nourishment according to the answer to the specific survey question. The “t-test” is computed carrying out a standard “t-test” which test whether the group specific average share of income spent on nourishment is different. | |||||

by access to saving technologies

Table 2 presents the average household share of income spent on nourishment according to whether they have access to the different saving technologies studied above. Columns (1), (2) and (4) show that on average, households which have access to bank accounts, report savings or report holding financial assets spend a significantly lower share of income on nourishment than households which do not have access to these savings technologies (between 30% and 60% lower). Columns (3) and (5) show that on average, households which either report debt or having a credit denied in the last 5 years spend significantly more on nourishment than household which do not report debt or have not had credit requests denied. The last row of Table 2 carries out a “t-test” to show that these group means are statistically different from each other.

In summary, this section used survey data to highlight two dimensions of household heterogeneity. To do so, I presented two stylized facts on households’ savings and consumption patterns emerging from cross-sectional data. Fact 1 argues that a significant share of households in Uruguay do not have access to saving technologies. To this end, I show that a notable share of households report no savings or hold no financial assets. Furthermore, I argue that the probability of reporting access to savings technologies is positively correlated with income. Fact 2 argue that relatively low income households spend a significantly higher share of their income on nourishment than relatively higher income households. These stylized facts are the cornerstone of the theoretical framework constructed in Díaz Alejandro [1963]. To test the aggregate implications of these dimensions of household heterogeneity, in the next section I construct a macroeconomic model inspired on the stylized facts introduced in these facts.

3 Model

This section of the paper presents a structural Two Agent New Keynesian model of a small open economy. The key novel features of this model are: Ricardian and Hand-to-mouth households and non-homothetic preferences over the consumption of a commodity good. Section 3.1 describes the two households’ optimality conditions. Section 3.2 describes the exporting of both commodity and non-commodity goods. The rest of the model is relatively standard and leave the details for Appendix B.

3.1 Households & Non-Homotheticity Preferences

The economy considered is populated by two type of households: Ricardian (””) households, which have access to different savings technologies, and Hand-to-Mouth (””) households which can not save and consequently consume the totality of their income. Parameter represents the share of Ricardian households in this economy.

Ricardian households. This households consume, work, save in domestic and foreign bonds, accumulate capital. Their life-time utility is given by

where and represent this households’ consumption and hours worked respectively; is the discount factor, is the inverse of the Frisch labor elasticity and parameter alters the dis-utility of labor and is used to match steady state hours worked; is the nominal exchange rate, is the Ricardian household consumption price index and represents the household holdings of foreign assets. Function , generates a non-pecuniary externality with respect to their holdings of foreign denominated bonds, which induce independence of the deterministic steady state from initial conditions (see Schmitt-Grohé and Uribe [2003]). The functional form for function is given by

| (2) |

where represents the households preferred target over it’s holdings of foreign assets.151515The term is introduced to accurately deflate the variables inside the parenthesis in Equation 2. More details on the introduction of long run growth and the deflation of variables are presented in Section B.1.

The Ricardian household’s budget constraint is given by

where represents the stock of capital, is the price of capital, are holdings of domestic asset, and are the interest rate on domestic and foreign assets, is workers’ wage rate and represents any profits from firms, commodity production and or net lump sum transfers from the government. Household’s optimality conditions can be characterized by its intra-temporal labor choice and three Euler equations with respect to capital, domestic asset and foreign assets

| (3) | ||||

| (4) | ||||

| (5) | ||||

| (6) |

where is the Lagrange multiplier in the household’s time budget constraint and is the rate of return on capital given by

where is the real rental rate of capital.

Hand-to-mouth Households. The remaining fraction of households consume and work, but are completely excluded from both financial and physical capital markets. This household’s lifetime utility is described by

where and represent consumption and hours worked respectively; is a discount factor, is the inverse of the Frisch labor elasticity. Parameter alters the dis-utility of labor and is used to match steady state hours worked across households.

Hand-to-mouth households are not able to smooth their consumption and, thus, consume their total income every period. The representative hand-to-mouth household’s budget constraint is given by

where is the price of this households consumption bundle, is the nominal wage of the hand-to-mouth households, and represent net taxes/transfers from the government. Hence, this household’s optimality condition include the intra-temporal which relates labor and consumption

| (7) |

but no intertemporal optimality conditions.

Non-Homothetic Preferences over Commodity Goods. Both Ricardian and Hand-to-mouth households have non-homothetic preferences over the consumption of the commodity good. I assume households have the same preferences. Consequently, for simplicity of notation I suppress the household identifier from the rest of the section. The consumption bundle is comprised of a two tier nested aggregator. The first tier is modeled as a mix of Cobb-Douglas and Stone-Geary aggregator between commodity goods and non-commodity goods given by

where and represents households’ consumption of commodity goods and non-commodity goods respectively. Parameter governs the non-homotheticity of households’ over commodity consumption.161616The economy has trend growth, consequently, parameters grows in steady state at the same rate of technology. For more details on the model see Appendix B. This aggregator gives rise to following demand schedules

| (8) | ||||

| (9) |

where and are the domestic currency price of the commodity good and the domestic currency price of the non-commodity aggregator (further described below). The presence of non-homothetic preferences implies that consumers set aside a subsistence level of commodity goods, , and allocate the remaining budget in proportion to parameter . Consequently, the consumption of commodity goods exhibits Engel’s law, i.e., relatively poor households spend a greater proportion of their income on food. To better understand the role of parameters I compute the share of expenditure for the commodity and non-commodity goods for different values.

Figure 3 shows how expenditure shares on the commodity good change as income levels increase when . The solid magenta line shows that when , the preferences presented in Equation 3.1 collapse into the standard Cobb Douglas preferences, i.e., the expenditure share of the commodity good is equal to . The dash and dot lines show the expenditure shares for the commodity (in red) and the non-commodity good (in blue) for a low but positive value of . Note that for low income levels the expenditure share in the commodity goods increase significantly (consequently the expenditure share in the non-commodity good decreases sharply). The skewness of expenditure share increases as increases, as can be seen in the red and blue dashed lines in Figure 3.

Note that the domestic price of the commodity good is assumed to be equal to the international price times the nominal exchange rate (which is the same assumption made for the domestic price of the imported goods in the rest of the model). This is not an innocuous assumption as it implies one-to-one exchange rate pass-through of the commodity good. In Appendix A.3 I study the dynamics of both international and Uruguay’s domestic food indexes and present evidence in support of this model assumption.

Finally, the non-commodity good is itself a CES aggregator of the homogeneous domestic final good and the homogeneous imported good, given by

where and represent the quantities consumed of the domestic and foreign final goods; is a parameter that represents the relative importance of domestic goods in the non-commodity aggregator and is a parameter governing the elasticity of substitution across the two goods. This framework yields standard demand schedules given by

| (10) | ||||

| (11) |

where is the price of the non-commodity consumption bundle, and is the price in foreign currency of the imported good.

3.2 Exports

This section describes the exporting side of the economy. In order to match the dynamics of a small open economy similar to those of Uruguay, exports are comprised of two distinct sub-sectors: a commodity sector and a non-commodity sector. On the one hand, the non-commodity good is produced using the domestic final good and exporters face a downward sloping demand curve which depend on a foreign demand shifter and the real exchange rate (in line with standard SOE-NK models). On the other hand, the commodity sector is characterized by stochastic processes which govern the international price of the good and the local endowment the commodity good.

Non-Commodity Exports. There is a continuum of non-commodity exporting firms. The amount exported of non-commodity goods is denoted by . Foreign demand for this good is given by

| (12) |

where is the price in foreign currency of the exported good, is a foreign demand shifter and is a parameter which governs demand elasticity. Foreign demand is exogenous to the domestic economy. In the above expression, is the non-commodity terms of trade:

| (13) |

Production of the non-commodity good is carried out through a one-to-one technology using domestic final goods as inputs. I assume that a perfectly competitive exporter purchases the domestic homogeneous good at price, . It sells the good at dollar price, , which translates into domestic currency units, . Note that competition implies that price, , equals marginal cost, .

Commodity Exports. The commodity side of exports is governed by stochastic processes. Both prices and quantities produced of the commodity good are determined by exogenous processes. For simplicity, I assume that the endowment process is completely constant at a steady state value of . I assume that the international commodity price follow an process in logarithms

| (14) |

where and are the prices of the commodity good in period and in steady state expressed in foreign currency; and is a Gaussian innovations with standard deviations given by .

The exported quantities of the sector are determined by the difference between the domestic production and the local consumption of the commodity good

In the parametrization of the model in Section 4.1, parameters are chosen such that the economy is a net-exporter of the commodity good both in steady state and for reasonable values of the stochastic processes in the economy.171717In other words, parameters are chosen such that in both the non-stochastic steady state of the economy and under simulations the trade balance of the commodity good is positive.

3.3 Policy

In this economy government is comprised of two distinct policy makers. First, there is a monetary authority which sets a policy rule for the nominal interest rate. Second, there is a fiscal institution which carries out government expenditure of the domestic homogeneous final good.

The central bank sets the nominal interest rate every period following a standard Taylor rule of the form

| (15) |

where is the central bank’s risk-less interest rate, and are the Ricardian and Hand-to-mouth consumption basket inflation rates, is the inflation target, is final output scaled by technology, is the nominal exchange rate. and is an i.i.d. mean zero policy shock. I consider the Taylor rule described by Equation 3.3 as a benchmark and study alternatives in Section 5 where I study the design of optimal policies.

The fiscal authority follows a government expenditure rule every period. This rule is composed of an endogenous and exogenous block.

| (16) |

The first term on the RHS of Equation 16 is comprised of a constant or steady state value of government expenditure. The second term implies that government expenditure reacts to deviations of the commodity price from steady state values via a tax rate .181818This rule is similar to the one proposed by García-Cicco and Kawamura [2015]. However, I abstract from government debt for simplicity. I assume that taxes are levied lump-sum so that the resource constraint is satisfied every period. Consequently, I abstract from government debt issues.191919See García-Cicco and Kawamura [2015] on fiscal expenditure optimal policy rules which take into account government debt explicitly. If , then the government expenditure rule will decrease government expenditure and taxes during periods in which the total revenue of the commodity exporting sector are above their steady state values and increase it when commodity revenues fall. Given that commodity prices explain a large fraction of macroeconomic fluctuations (see Drechsel and Tenreyro [2018]), a rule parametrized to will take the form of a counter-cyclical government expenditure rule.

4 Model Dynamics

This section of the paper carries out impulse response function exercises to analyze the aggregate implications of the different features of the model introduced in Section 3.202020The computation and solution to the model is carried out using the Dynare toolbox version 4.6.3. For more details on this toolbox see Adjemian et al. [2011]. Given that in Section 5 I study the welfare benefits of different policy regimes, I solve the model using a second order approximation around the deterministic steady state. For more details on the solution and computation of the steady state see Appendix B.4. In particularly, I focus on three structural shocks: a foreign interest rate shock, a commodity price shock, and a domestic monetary policy shock. Section 4.1 describes the parametrization of the model based on the micro level stylized facts presented in Section 2 and aggregate moments. Section 4.2 studies how introducing non-homothetic preference over the consumption of a commodity good matter for the transmission of both foreign interest rate and commodity price shocks. Section 4.3 studies the aggregate and household impact of exogenous domestic monetary policy shocks households. Furthermore, I argue that under the framework presented in Section 3 monetary policy affects aggregates through a re-distributive channel.

4.1 Model Parametrization

In this section I describe the parametrization of the model. In particular, I focus on discussing the choice of households’ and aggregate parameter values. This parametrization is the benchmark for the impulse response functions presented in Sections 4.2 and 4.3. Appendix C presents a full description of parameter values.

I begin by describing the parametrization of the Ricardian and Hand-to-mouth household’s parameters. Overall, the rationale behind the choice of households’ parameter is to simultaneously match statistics presented in Section 2: the share of Ricardian and Hand-to-mouth households, and heterogeneity in the share of consumption of commodity based nourishment goods without imposing unrealistic steady state values on models’ variables. Table 3 presents the benchmark numerical values and description of households’ key parameters.

| Parameter | Description | Value |

|---|---|---|

| Discount Factor | ||

| Share of Ricardian HH. | 0.50 | |

| Frisch Elasticity | 1 | |

| Ricardian Labor Dis-utility | 1 | |

| Hand-to-Mouth Labor Dis-utility | 1 | |

| Cons. Share on Commodity | 0.25 | |

| Commodity Non-Homotheticity | 0.45 |

The choice of the discount factor is consistent with a steady state interest rate of 5%, which is in line with EMBI spreads for Uruguay in the last two decades.212121Furthermore, this value of is close to other values used in the literature, for instance higher than the value chosen in Garcia Cicco et al. [2012], but lower than the value used in Cubas et al. [2012]. The choice of a logarithmic utility function over consumption is in line with Cubas et al. [2012] and Camara et al. [2021]. The share of Ricardian households, , is set to 0.50. This motivation behind this value is twofold. Figure 1 in Section 2 the first bar graph in shows that around 50% of Uruguayan households have access to a bank account. However, the amount of savings and/or limits to overdrafts on these banks accounts is not clear. Thus, assuming 50% of Ricardian households is an upper bound on the share of agents with access to saving technologies. Additionally, 50% of Ricardian households is in line with other papers in the literature of TANK models in small open economies (see García-Cicco and Kawamura [2015] and Cugat et al. [2019]). I set the Frisch elasticity equal to 1, in line with Mendoza [2002]. The only parameter values which differ across households are and which are set to match steady state labor across the two type of households. Finally, I set equal to 0.25 and equal to 0.45 such that in steady state commodity expenditure represent 33.69% and 48.43% of Ricardian and Hand-to-Mouth consumption, respectively (in line with the results presented in Table 2).

Second, I describe the numerical values key model parameters that govern aggregate trade and policy rules, presented in Table 4. The first four parameters relate to the export of commodity and non-commodity goods

| Parameter | Description | Value |

|---|---|---|

| SS. Foreign Demand Shifter | 5 | |

| Non-Commodity Export Elasticity | 1.5 | |

| SS. Commodity Endowment | 2 | |

| SS. Commodity Price | 0.15 | |

| Central Bank’s Inflation Target | ||

| Auto-Regressive Parameter Taylor Rule | 0.75 | |

| Inflation Coefficient Taylor Rule | 1.5 | |

| GDP Gap Coefficient Taylor Rule | 0.05 | |

| Exchange Rate Coefficient Taylor Rule | 0.02 |

This parameter choice implies a steady state ratio of total exports to GDP of 33%, with 80% of exports being commodity goods in line with aggregate trade data. Additionally, the steady state price of the commodity good is set to 0.15, in line with firm-customs level data on export prices of commodity and non-commodity goods.222222For more details on aggregate and firm-customs level data see Appendix A.2 for more details. The bottom five parameters of Table 4 govern the central bank’s Taylor rule. The inflation target is set to 5%, in the middle of the 3% to 7% inflation rate set by the Uruguayan Central Bank.232323See https://www.bcu.gub.uy/Politica-Economica-y-Mercados/Paginas/Reportes-de-Politica-Monetaria.aspx. This value is in line with the value used in Cubas et al. [2012]. The numerical values of the Taylor rule’s reaction coefficients are in line with the estimation results of Christiano et al. [2011] and Gonzalez-Rozada and Sola [2014]. In terms of fiscal policies, the value of parameter is set to match a government expenditure to GDP ratio of 30% in line with data coming from the IMF’s WEO. For the benchmark exercises carried out in Sections 4.2 and 4.3 is set to zero.

4.2 Non-Homotheticity & Foreign Shocks

Next, I describe the role of non-homothetic preferences over commodity goods in propagating two relevant exogenous shocks in small open economies: a foreign interest rate shock and a commodity price shock . These exercises shed light on how changes in prices of key inputs of households’ consumption baskets have aggregate repercussions. In particular, I argue that higher degrees of non-homotheticity amplifies the macroeconomic impact of these shocks.

Foreign Interest Rate Shock. First, I study the impulse response functions of a foreign interest rate shock on this small open economy. Figure 4 presents the impulse response functions dynamics.

The rise in the foreign interest rate first impacts the small open economy through the uncovered interest rate parity condition. An increase of 60 annual basis points (see Panel 1.1) leads to a depreciation of the nominal exchange rate (see Panel 1.2). The exchange rate depreciation increases in the domestic currency price of both commodity and imported consumption goods, leading to a jump in the consumption bundle inflation rate of both households (see Panel 1.3). The central bank’s policy rate reacts to the exchange rate pass-through in prices by increasing the nominal policy rate (see Panel 2.1). While the initial depreciation boost exports and the production of the domestic final good for the first two periods after the shock, the higher domestic rate leads to a persistent drop in even 20 periods after the shock. The trade balance exhibits a similar pattern, with a sharp improvement in the first period which rapidly becomes a deficit, and later returns to its steady state value (see Panel 2.3). Ricardian and Hand-to-mouth households’ consumption exhibit a significant drop on impact (see Panels 3.1 and 3.2 respectively). However, Hand-to-mouth’s consumption a significantly greater initial drop and slower recovery. This slow recovery is primarily explained by the persistent drop in real wages measured in terms of the domestic final good (see Panel 3.3).

Next, I study the implications of non-homothetic preferences in the response of household specific variables to a foreign interest rate shocks . Figure 5 shows the dynamics of household specific consumption, consumption price bundles and real wages for the benchmark model (blue solid line) and a parametrization homothetic preferences (magenta dotted line).

Role of Non-Homothetic Preferences

Non-homothetic preferences barely affect response of Ricardian consumption to a foreign interest rate shock (see Panel 2.1). However, non-homothetic preferences lead to a significantly greater and more persistent drop in Hand-to-Mouth consumption (see Panel 2.2). These greater initial drop in Hand-to-Mouth consumption in the model with non-homothetic preferences is partially explained by a greater drop in real wages, measured in terms of domestic final good. Notwithstanding, non-homothetic preferences impact households’ consumption primarily through price indexes. Panel 2.1 of Figure 5 shows that the relative price of the Ricardian consumption bundle with respect to the domestic final good hardly changes with respect to a homothetic exercise. However, Panel 2.2 shows that the increase in the relative price of Hand-to-mouth consumption bundle is five times greater with non-homothetic preferences compared to the homothetic exercise.

In summary, the model’s benchmark parametrization leads to aggregate dynamics in line with other Two Agent New Keynesian models. The introduction of non-homothetic preferences amplifies the dynamics of both households’ consumption. The Hand-to-mouth household is particularly hit due to the drop in real wages and the lack of access to saving technologies. Moreover, non-homothetic preferences implies that as consumption decreases, a greater share of income is spent on the now more expensive commodity good (due to exchange rate pass-through). Thus, non-homothetic preferences amplify the drop in Hand-to-Mouth consumption.

Commodity Price Shocks. Next, I turn to analyzing the model’s dynamics after a commodity price shock. Figure 6 presents the impulse response functions dynamics.

The higher international prices for the commodity good impact the small open economy through two main channels: a transitory wealth effect and an increase in the price of households’ consumption bundle. A 5% international commodity price shock leads to a 1% increase in the domestic currency price of the commodity good (see Panel 1.1). The smaller impact on the domestic currency price of the commodity good is explained by the initial sharp appreciation of the nominal exchange rate (see Panel 2.1). However, the nominal appreciation is short-lived, leading to a mild depreciation in the following periods. The rise in the commodity price leads to an increase in the consumption bundle inflation rate (see Panel 1.3). The monetary authority reacts by increasing the nominal interest rate (see Panel 2.1). On the real side of the economy, the production of the domestic final good expands and the trade balance experiences a surplus (see Panels 2.2 and 2.3). On the one hand, Ricardian consumption experiences a initial drop and a mild expansion in subsequent periods, explained by consumption smoothing to a transitory wealth shock. On the other hand, the commodity price shock leads to a significant drop in Hand-to-Mouth consumption. Finally, Panel 3.3 shows that drop in Hand-to-Mouth consumption is at least partially explained by a drop in real wages measured in terms of the domestic final good.

Again, I analysis the implications of non-homothetic preferences in the response of household specific variables to a commodity price shock .

Role of Non-Homothetic Preferences

Figure 7 presents the dynamics for the benchmark parametrization (blue solid line) and for a homotheticity exercise (magenta dotted line). In line with the results presented for a foreign interest rate shock, non-homothetic preferences primarily affect households which do not have access to saving technologies. To see this, note that under the benchmark parametrization, Ricardian consumption experience a sharper drop on impact, but recovers faster than the case with homothetic preferences (see Panel 1.1). But non-homothetic preferences lead to a drop in Hand-to-Mouth consumption which is almost three times greater than in the homothetic exercise. The drop in Hand-to-Mouth consumption is driven by a significant fall in real wages, measured in domestic final goods, and a greater increase in the price of its consumption bundle.

In short, while the benchmark model parametrization leads to aggregate dynamics in line with a previous literature, non-homothetic preferences matter for household specific dynamics. While Ricardian households experience an increase in consumption after an increase in commodity prices, Hand-to-Mouth households experience a persistent drop in consumption. Moreover, I show that non-homothetic preferences amplify the negative impact of a commodity price shock on Hand-to-Mouth households. These results are in line with a literature which has highlighted how the commodity price boom in the 2000s negatively affected poor income households in Latin American (see Frenkel et al. [2016] for Argentina and Estrades and Terra [2012] for Uruguay) and African (Benson et al. [2008] for Uganda and Shimeles and Woldemichael [2013] for Ethiopia) countries. Thus, this framework highlights an underlying tension which arises in agricultural commodity exporting countries: an increase in commodity prices creates a positive wealth shock for the small open economy but negatively affects poor income countries which spend a significant share of their income in food and have no access to saving technologies.

4.3 Redistribution Channel of Domestic Monetary Policy

In this section of the paper I show that in the structural framework presented in Section 3 monetary policy has a redistribution channel. More specifically, exogenous shocks in the domestic monetary policy rate produce opposite dynamics for the consumption of Ricardian and Hand-to-mouth households. Furthermore, I argue that the relative importance of this redistribution channel increases with the degree of non-homotheticity over the consumption of commodity goods. In order to show this, I carry out impulse response function exercises of a domestic monetary policy shock under different model parametrizations.

First, I study the dynamics of benchmark model after a domestic interest rate shock, presented in Figure 8.

This shock leads to a persistent drop in the domestic currency commodity price (see Panel 1.1) explained by a persistent nominal exchange rate appreciation (see Panel 1.2). The drop in the domestic currency price of the commodity good leads to an overall initial fall in the consumption price bundle inflation (see Panel 1.3). Panel 2.1 exhibit the dynamics of the domestic monetary policy interest rate . The significant drop in the domestic price of the commodity good leads to an initial and brief drop in which later reverts to a temporary increase. The higher interest rate lead to a drop in the production of the homogeneous final good (see Panel 2.2) and a deterioration of the trade balance (see Panel 2.3). Households’ consumption experience exactly opposite dynamics. On the one hand, the Ricardian household experience a hump-shaped decrease in consumption driven by inter-temporal consumption smoothing (see Panel 3.1). On the other hand, Hand-to-mouth households experience a significant increase in consumption (see Panel 3.2). This increase in is explained by both the decrease in the domestic price of commodity goods and an increase in real wages measured in terms of the homogeneous final good (see Panel 3.3). In summary, the structural framework presents aggregate dynamics in line with previous literature (exchange rate appreciation, fall in inflation, drop in economic output), but suggests households react differently to a hike in domestic interest rates.

Next, I study the role of non-homothetic preferences in explaining the opposing households’ consumption dynamics in response to a domestic monetary policy shock.

Role of Non-Homothetic Preferences

Figure 9 presents the dynamics for the benchmark parametrization (blue solid line) and for a homotheticity exercise (magenta dotted line). Note that non-homothetic preferences are not the driving force which explains the opposing consumption dynamics. The inter-temporal smoothing channel leads Ricardian households to reduce consumption under both exercises (see Panel 1.1). Hand-to-mouth households increase consumption (see Panel 1.2) due to the increase in real wages (see Panel 1.3) and the reduction in the consumption price bundle (see Panel 2.2). However, in line with the results presented in Section 4.2, non-homothetic preferences matter for the quantitative impact of a domestic monetary policy shock for Hand-to-mouth households. Panel 1.2 shows that the presence of non-homothetic preferences doubles the increase of Hand-to-mouth consumption, while a significantly smaller impact for Ricardian consumption (see Panel 1.1). The greater increase in is driven by an appreciably greater increase in real wages and significantly sharper decrease in the Hand-to-mouth consumption price index.242424Note that non-homothetic preferences do not affect the Ricardian consumption price index as significantly as the Hand-to-mouth consumption price index

To summarize, the exercises presented in this section showed that under the present structural framework a domestic monetary policy shock impact households’ consumption with opposite signs. Hand-to-mouth households are benefited by the nominal exchange rate appreciation which reduces the domestic currency price of the consumption commodity good. Additionally, I showed that non-homothetic preferences matter for the quantitative impact of a domestic monetary policy shock on Hand-to-mouth households’ variables. These results suggest that monetary policy has a re-distributional channel, negatively affecting Ricardian households while benefiting Hand-to-mouth households.

5 Optimal Policy

This section of the paper computes optimal monetary and fiscal policies from the point of view of both Ricardian and Hand-to-mouth households. I begin by analyzing how different policy regimes affect both aggregate and household specific dynamics in response to exogenous foreign shocks. Then, I compute household specific preferences over the different policy regimes using a second order approximation to the welfare function as in Schmitt-Grohé and Uribe [2004]. I show that Ricardian and Hand-to-mouth households have opposing preferences over policy regimes. Finally, I shed light on the reasoning behind these differences in preferred policy regimes by analyzing how they shape the volatility of households’ consumption and labor profiles and stress the role of non-homothetic preferences over commodity goods.

5.1 Dynamics under Different Policy Rules

Before carrying out the welfare analysis I show how different policy regimes shape aggregate and household specific dynamics in response to foreign interest rate shocks and commodity price shocks. This exercise sheds light on how households value different policy regimes. I consider both monetary and fiscal policy regimes.

Flexible vs fixed exchange rate regimes. First, I consider different monetary policy regime which differ on their exchange rate flexibility. In particular, I compare the dynamics under the benchmark parametrization presented in Figure 4 with a monetary policy regime in which the domestic rate, , increases to reduce changes in the nominal exchange rate. Figure 10 shows this comparison of the benchmark dynamics (solid blue line), a regime with a mid (red dashed line) and high value (dotted magenta line) .

Different Monetary Regimes

The impact of monetary police regimes with less-flexible exchange rate regimes are in line with a previous literature. In response to a foreign interest rate shock, regimes with a less flexible nominal exchange rate (see Panel 1.2), the impact on consumer price inflation is lower or may even lead to deflation (see Panel 1.3). The policy rate shows a more persistent increase (see Panel 2.1). Note that the impact on the real interest rate (proxied by the difference between the dynamics shown in Panels 2.1 and 1.3) is appreciably greater in monetary policy regimes with less flexible nominal exchange rates. The higher domestic interest rate leads to greater drops in the production of the domestic final good (see Panel 2.2) and smaller trade balance surplus (see Panel 2.3).

Following the description of aggregate dynamics, I analyze household specific dynamics under a monetary policy regime with less flexible exchange rates. On the one hand, panel 3.1 shows that, compared to the benchmark parametrization, regimes with less flexible nominal exchange lead to a greater drop in Ricardian households’ consumption. This is driven by the greater response of the policy interest rate which leads to a higher inter-temporal motive. On the other hand, Panel 3.2 shows that Hand-to-mouth households’ consumption actually increases on impact under less flexible regimes. This initial increase is driven by a drop in the consumption price index (see Panel 1.3) and lower drop in real wages measured in the domestic final good (See Panel 3.3). However, this increase is short lived, and after 4 quarters consumption decreases and follows dynamics similar to the benchmark exercise. The opposing impact over households’ consumption dynamics under less flexible exchange rate regimes is in line with the results presented in Section 4.3. The benchmark exercise with a greater nominal depreciation and lower real interest rate leads to a lower impact on Ricardian households’ consumption and in the production of final goods. However, the less flexible regimes reduces the impact on Hand-to-mouth’s consumption price index which may even increase their total income (at least initially).

Pro-cyclical vs counter-cyclical regimes. I now turn to analyzing how fiscal policy can shape aggregate and household specific dynamics in response to commodity price shocks.

Different Fiscal Regimes

In particular, in Figure 11 I compare the benchmark dynamics presented in Figure 6 with two fiscal regimes depending on the value of in Equation 16: (i) a pro-cyclical regime with (dotted magenta line) in which government expenditure increases in response to an increase in the commodity price; (ii) a counter-cyclical regime with (dashed red line) in which government expenditure decreases in response to an increase in the commodity price.

First, a pro-cyclical (counter cyclical) fiscal regime exacerbates (reduces) the aggregate impact of a commodity price shock, compared to the benchmark exercise. For instance, a pro-cyclical fiscal rule leads to a greater impact in consumer price in inflation (see Panel 1.3), and consequently a greater reaction of the domestic monetary interest rate (see Panel 2.1). Furthermore, the pro-cyclical rule increases aggregate demand leading to higher production of domestic final goods (see Panel 2.2). These exacerbation of aggregate dynamics can also be observed in the a greater trade balance surplus and a sharper drop in real wages measured in terms of the domestic final good (see Panels 2.3 and 3.3 respectively).

Second, I show that the pro-cyclical (counter-cyclical) fiscal regime also exacerbates (reduces) the impact of a commodity price shock on households’ consumption dynamics. Panel 3.1 shows that the pro-cyclical regime leads to greater Ricardian consumption, while Panel 3.2 shows that this regime leads to a greater drop in Hand-to-mouth consumption. This greater drop is explained by the aforementioned greater consumer price inflation and the sharper drop in real wages.

In summary, a pro-cyclical fiscal policy regimes in response to commodity prices shocks amplifies the dynamics found under the benchmark parametrization presented in Section. A counter-cyclical fiscal policy rule has the opposite effect, reducing the impact of a commodity price shocks. This result implies significant differences for the households in this economy. On the one hand, Ricardian households experience an even greater increase in consumption under a pro-cyclical rule compared to the benchmark scenario. On the other hand, Hand-to-mouth households experience an even greater drop in consumption under a pro-cyclical expenditure rule compared to the benchmark scenario. Consequently, households’ consumption dynamics differ across fiscal policy rules, as is the case for monetary policy regimes.

5.2 Households’ Preferences over Policy Regimes

This section of the paper presents a normative analysis of households’ welfare under the different policy regimes described in previous sections. To do so, I choose the value of which maximizes

for . I approximate the value of this expected utility using a second order Taylor approximation around the non-stochastic steady state, following Schmitt-Grohé and Uribe [2007]. Furthermore, I compute both the mean and standard deviation of households’ consumption and labor across different values of to shed light on the household specific preferences over policy regimes.252525To carry out the computation of the optimal policy exercise I impose bounds on parameter values. In particular, I set , which implies I consider fiscal policies anywhere between the full pro-cyclical and complete counter-cyclical cases. These bounds are in line with the optimal policy exercise carried out by García-Cicco and Kawamura [2015]. In the case of , I only set a lower bound of 0.0002. This is due to a second order approximation solution to the model fails the Blanchard-Kahn conditions for values under this lower bound. I show that both Ricardian and Hand-to-mouth’s welfare is maximized at values of above this lower bound. I take this result as evidence that imposing a lower bound on does not drive the results of this normative analysis. Finally, I carry out the same optimal policy analysis shutting down non-homothetic preferences, i.e., setting equal to zero.

The results of the optimal policy regimes are presented in Table 5. The main message of this table is that Ricardian and Hand-to-mouth households have opposing preferences over policy regimes. The former prefer regimes with strongly pro-cyclical fiscal policy and relatively more free floating exchange rate regimes, while the latter prefer counter-cyclical fiscal policy and a monetary policy regimes which exhibit “fear-of-floating”. The first panel shows the results for Ricardian households. For both the case with non-homothetic preferences and the case with homothetic preferences, Ricardian households prefer a pro-cyclical fiscal policy. The optimal combination of policy regimes reduce both the volatility of consumption and labor, while simultaneously increasing the mean consumption stream and decreasing average labor (compared to the benchmark case with an acyclical fiscal policy regime and a freely floating exchange rate regime).

| St. Dev. | Mean | |||||

|---|---|---|---|---|---|---|

| Optimal | Optimal | |||||

| Ricardian Households | ||||||

| Non-Homothetic Preferences | 1 | 0.0822 | 0.8612 | 0.8159 | 0.0292 | -0.0267 |

| Homothetic Preferences | 1 | 1.4448 | 0.6189 | 0.3524 | 0.0386 | -0.0019 |

| Hand-to-mouth Households | ||||||

| Non-Homothetic Preferences | -1 | 11.7048 | 0.4074 | 0.3929 | 0.1590 | -0.1880 |

| Homothetic Preferences | -1 | 34.7898 | 0.3415 | 0.4016 | 0.0503 | -0.0409 |

Note: The second and third line present the household specific values of and which maximizes ex ante utility, respectively. The fourth column, “St. Dev. ” presents the ratio of standard deviation of consumption under the optimal values of vector compared to the case of the benchmark parametrization with and . The fifth column, “St. Dev. ” is the analogous exercise but for households’ labor. The sixth column, “Mean ”, represents the percentage increase in the mean household consumption under the optimal set relative to the benchmark parametrization. The last column, “Mean ”, carries out the analogous exercise for households’ labor. The computation of these exercises is carried out using a second-order approximation around the non-stochastic steady state. In the case with homothetic preferences, is set to zero and and are chosen such that households work the same amount of time in steady state.

To better understand the intuition behind Ricardian households’ preferences over policy regimes, Figure 12 shows the mean and standard deviation of Ricardian consumption streams as a function of .

as a function of

\floatfoot

\floatfoot

Note: The computation exercise is carried out for the benchmark specification with non-homothetic preferences. Results are qualitatively similar for the exercise without non-homothetic preferences.

The first panel shows that pro-cyclical fiscal rules lead to higher mean Ricardian consumption streams, compared to acyclical or counter-cyclical rules. Also, for a given fiscal rule, higher exchange rate rigidity decreases mean consumption streams. The second panel shows that pro-cyclical fiscal rules increases the volatility of consumption streams compared to acyclical or counter-cyclical rules. Interestingly, the exchange rate rigidity has a non-monotonic relationship . For a given fiscal policy rule, an increase in exchange rate rigidity initially reduces consumption volatility, but after some intermediate level, further increasing leads to greater volatility. Consequently, the Ricardian households’ optimal set of policy regimes is the fiscal policy which maximizes mean consumption streams. This fiscal policy rule is accompanied of a low-degree of exchange rate rigidity which reduces overall consumption volatility, albeit sacrificing a small degree of mean consumption stream.

Next, I turn to the analysis of optimal policy regimes from the perspective of the Hand-to-mouth households, shown in the second panel of Table 5. Contrary to Ricardian households, Hand-to-mouth households prefer counter-cyclical fiscal policies for both the non-homothetic and homothetic cases. Furthermore, Hand-to-mouth households with and without non-homothetic preferences have preference towards “dirty-float” exchange rate regimes. This set of optimal policy regimes lead to a significant reduction in Hand-to-mouth consumption and labor compared to the benchmark parametrization (see columns 4 and 5 respectively). Additionally, the optimal policy regime leads to a significant increase in the mean consumption stream and a decrease in mean labor compared to the benchmark parametrization.

Once more, to shed light on the Hand-to-mouth households’ preferences over policy regimes, Figure 13 shows the mean and standard deviation of consumption streams as a function of . The first panel shows that the mean is decreasing with the level of fiscal pro-cyclicality.

as a function of

\floatfoot

\floatfoot

Note: The computation exercise is carried out for the benchmark specification with non-homothetic preferences. Results are qualitatively similar for the exercise without non-homothetic preferences.

Also, for a given fiscal policy rule, the relationship between exchange rate rigidity and mean consumption stream is U-shaped. Initial increases in exchange rate rigidity increases mean consumption streams. After certain value of , further increasing exchange rate rigidity decreases mean consumption streams. However, the decreasing segment of the “U” is significantly less steep than the increasing segment. A similar pattern is exhibited by the standard deviation of Hand-to-mouth consumption, with volatility increasing with the degree of fiscal pro-cyclicality. For a given fiscal policy rule exchange rate rigidity has an inverted U-shape impact on consumption volatility. Again, the second segment of the “U” is appreciably less steep than for the Ricardian households’ case. Consequently, Hand-to-mouth household’s optimal policy regime implies counter-cyclical and high-degree of exchange rate rigidity. Finally, while Hand-to-mouth preferences over policy regimes are aligned with and without non-homothetic preferences, the gain in utility from the changes in mean consumption and mean labor streams of moving to the optimal policy regime is three times greater in the case with non-homothetic preferences. This is not the case for Ricardian households, in line with the results presented in Section 4 which show that non-homothetic preferences only significantly amplify the response of Hand-to-mouth households’ consumption.

In summary, the normative analysis carried out in this section leads to the conclusion that in the current structural framework households have opposing preferences over both fiscal and monetary policy regimes. This result presents policy makers with a challenge on which policy regime to put in place. Even more, the preference of Hand-to-mouth for monetary policy regimes with significant exchange rate rigidity is a rationalization for Central Bankers’ “Fear-of-floating” found in the data (see Calvo and Reinhart [2002]). This preference over “dirty float” exchange rate regimes is based on the impact of exchange rate movements have on Hand-to-mouth households’ consumption and labor. Given that non-homothetic preferences exacerbate the impact of exogenous shocks on Hand-to-mouth households’ variables, as seen in Sections 4.2 and 4.3, it is not surprising that the benefits of “dirty float” regimes are increasing in the degree of non-homothetic preferences.

6 Conclusion

In this paper I studied the implications of household heterogeneity for the transmission of aggregate shocks and the design of optimal policy regimes. First, I use household survey data from Uruguay to highlight two dimensions of heterogeneity: access to saving technologies and exposure to commodity based goods. In particular, I show that households which report having no access to saving technologies (proxied by reporting no savings, no bank accounts or no financial assets) spend a significantly higher share of their income in commodity based nourishment than households which do have access to saving technologies. This result is in line with Engel’s law, i.e., the presence of non-homothetic preferences.

Based on this observations, I construct a Two-Agent New-Keynesian small open economy model with two key features: (i) Ricardian and hand-to-mouth agents, and (ii) non-homothetic preferences over commodity goods. I show that these features lead to aggregate responses in line with intuition introduced by Díaz Alejandro [1963]. I emphasize that the presence of non-homothetic preferences exacerbate the impact of exogenous shocks, such as foreign interest rate or commodity price shocks. Finally, I argue that under this framework, domestic monetary policy has a re-distribution channel. On the one hand, an exogenous interest rate hike, appreciates the currency, reduces economic output and leads to a drop in Ricardian households’ consumption. On the other hand, an exogenous interest rate hike appreciates the nominal exchange rate, reduces the domestic price of commodity based goods, leading to an increase of Hand-to-mouth household’s consumption.

Finally, I show that these features lead to households’ having opposing preferences over optimal policy regimes, and provide a rationale for Central Bank’s “fear-of-floating”. Ricardian households’ prefer a more freely floating regime and a pro-cyclical fiscal rule which increase their mean consumption stream, albeit somewhat increasing its volatility. On the contrary, I show that Hand-to-mouth households prefer a “dirty-float” exchange rate regime and a counter-cyclical fiscal policy rule as it stabilizes the price of their consumption bundle. On the contrary, . Additionally, I argue that non-homothetic preferences increases the benefits of “dirty-float” exchange rate regimes (compared to an exercise without non-homothetic preferences).

References

- Adjemian et al. [2011] Stéphane Adjemian, Houtan Bastani, Michel Juillard, Ferhat Mihoubi, George Perendia, Marco Ratto, and Sébastien Villemot. Dynare: Reference manual, version 4. Working Paper, 2011.

- Aiyagari [1994] S Rao Aiyagari. Uninsured idiosyncratic risk and aggregate saving. The Quarterly Journal of Economics, 109(3):659–684, 1994.

- Auclert et al. [2021] Adrien Auclert, Matthew Rognlie, Martin Souchier, and Ludwig Straub. Exchange rates and monetary policy with heterogeneous agents: Sizing up the real income channel. Technical report, National Bureau of Economic Research, 2021.

- Baffes [1991] John Baffes. Some further evidence on the law of one price: The law of one price still holds. American Journal of Agricultural Economics, 73(4):1264–1273, 1991.

- Benson et al. [2008] Todd Benson, Samuel Mugarura, and Kelly Wanda. Impacts in uganda of rising global food prices: the role of diversified staples and limited price transmission. Agricultural Economics, 39:513–524, 2008.

- Calvo and Reinhart [2002] Guillermo A Calvo and Carmen M Reinhart. Fear of floating. The Quarterly journal of economics, 117(2):379–408, 2002.

- Camara et al. [2021] Santiago Camara, Lawrence Christiano, and Husnu Dalgic. Sterilized fx interventions: Benefits and risks. Northwestern University - Working Paper, 1(1):1 – 61, 2021.

- Christiano et al. [2011] Lawrence J Christiano, Mathias Trabandt, and Karl Walentin. Introducing financial frictions and unemployment into a small open economy model. Journal of Economic Dynamics and Control, 35(12):1999–2041, 2011.

- Cravino and Levchenko [2017] Javier Cravino and Andrei A Levchenko. The distributional consequences of large devaluations. American Economic Review, 107(11):3477–3509, 2017.

- Cubas et al. [2012] German Cubas et al. The Rate of Reserve Requirements and Monetary Policy in Uruguay: a DSGE Approach. BCU, 2012.

- Cugat et al. [2019] Gabriela Cugat et al. Emerging markets, household heterogeneity, and exchange rate policy. Unpublished paper, 2019.

- De Ferra et al. [2020] Sergio De Ferra, Kurt Mitman, and Federica Romei. Household heterogeneity and the transmission of foreign shocks. Journal of International Economics, 124:103303, 2020.

- De Ferranti [2004] David M De Ferranti. Inequality in Latin America: breaking with history? world bank publications, 2004.

- Díaz Alejandro [1963] Carlos F Díaz Alejandro. A note on the impact of devaluation and the redistributive effect. Journal of Political Economy, 71(6):577–580, 1963.

- Do and Levchenko [2017] Quy-Toan Do and Andrei A Levchenko. Trade policy and redistribution when preferences are non-homothetic. Economics Letters, 155:92–95, 2017.

- Drechsel and Tenreyro [2018] Thomas Drechsel and Silvana Tenreyro. Commodity booms and busts in emerging economies. Journal of International Economics, 112:200–218, 2018.

- Estrades and Terra [2012] Carmen Estrades and María Inés Terra. Commodity prices, trade, and poverty in uruguay. Food Policy, 37(1):58–66, 2012.

- Fernandes et al. [2016] Ana M. Fernandes, Caroline Freund, and Martha Denisse Pierola. Exporter behavior, country size and stage of development: Evidence from the exporter dynamics database. Journal of Development Economics, 119(1):121–137, 2016.

- Fleming [1962] J Marcus Fleming. Domestic financial policies under fixed and under floating exchange rates. Staff Papers, 9(3):369–380, 1962.

- Frenkel et al. [2016] Roberto Frenkel, J Ros, and D Friedheim. La inflación en argentina en los años 2000. In Workshop Central Banks in Latin America: in Search for Stability and Development, 2016.

- Gali and Monacelli [2005] Jordi Gali and Tommaso Monacelli. Monetary policy and exchange rate volatility in a small open economy. The Review of Economic Studies, 72(3):707–734, 2005.

- Garcia Cicco et al. [2012] J Garcia Cicco, R Heresi, and A Naudon. The real effects of global risk shocks in small open economies. mimeograph, LACEA, 2012.

- García-Cicco and Kawamura [2015] Javier García-Cicco and Enrique Kawamura. Dealing with the dutch disease: Fiscal rules and macro-prudential policies. Journal of International Money and Finance, 55:205–239, 2015.

- Gonzalez-Rozada and Sola [2014] Martin Gonzalez-Rozada and Martin Sola. Towards a’new’inflation targeting framework: The case of uruguay. Uruguayan Central Bank’s Working Paper Series, 2014.

- Hong [2020] Seungki Hong. Emerging market business cycles with heterogeneous agents. Technical report, Tech. rep, 2020.

- Johansen et al. [1995] Søren Johansen et al. Likelihood-based inference in cointegrated vector autoregressive models. Oxford University Press on Demand, 1995.

- Li et al. [2015] Hongbin Li, Hong Ma, and Yuan Xu. How do exchange rate movements affect chinese exports?—a firm-level investigation. Journal of International Economics, 97(1):148–161, 2015.

- Medina et al. [2007] Juan Pablo Medina, Claudio Soto, et al. Copper price, fiscal policy and business cycle in Chile. Citeseer, 2007.

- Mendoza [1991] Enrique G Mendoza. Real business cycles in a small open economy. The American Economic Review, pages 797–818, 1991.

- Mendoza [2002] Enrique G Mendoza. Credit, prices, and crashes: Business cycles with a sudden stop. In Preventing currency crises in emerging markets, pages 335–392. University of Chicago Press, 2002.

- Mundell [1963] Robert A Mundell. Capital mobility and stabilization policy under fixed and flexible exchange rates. Canadian Journal of Economics and Political Science/Revue canadienne de economiques et science politique, 29(4):475–485, 1963.

- Neumeyer and Perri [2005] Pablo A Neumeyer and Fabrizio Perri. Business cycles in emerging economies: the role of interest rates. Journal of monetary Economics, 52(2):345–380, 2005.

- Parrado and Velasco [2002] Eric Parrado and Andrés Velasco. Optimal interest rate policy in a small open economy, 2002.

- Rauch [1999] James E Rauch. Networks versus markets in international trade. Journal of international Economics, 48(1):7–35, 1999.

- Rojas and Saffie [2020] Eugenio Rojas and Felipe Saffie. Non-homothetic sudden stops. Available at SSRN 3753196, 2020.

- Schmitt-Grohé and Uribe [2003] Stephanie Schmitt-Grohé and Martın Uribe. Closing small open economy models. Journal of international Economics, 61(1):163–185, 2003.

- Schmitt-Grohé and Uribe [2004] Stephanie Schmitt-Grohé and Martın Uribe. Solving dynamic general equilibrium models using a second-order approximation to the policy function. Journal of economic dynamics and control, 28(4):755–775, 2004.

- Schmitt-Grohé and Uribe [2007] Stephanie Schmitt-Grohé and Martin Uribe. Optimal simple and implementable monetary and fiscal rules. Journal of monetary Economics, 54(6):1702–1725, 2007.

- Shimeles and Woldemichael [2013] Abebe Shimeles and Andinet Woldemichael. Rising food prices and household welfare in ethiopia: evidence from micro data. African Development Bank Group, Working Paper Series, 2013.

Appendix A Appendix: Additional Data Description & Facts

A.1 Additional Data Description

First, I describe the firm level data coming from Uruguay. The data employed are transaction-level customs data for the period 2001-2012. After suffering the external shock of the Argentinean 2001 sovereign default crisis, Uruguay experienced a period of rapid growth of both the economic output and total exports. Additionally, this period in which the Central Bank of Uruguay implemented an inflation targetting regime. The data was collected by the Trade and Integration Unit of the World Bank Research Department, as part of their efforts to build the Exporter Dynamics Database described in Fernandes et al. [2016].262626The sources for the data for each country are detailed at http://www.worldbank.org/en/research/brief/exporter-dynamics-database. The dataset contains information on the firm identification, value exported, quantities exported measured in kilos, HS6 good classification and the country of destination.

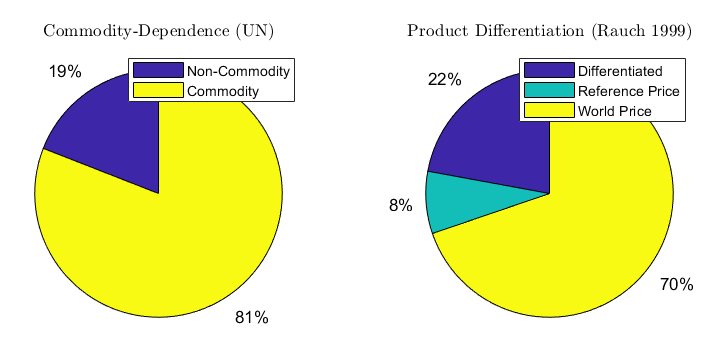

Additionally, across the paper I use several aggregate or macro level datasets across the paper. Data on GDP and the components of aggregate expenditure are sourced directly from the Uruguayan Central Bank.272727See https://www.bcu.gub.uy/Paginas/Default.aspx. More over, the national account data is reported at the quarterly frequency for two different base years periods: 1983 and 2005. To construct a long dataset I seasonally adjust the two datasets and later splice them. This data set is used to calibrate the structural model presented in Section 3 and to analyze the different policy rules presented in Section 5. I complement these aggregate datasets with international trade data which characterize . Particularly, I use the good-classification introduced by Rauch [1999] the commodity dependence indicator developed by the United Nations.282828The State of Commodity Dependence report elaborated by the United Nations can be obtained at https://unctad.org/webflyer/state-commodity-dependence-2019.

A.2 Customs Level Findings

In this section of the paper I characterize the role commodity goods at the aggregate and firm level. In particular, I stress the fact that commodity goods represent the vast majority of the aggregate export bundle. Second, using firm level evidence I show that commodity goods have lower exchange rate elasticities than non-commodity or differentiated goods.