tlcyan \addauthoradolive \addauthorjbmagenta

Social Learning with Bounded Rationality:

Negative Reviews Persist under Newest First

Current version: August 2024111An extended abstract appeared at the ACM Conference on Economics and Computation (EC) 2024.)

Abstract

We study a model of social learning from reviews where customers are computationally limited and make purchases based on reading only the first few reviews displayed by the platform. Under this bounded rationality, we establish that the review ordering policy can have a significant impact. In particular, the popular Newest First ordering induces a negative review to persist as the most recent review longer than a positive review. This phenomenon, which we term the Cost of Newest First, can make the long-term revenue unboundedly lower than a counterpart where reviews are exogenously drawn for each customer.

We show that the impact of the Cost of Newest First can be mitigated under dynamic pricing, which allows the price to depend on the set of displayed reviews. Under the optimal dynamic pricing policy, the revenue loss is at most a factor of 2. On the way, we identify a structural property for this optimal dynamic pricing: the prices should ensure that the probability of a purchase is always the same, regardless of the state of reviews. We also study an extension of the model where customers put more weight on more recent reviews (and discount older reviews based on their time of posting), and we show that Newest First is still not the optimal ordering policy if customers discount slowly.

Lastly, we corroborate our theoretical findings using a real-world review dataset. We find that the average rating of the first page of reviews is statistically significantly smaller than the overall average rating, which is in line with our theoretical results.

1 Introduction

The use of product reviews to inform customer purchase decisions has become ubiquitous in a variety of online platforms, ranging from electronic commerce to accommodation and recommendation platforms. While the online nature of such platforms may hinder the ability of customers to confidently evaluate the product compared to an in-person experience, reviews written by previous customers can shed light on the product’s quality. It is well established that product reviews play a significant role on customer purchase decisions [CM06, ZZ10, Luc16].

The process in which reviews impact product purchases can be seen as a problem of social learning, which generically studies how agents update their beliefs for an unknown quantity of interest (e.g., product quality) based on observing actions of past agents (e.g., reading reviews written by past customers). The typical assumption in the literature of social learning with reviews is that, when deciding whether to purchase a product, customers consider either all reviews provided by previous customers [CIMS17, IMSZ19, GHKV23] or a summary statistic such as their average rating [BS18, CLT21, AMMO22]. The motivation for the latter assumption is that customers have limited time and computational power and thus rely on a summary statistic, often provided by the platform (see Section 1.2 for a further discussion on these lines of work).

However, in practice, a common scenario may be somewhere “in between” the above two assumptions: customers read a small number of reviews in detail. Existing works have found that the textual content of a review contains important information that goes beyond its numeric score and such information can heavily influence purchase decisions [GI10, AGI11, LDRF+13, LLS19, LYMZ22]. Therefore, customers look beyond the average review rating and read a small number of reviews in detail. In particular, [Kav21] find that 76% of customers read between 1 and 9 reviews before making a purchase. This motivates the main questions of our work:

When customers read a limited number of reviews, how does this impact social learning?

Are there operational decisions that should be reconsidered due to this bounded rationality?

To answer these questions, we study a model for a single product (formalized in Section 2), where a platform makes decisions regarding how reviews are ordered and how the product is priced. Customers arrive sequentially and each customer takes only the first reviews into account to inform their purchase decision, where is a small constant. We assume that the ’th customer’s valuation can be decomposed as the sum of a) an idiosyncratic valuation that is known to them and b) a product quality that has a fixed mean ; the latter quantity is unknown to the customer and can only be inferred via the reviews. We assume that when a customer reads a review written by customer , they observe (see Section 1.2 for a discussion of this assumption). Each customer uses reviews to update their belief about , and makes a purchase if their estimate of their valuation is higher than the price. In the event of a purchase, they leave a review that future customers can read.

1.1 Our contribution

A popular review ordering policy is to display reviews in reverse chronological order (newest to oldest); we refer to this policy as . This is the default option in platforms such as Airbnb, Tripadvisor and Macy’s222This statement is based on access on Feb 7, 2024. Many other platforms such as Amazon and Yelp list newest as the second default and have their own ordering mechanism as the default option. as it allows customers to get access to the most up-to-date reviews. In the context of our model, under the ordering, a customer considers the most recent reviews. The set of these reviews evolves as a stochastic process over customer arrivals: when a new purchase happens and thus a new review is provided, this review replaces the -th most recent review.

Cost of Newest First.

By analyzing the steady state of the aforementioned stochastic process, we observe that the ordering policy induces an undesirable behavior where negative reviews are read more than positive reviews, leading to a significant loss in overall revenue (Section 3).

To illustrate this phenomenon, consider a simple setting where customers only read the first review () and the probability of a purchase is higher when the review is positive. When the ’th customer arrives, if the first review is positive, this customer is likely to buy the product and subsequently leave a review; the new review from the ’th customer then becomes the “first review” for the ’th customer. On the other hand, if the first review is negative for the ’th customer, they are less likely to buy the product, and hence the same negative review remains as the “first review” for the ’th customer. Therefore, negative reviews persist under the newest first ordering: a review will stay longer as the first review if it is negative compared to if it is positive.

We show that this arises due to the endogeneity of the stochastic process that induces and results in a loss of long-term revenue. To formalize this notion, we compare to an exogenous process where each arriving customer sees an independently drawn random set of reviews; we refer to this ordering policy as . We establish that the long-term revenue under is strictly smaller than that of under any non-degenerate instance (Theorem 3.1) and that the revenue under can be arbitrarily smaller, in a multiplicative sense, compared to (Theorem 3.2). We refer to this phenomenon as the Cost of Newest First (CoNF).

Dynamic pricing mitigates CoNF.

Seeking to mitigate this phenomenon, we consider the impact of optimizing the product’s price (Section 4). We show that even under the optimal static price, the CoNF remains arbitrarily large (Theorem 4.1). However, if we allow for dynamic pricing, where the price can depend on the state of the reviews, we show that the CoNF is upper bounded by a factor of when the idiosyncratic valuation distribution is non-negative and gracefully decays with its negative mass otherwise (Theorem 4.2).

This improvement stems from the fact that dynamic pricing allows us to change the steady state distribution of the stochastic process. Recall that, under , the stochastic process spends more time on states with negative reviews than states with positive reviews. The optimal dynamic pricing policy sets prices so that the purchase probability is equal across all states (Theorem 4.4) — this ensures that the steady state distribution under is the same as that of .

A broader implication of this result is that, when purchase decisions depend on the state of the first reviews, platforms that offer state-dependent prices can be arbitrarily better off than platforms that are unaware of this phenomenon and statically optimize prices (Theorem 4.6).

Time-discounting customers.

Having identified the potential inefficiency of the ordering policy, we extend our model to incorporate the main reason behind its popularity: customers often prefer to read more recent reviews as they contain more up-to-date content. A recent survey [Mur19] shows that of the participants only look at reviews within the last two weeks and over of the participants disregard any review that was not posted in the past three months.

To capture this recency-awareness, we extend our model to allow for customers to place more weight on more recent reviews when they update their beliefs (Section 5). Despite the presence of CoNF, when customers severely time-discount, we show that yields the highest revenue (Theorem 5.1); in the other extreme where customers do not discount at all, maximizes revenue (Theorem 5.2). Interestingly, when customers discount slightly, neither of or maximizes revenue; it is better to consider a finite window of the most recent reviews, and select reviews at random from this set (Theorem 5.3). Finally, we show that the CoNF interacts with the discount factor in a non-trivial way. For a random set of reviews, if higher weights imply a higher purchase probability, then one would expect that non-discounting customers purchase more than discounting customers. However, due to the CoNF, we show that there are cases in which discounting customers yield a higher purchase rate than non-discounting customers (Theorem 5.4).

Empirical evidence from Tripadvisor data.

Finally in Section 6, we corroborate our theoretical findings using real-world review data from Tripadvisor, an online platform where the default review ordering policy is newest first. We evaluate 109 hotel pages, and we find that for 79 of them, the average review rating of the first 10 reviews is lower than the average review rating of all reviews. These empirical findings support our main theoretical results with statistical significance.

1.2 Related Work and Comparison of Key Modeling Assumptions

Social learning and incentivized exploration.

Classical models of social learning from [Ban92] and [BHW92] study a setting in which there is an unknown state of the world and each agent observes an independent, noisy signal about the state as well as the actions of past agents. The agent uses this information to update their beliefs and then takes an action. In this setting, undesirable “herding” behavior can arise: agents may converge to taking the wrong action. Conceptually closer to our work, [Say18] shows that dynamic pricing can mitigate the aforementioned herding behavior. Subsequent works study how social learning is affected by the agent’s signal distribution [SS00], prior for the state [CDO22], heterogeneous preferences [GPR06, LS16], as well as the structure of their observations [AMMO22]. From a different perspective, there is a stream of literature that aim to design mechanisms to help the learning process, either by modifying the information structure [KMP14, MSS20, BPS18] or by incentivizing exploration through payments [FKKK14, KKM+17].

Social learning with reviews.

Closer to our work, several papers focus on the setting where customers learn about a product’s quality through reviews [HPZ17, CIMS17, BS18, SR18, IMSZ19, CLT21, AMMO22, GHKV23, Bon23, CSS24]. This literature induces several modeling differences compared to classical social learning. First, agents do not receive independent signals of the unknown state (the product quality). Second, agents not only observe the binary purchase decision of previous agents, but also the reviews of previous agents who purchased the product. We highlight the key modeling assumptions of our work and how they relate to existing works.

No self-selection bias.

In prior works of social learning with reviews, the main difficulty stems from the self-selection bias, the idea that only customers who value the product highly will buy the product and hence these customers leave reviews with higher ratings. In the presence of self-selection bias, [CIMS17] and [IMSZ19] study conditions in which customer beliefs eventually successfully learn the quality of a product, where customers update their beliefs based on the entire history of reviews. [AMMO22, BS18, SR18, CLT21] consider models in which customers only incorporate summary statistics of prior reviews (e.g., average rating) into their beliefs. [Bon23] analyzes how the magnitude of the self-selection bias depends on the product’s quality and polarization. [CSS24] consider a model where the platform’s pricing decision affect the review ratings and characterizes the impact of the price on the average rating. This is also empirically supported by [BMZ12] which shows that Groupon discounts lead to lower ratings. [HPZ17] study a two-stage model which quantifies both self-selection bias and under-reporting bias (reviews are provided only by customers with extreme experiences); see references within for further related work.

In contrast, our work studies a model where self-selection bias does not arise. Specifically, we assume that customer ’s valuation can be decomposed as , where is customer-specific, and has a fixed mean shared across customers. The quantity is the unknown quantity of interest for all customers. Our model assumes that a review reveals . In contrast, prior works assume that a review reveals and one cannot separate the contribution from each term. This means that, in our model, the customer-specific valuation and the pricing decision affect the purchase probability but do not affect the review itself conditioning on a purchase. Although our assumption makes it “easier” for customers to learn , we study a new phenomenon that arises due to the fact that customers only read a small number of reviews.

The practical motivation for our modeling assumption is the following. On most online platforms, a review is composed by both a numeric score (e.g., 4 out of 5) and a textual description that further explains the reviewer’s thoughts. Within our model, one interpretation is that the numeric score reveals , but one can use the textual content of the review to separate from . Therefore, we assume that reading the text of the review reveals , but we also assume that each customer only reads a small number of reviews since reading the text takes time. Even though most platforms provide the average score of the numeric ratings, this will suffer from self-selection bias (as shown in [BS18, CLT21]) and hence customers must read reviews in detail to learn .

[GHKV23] also study a setting with no self-selection bias (without bounded rationality), focusing on dynamic pricing. Their model assumes that customers are partitioned into a finite number of types and only read reviews written by customers of the same type. This overcomes self-selection bias as customers of the same type can be thought of as having the same value of in our model.

Belief convergence vs. stochastic process.

In the existing literature, social learning is deemed “successful” if the customer’s estimate of product quality converges to the true quality. This convergence can either be that their belief distribution converges to a single point [IMSZ19, AMMO22], or that the customer’s scalar estimate of the product quality (e.g., average rating) converges to the true quality [CIMS17, BS18]. In our setting, customers update their beliefs based on the first reviews and, as discussed above, these reviews evolve across customers as a stochastic process. Therefore, customer beliefs do not converge but rather oscillate based on the state of those reviews, even as the number of customers goes to infinity.

Closer to our work, [PSX21] study a similar model (without bounded rationality) and show that the initial review can have an effect on the proclivity of customer purchases and the number of reviews. This bias introduced by initial reviews is also empirically observed by the work of [LKAK18]. Unlike our model, this effect diminishes over time as the product acquires more reviews and the initial review becomes less salient. Our results on the Cost of Newest First can thus be viewed as a stronger version of the result in [PSX21] as we show that, in the presence of bounded rationality, the effect of negative reviews persists even in the steady-state of the system.

Fully Bayesian vs. non-Bayesian.

Existing papers differ in whether customers incorporate information from reviews in a fully Bayesian or non-Bayesian manner. For example, [IMSZ19] and [AMMO22] study a fully Bayesian setting where all distributions (prior on , distribution of ) and purchasing behaviors are common knowledge and each customer forms a posterior belief on using the information given to them. In contrast, [CIMS17] and [CLT21] assume that customers use a simple non-Bayesian rule when making their purchase decision. Moreover, [BS18] study both Bayesian and non-Bayesian update rules and compare them.

In our paper, customers use a Bayesian framework but their update rule is not fully Bayesian. Specifically, customers start with a Beta prior on . This prior need not be correct as we assume that is a fixed number. We assume reviews are binary (0 or 1), and customers read of them and update their beliefs assuming that these reviews are independent draws from . However, this is not necessarily the “correct” Bayesian update rule for the customers, due to the endogeneity of the stochastic process of the first reviews. That is, under the ordering rule, negative reviews are more likely to persist as the most recent review — hence even if , the most recent review is more likely to be negative than positive. Therefore, a fully Bayesian customer should take this phenomenon into account when updating their beliefs. We assume that customers do not account for this (and hence are not fully Bayesian), and we study the impact of how this endogeneity impacts the steady state of the process. Our model also implicitly assumes that customers do not use additional information about previous customers’ non-purchase decisions (which are typically non-observable) and the platform’s pricing policy (which is often opaque).

Finally, our model is flexible in that it allows customers to map their belief distribution to a scalar estimate of in an arbitrary manner, e.g, the mean of the belief distribution (which is considered in most prior work) as well as a pessimistic estimate thereof (as studied in [GHKV23]).

Other work on social learning with reviews.

[HC24] study the design of rating systems motivated by the idea that older reviews become less relevant. In a setting where the product’s quality changes, they show that a moving average rating system is optimal in reflecting the true quality. Social learning with reviews has also been studied for ranking [MSSV23], incorporating quality variability [DLT21], dealing with non-stationary environments [BPS22], and has been applied to green technology adoption [RHP23].

2 Model

We consider a platform that repeatedly offers a product to customers that arrive in consecutive rounds . The customer makes a purchase decision based on a finite number of reviews and the price; if a purchase occurs, they leave a new review for the product. We consider the platform’s decisions regarding the ordering of reviews as well as the price.

Customer valuation. The customer at round has a realized valuation for the product, where and represent the contribution from the product’s unobservable and observable parts respectively. Specifically, is drawn independently from for each customer , where is the same across all customers and is unknown to them. Contrastingly, the quantity is customer-specific and is known to customer before they purchase. We assume that, at every round , is drawn independently from a distribution with bounded support. The platform knows the distribution but not .

If the customer at round knew their exact valuation , then they would purchase the product if and only if , where is the price of the product at time . However, is unknown and hence so is . We assume that the customers read reviews to learn about , and their purchase decision depends on their belief about after reading the reviews. Note that customers cannot aim to estimate beyond estimating , since is drawn independently for each customer.

Review generation. If the customer at round purchases the product, they write a review that future customers may read. The review rating given by customer is (see Section 1.2 for a discussion of this assumption). We often refer to a review with as positive and to a review with as negative. We denote by the rating of customer ’s review, where if customer did not purchase the product.

2.1 Customer Purchase Behavior

We describe the customer purchase behavior at one round, taking the price and the review ordering as fixed. Customers have a prior for the value of , for some fixed . This prior need not be correct and could be based on information about the features of the product or summary statistics of all reviews which are subject to self-selection bias (see discussion in Section 1.2). Customers read the first reviews that are shown to them to update their prior. Formally, letting denote the ratings of the first reviews shown, the customer creates the following posterior for the unobservable quality :

This corresponds to the natural posterior update for if each is an independent draw from .333The reviews are not necessarily independent draws from , hence the customers are not completely Bayesian. See the last point in Section 1.2 for a detailed discussion. Note that the customer places equal weight on the first reviews (we also consider time-discounted weights in Section 5). Based on this posterior, the customer creates an estimate for their valuation. We assume that there is a mapping from their posterior to a real number that represents an estimate of the fixed valuation . For example, the mapping represents risk-neutral customers, while if corresponds to the -quantile of for , this represents pessimistic customers (see Section 5.1). The customer then forms their estimated valuation and buys the product at price if and only if . Finally, the customer leaves a review if they bought the product, otherwise .

To ease exposition, we often use to denote the number of positive ratings (i.e., ), and we overload notation to denote by to refer to . We make the natural assumption that higher number of positive ratings leads to a higher purchase probability.

Assumption 2.1.

The estimate is strictly increasing in the number of positive reviews .

We also assume that the idiosyncratic valuation has positive mass on non-negative values.

Assumption 2.2.

The distribution has positive mass on non-negative values: .

We denote the above problem instance as for product quality , prior parameters , idiosyncratic distribution , customers’ attention budget , and an estimate mapping .

2.2 Platform Decisions

We consider two platform decisions, review ordering and pricing.

Review ordering. With respect to ordering, since customers only take the first reviews into account, choosing an ordering is equivalent to selecting a set of reviews to show. Let be the set of previous rounds in which a review was submitted and let be the observed history before round . At round , the platform maps (possibly in a randomized way) its observed history to the set of review ratings corresponding to the reviews shown. We study the steady-state distribution of the system; to avoid initialization corner cases, we assume that at time , there is an infinite pool of reviews where . We consider the following review ordering policies:

-

•

selects the newest reviews. This is formally defined as where is the rating of the -th most recent review.

-

•

selects reviews uniformly at random (without replacement) from the most recent reviews, independently at each round . Note that .

-

•

shows random reviews. This corresponds to ratings being drawn independently from at each round ; i.e., where .

Formally, is defined as the limit of as (see Appendix A for details). Note that, under , the customers’ and platform’s actions at the current round do not influence the reviews shown in future rounds (i.e. the reviews are exogenous). In contrast, under and for any , the customers’ and platform’s actions influence what reviews are shown in future rounds (i.e. the reviews are endogenous to the underlying stochastic process).

Pricing. The platform also decides on the pricing policy, where the price at each round can depend on the set of displayed reviews. We denote a pricing policy by a function , which maps the set of displayed review ratings to a price. We study two classes of pricing policies: static and dynamic. We let be the set of pricing policies that assign a fixed price , i.e., for any . Similarly, includes the set of pricing policies where can depend on the review ratings .

2.3 Revenue and the Cost of Newest First

For an ordering policy and pricing policy , we define the revenue as the steady-state revenue:444The policies we consider have a stationary distribution so, in our analysis, we replace the with a .

| (1) |

Our main focus lies in understanding the effect of the ordering policy on the revenue. Specifically, we compare the revenues of the ordering policies and . For a pricing policy , we define the Cost of Newest First (CoNF) as follows:555For all the policies we consider, . This is formalized for in Definition 3.1.

If , i.e., for any we use and as shorthand for the corresponding steady-state revenue and CoNF.

In Section 4, we study the CoNF when the platform can optimize its pricing policy over a class of policies. For a class of pricing policies , we define similarly the optimal revenue within-class with respect to an ordering policy and the corresponding CoNF as:

To ease exposition, we make the mild assumption that .666For the policies we consider, by Assumption 2.2 and the fact that ; is satisfied if the maximum revenue from a customer’s idiosyncratic valuation is finite, i.e., .

Finally, we note that, unlike classical revenue maximization works, our focus is not on identifying policies that maximize revenue but rather in comparing the performance of different ordering policies ( vs ) and different pricing policies ( vs ).

Remark 2.1.

Our assumption of Bernoulli reviews and Beta prior is made for ease of exposition. Our results extend to a more general model where reviews come from an arbitrary distribution with finite support (not only ) and the estimator arbitrarily maps reviews to an estimate for the fixed valuation ; see Appendix B for details.

3 Cost of Newest First with a Fixed Static Price

Throughout this section, we assume a static pricing policy where the price is fixed and given. We establish the main phenomenon of the Cost of Newest First by showing that under very mild conditions on the price . We then show that can be arbitrarily large.

Recall that refers to , where refers to the number of positive reviews. We first introduce two natural conditions that the price should satisfy.

Definition 3.1 (Non-absorbing price).

A price is non-absorbing if the purchase probability is positive for any displayed review ratings; i.e., for all ,

A non-absorbing price is required to guarantee that does not get “stuck” in a zero-revenue state. Specifically, under an absorbing price, there exists a set of review ratings such that the purchase probability is zero. In such a state, there will be no new subsequent review, and the set of most recent reviews will never be updated, resulting in zero revenue for . This is formalized in the following proposition (whose proof is provided in Appendix C.1).

Proposition 3.1.

Any absorbing price yields revenue under , i.e., .

Definition 3.2 (Non-degenerate price).

A price is non-degenerate if there exist , such that the purchase probability is different given and positive review ratings:

A non-degenerate price implies that the review ratings “matter”, since there exist distinct review ratings where the purchase probability differs. In contrast, under a degenerate price, the review ratings have no impact on the purchase probability, hence the review ordering policy has no impact on revenue under such prices. Note that there exist prices which are absorbing and non-degenerate and there also exist prices which are degenerate and non-absorbing.777E.g. if , , and (mean). Then the price is non-degenerate but absorbing, while the price is degenerate but non-absorbing.

3.1 Existence of Cost of Newest First

Our main result is that the revenue under is strictly higher than that of ; that is, . As a building block towards this result, we first provide simple and interpretable closed form expressions for and for a static price , which are given in Propositions 3.2 and 3.3 respectively. Let denote the Bernoulli distribution with success probability and denote the Binomial distribution with i.i.d. trials.

Proposition 3.2 (Revenue of ).

For any fixed price ,

Proof.

By definition, displays i.i.d. reviews at every round . As a result, the number of positive reviews is distributed as , yielding expected revenue, at every round , equal to the right hand side of the theorem. Given that this quantity does not depend on , recalling Eq.(1), it equals the steady-state revenue. ∎

Unlike which displays i.i.d. reviews at every round, the reviews displayed by are an endogenous function of the history. The proof of the next result underlies the technical crux of this section and is presented in Section 3.2.

Proposition 3.3 (Revenue of ).

For any non-absorbing fixed price ,

Intuitively, when the newest reviews are positive, the customer is more likely to buy the product and leave a new review, which then updates the set of newest reviews. On the other hand, when the newest reviews are negative, the customer is less likely to buy, and hence the set of newest reviews is less likely to be updated. This implies that spends more time in a state with negative reviews (which yield lower revenue) compared to . This phenomenon is the driver of our main result and we refer to it as the Cost of Newest First (CoNF).

Theorem 3.1 (Cost of Newest First).

For any non-degenerate price , the revenue of is strictly smaller than that of , i.e., .

Proof.

If is absorbing (Definition 3.1), by Proposition 3.1, as there is a state of reviews in which there will never be another purchase. However, as is non-degenerate and hence there is a state of reviews with a positive purchase probability.

If is non-absorbing, we next show that the expression of Proposition 3.2 is higher than the one of Proposition 3.3. By Jensen’s inequality, for any non-negative random variable and equality is achieved if and only if is a constant. Letting be the purchase probability in a state with positive reviews, we apply the inequality for ,

Multiplying with on both sides we obtain that . It remains to show that when is non-degenerate, the inequality is strict. Note that since is non-degenerate, we have that and thus is not a constant random variable when . Therefore, the inequality is strict. ∎

We describe a simple example that provides intuition on the CoNF established in Theorem 3.1, which is also illustrated in Figure 1.

Example 3.1.

Suppose , , , , and . Under the probability that the review shown is positive is (see Figure 1(a)). Under the purchase probability is when the review is positive and when it is negative. Thus, under , transitioning from a positive to a negative review is twice as likely as transitioning from a negative to a positive review (see Figure 1(b)). Hence, a negative rating is twice as likely as positive rating. This leads to lower revenue in steady state for compared to .

3.2 Characterization of Revenue under Newest (Proof of Proposition 3.3)

We provide the proof of Proposition 3.3, which contains the main technical crux of this section. We first introduce some notation. Recalling that denotes the rating of the -th most recent review at round , we refer to the most recent reviews by the vector . We note that is a time-homogeneous Markov chain with a finite state space . Given that we assume an infinite pool of initial reviews, where for .

With respect to its transition dynamics of this Markov chain, for the state , the purchase probability is . If there is no purchase, no review is given and the state remains . If there is a purchase, transitions to the state if the review is positive (with probability ) and to the state if the review is negative (with probability ).

Because the price is non-absorbing, for every state of reviews , the purchase probability is positive, and the probability that a new review is positive is strictly greater than zero (since ). Then, can reach every state from every other state with positive probability (i.e. it is a single-recurrence-class Markov Chain with no transient states), and hence has a unique stationary distribution, which we denote by . Our next lemma exactly characterizes the form of this stationary distribution.

Lemma 3.1.

The stationary distribution of under any non-absorbing price is

where is a normalizing constant.

Proof sketch.

If the reviews were drawn i.i.d. at each round, the probability of state would be exactly , which is the numerator. However, the set of newest reviews is only updated when there is a purchase, which occurs with probability . Therefore, we multiply the numerator by , which is the expected number of rounds until there is a new review under state ; in fact, we show such a property holds for general Markov chains (Lemma C.3). A formal proof is provided in Appendix C.2. ∎

Equipped with Lemma 3.1, we now prove Proposition 3.3.

Proof of Proposition 3.3.

Using Eq. (1), the revenue of can be written as

where the second step expresses the revenue of the stationary distribution via the Ergodic theorem. Expanding based on Lemma 3.1, the term cancels out and:

Note that the term in the parenthesis equals 1, since it is a sum over all probabilities of . This yields , which gives the expression in the theorem. ∎

3.3 Cost of Newest First can be arbitrarily bad

Theorem 3.1 implies that, for any non-absorbing price , the CoNF is strictly greater than , i.e. .888For a non-absorbing price the denominator of is strictly positive. We now show that it can be arbitrarily large. We first provide a closed-form expression for by dividing the expressions in Propositions 3.2 and 3.3 (see Appendix C.3 for proof details).

Lemma 3.2.

For any non-absorbing price , the CoNF is given by:

Theorem 3.2.

For any continuous value distribution with positive mass on a bounded support, and any , there exists a non-degenerate and non-absorbing price such that .

Proof.

One summand in the right hand side of Lemma 3.2 has a term corresponding to the ratio of the purchase probability of all reviews being positive compared to all reviews being negative:

which quantifies how much the reviews affect the purchase probability. Since all other terms are non-negative, the CoNF is lower bounded by this summand, i.e., .

Since is bounded, suppose that its support is . When all reviews are negative, selecting a price of results in a purchase probability of . Combined with the continuity of , this implies that, when , the purchase probability goes to 0. If, on the other hand, all reviews were positive, then using and that is continuous and has positive mass on its support, the purchase probability is positive; i.e., . Therefore , which implies that since .

Lastly, any price is non-absorbing and non-degenerate because for such prices, Hence, for every there exists such that is non-absorbing, non-degenerate, and . ∎

Remark 3.1.

In Appendix C.4, we complement Theorem 3.2 by showing that, if has monotone hazard rate, is monotonically increasing in . In Appendix C.5, we present an explicit expression when and is uniform on ; in particular, for .

Remark 3.2.

In Appendix C.6, we show that . This suggests that, when is small, the Cost of Newest First is also small. The former occurs when review ratings have small impact on purchases. For example, when and , the idiosyncratic variability dominates the variability from estimating through reviews, yielding and thus .

3.4 Generalizing the insight beyond revenue

We generalize our main insights beyond revenue loss by analyzing the distribution of the number of positive reviews among the reviews. We prove a structural result on this distribution (Proposition 3.4) and show that its expectation is smaller under compared to (Theorem 3.3). These theoretical results are used as a basis for comparison in Section 6, where we analyze a real-world review dataset. We first strengthen the non-degeneracy condition (Definition 3.2) to hold for each pair of review ratings.

Definition 3.3 (Strongly non-degenerate price).

A price is strongly non-degenerate if the purchase probability is different for all positive review ratings with :

Lemma 3.1 implies that the stationary distribution of seeing positive reviews under is

By Proposition 3.3, , so can be interpreted as the rate at which customers purchase under . In contrast, the corresponding stationary distribution under is

To compare and , we show that there is critical threshold such that the steady-state probability of having positive reviews is higher under than if , and smaller if . This phenomenon is illustrated in Figure 2. Formally, is the largest number of positive review ratings where the purchase probability is at most the average purchase rate , i.e., .

Proposition 3.4.

For any strongly non-degenerate and non-absorbing price , if and if .

Proof.

Observe that . As is strongly non-degenerate, the purchase probability is strictly increasing in . By the definition of , if , and thus . The other case is analogous. ∎

Next, we use Proposition 3.4 to show that the mean of is strictly smaller than that of ; the proof of the this result is in Appendix C.7.

Theorem 3.3.

For any non-degenerate and non-absorbing price , the average number of positive reviews under is smaller than under . Formally, .

In Section 6, we track the distribution of review ratings for a set of hotels from Tripadvisor (which uses as its default ordering policy). The results from this data analysis support our theoretical findings (Proposition 3.4 and Theorem 3.3).

4 Dynamic Pricing Mitigates the Cost of Newest First

In this section, we allow the platform to optimize the pricing policy , while the review ordering policy is either or . We assume that the platform knows the true underlying quality .999We assume is fixed over time and the platform has access to enough reviews to estimate arbitrarily well. Recall that and are the classes of static and dynamic pricing policies respectively, and that the revenue and CoNF for a class are defined respectively as

The main results of this section (Section 4.1) establish that the CoNF can be arbitrarily large for the optimal static pricing policy (Theorem 4.1) but that it is bounded by a small constant for the optimal dynamic pricing policy (Theorem 4.2). The main technical challenge of this section is in proving Theorem 4.2. To do this, we first characterize the optimal dynamic pricing policies under both and and derive exact expressions for their long-term revenue (Section 4.2). In doing so, we derive a structural property of the optimal dynamic pricing policy under : the prices ensure that the purchase probability is always equal regardless of the state of reviews.

4.1 Cost of Newest First under Optimal Static and Dynamic Pricing

We first establish that when optimizing over static prices, the CoNF can be arbitrarily large for any number of reviews . Note that this is not implied by Theorem 3.2, since here we assume the platform always chooses the optimal static price for a given instance.

Theorem 4.1.

For any instance where the support of is , it holds that .

This implies that if is held constant and and . Intuitively, this means that when the variability in the customer’s idiosyncratic valuation is negligible compared to the variability in review-inferred quality estimates, spends a disproportionate time in the state with no positive reviews, which leads to unbounded CoNF.

Proof of Theorem 4.1.

Observe that any price is absorbing since . By Proposition 3.1, such prices induce . For any non-absorbing price , its revenue is at most . As a result, .

Under , if all reviews are positive, the non-negativity of the value distribution implies that a price induces a purchase with probability one. The probability of this event is , which implies that . Combining the two inequalities we obtain

∎

Next, we show an upper bound under dynamic pricing, which is the main result of this section.

Theorem 4.2.

For any instance, it holds that .

In contrast to static pricing where the CoNF can be arbitrarily bad, Theorem 4.2 shows that its negative impact can be mitigated via dynamic pricing. If the idiosyncratic valuation is always non-negative, the upper bound on is 2. Even when can be negative, for example if it is non-negative at least with probability 1/2, then Theorem 4.2 implies that .

The proof of Theorem 4.2 (Section 4.3) relies on characterizing the optimal dynamic pricing policies under both and and their corresponding revenues (Section 4.2). Recall that with static pricing, spends a disproportionate amount of time in a negative review state compared to . In contrast, the optimal dynamic pricing sets prices so that the purchase probability is equal across all review states, leading to and spending the same amount of time in each review state (Section 4.2). This allows us to bound the ratio of demands under and by a factor of . Finally, we bound the ratio of the optimal prices under and , which we decompose in two terms stemming from the customer’s belief about and customer specific valuation; each term is bounded by 1 (Section 4.3).

We complement this result by a lower bound (proof in Appendix D.1) which shows that the Cost of Newest First still exists even under optimal dynamic pricing.

Proposition 4.1.

For any , there exists an instance such that .

Remark 4.1.

Even under optimal dynamic pricing, it is still the case that induces no smaller revenue than , i.e., (see Appendix D.2).

Remark 4.2.

If we have the additional knowledge of for some , then we can improve the result of Theorem 4.2 to (see Appendix D.3).

4.2 Characterization of Optimal Dynamic Pricing

A useful quantity in our characterization results is the optimal revenue for a given valuation distribution represented by a random variable ; in particular, the optimal revenue is101010We note that for our valuations distributions as has bounded support and .

First, we derive the optimal pricing policy for . Specifically, for every state of reviews, the optimal price is the revenue-maximizing price for that state. For a state of reviews , we denote by the number of positive review ratings.

Theorem 4.3.

For every review state , any optimal pricing policy under sets . This implies that

Proof.

By definition, displays i.i.d. reviews at every round . If the displayed reviews are , the revenue obtained by offering price is equal to

Thus the optimal price is any revenue-maximizing price . Since the number of positive reviews is distributed as , the optimal revenue is equal to . ∎

Next, we characterize the optimal dynamic pricing policy under . We show that it satisfies a structural property: the purchase probability is equal regardless of the review state. We define the policies that satisfy this property as review-offsetting policies.

Definition 4.1.

A dynamic pricing policy is review-offsetting if there exists an offset such that for all .

Note that for a review-offsetting policy , the purchase probability at any state is , where the last term does not depend on . Hence, review-offsetting policies induce equal purchase probability regardless of the state of reviews.

The main result of this section establishes that under , there is a review-offsetting dynamic pricing policy that maximizes revenue and characterizes the corresponding offset.111111We note that this characterization is the only place where we require the platform to know the true quality .

Theorem 4.4.

Let . Under , the review-offsetting policy with offset is an optimal dynamic pricing policy.

Intuitively, the term is the optimal price when facing a single customer with a random valuation for . The selected offset makes the purchase probability equal to the purchase probability under the “single customer” setting with the optimal price . This intuition enables us to characterize the optimal revenue of dynamic policies (proof in Appendix D.4).

Theorem 4.5.

The revenue of the optimal dynamic pricing policy under equals the optimal revenue from selling to a single customer with valuation . That is,

Remark 4.3.

To prove Theorem 4.4, for any dynamic pricing policy and any state , we define a corresponding policy to be the review-offsetting policy with offset . The policy has the same purchase probability as at state , i.e., . We show that (1) can be improved by one of for (Lemma 4.1) and (2) using such a review-offsetting policy reduces the problem to facing a single customer with valuation (Lemma 4.2).

Lemma 4.1.

The revenue of is at most the highest revenue of over , i.e.,

Equality holds if and only if for all .

Lemma 4.2.

Let . For a review-offsetting policy with offset :

Proof of Theorem 4.4.

By Lemma 4.2, a review-offsetting policy with offset has revenue

This is the revenue of selecting a price when facing a single customer with valuation . The revenue-maximizing price against such a customer is . By Lemma 4.2, the review-offsetting policy (of the theorem) with offset attains this optimal revenue and is thus the revenue-maximizing review-offsetting policy. What remains is to show that dynamic pricing policies that are not review-offsetting do not obtain higher revenue; this follows from Lemma 4.1. ∎

To prove Lemmas 4.1 and 4.2, we provide a closed-form expression for the revenue of any dynamic pricing policy (proof in Appendix D.7), which is an analogue of Proposition 3.3. Similar to Definition 3.1, we define a non-absorbing dynamic pricing policy as one where the purchase probability for every state of reviews is positive, i.e., for all .

Proposition 4.2.

For a non-absorbing dynamic pricing policy ,121212In this proposition and the following proofs we again use the notation and .

Proof of Lemma 4.2.

Since , its expected price is . The purchase probability in every state is the same and equal to . As a result, by Proposition 4.2, . ∎

To prove Lemma 4.1 we use the following natural convexity property (proof in Section D.8).

Lemma 4.3.

Let be such that for all . Then . Equality is achieved if and only if for all .

Proof of Lemma 4.1.

Given that is review-offsetting policy with offset , by Lemma 4.2,

where . Given that and thus , Proposition 4.2 implies that the revenue of can be expressed as:

Letting and be the probability that i.i.d. trials result in , Lemma 4.3 implies that the maximum revenue among is no smaller than that of :

By Lemma 4.3 equality holds if and only if is the same for all . ∎

Remark 4.4.

In Section D.9, we compare the optimal dynamic pricing policies under and . We show that, under mild regularity conditions, states with result in higher price under , while states which result in lower price under .

4.3 Cost of Newest First is Bounded under Dynamic Pricing (Theorem 4.2)

We now prove Theorem 4.2, leveraging the results of Section 4.2 that characterize the optimal dynamic pricing policies. For convenience, we denote by and . By Theorem 4.3 and Theorem 4.5, we can express the Cost of Newest First as:

| (2) |

where the denominator does not depend on and can thus move inside the expectation. We now focus on the quantity inside the expectation for a particular realization of . For any price ,

| (3) |

The inequality replaces the revenue-maximizing price by another price , which can only increase the ratio. Given that we operate with dynamic prices, we are allowed to select a different price for any number of positive reviews .

In particular, a price of ensures that the demand ratio is one. However, if , the denominator in the price ratio can be unboundedly small. To simultaneously bound the expected price and demand ratios, we select .

Lemma 4.4.

The expected price ratio is at most .

Lemma 4.5.

For any , the demand ratio is .

What is left is to prove the lemmas that bound the expected price ratio and the demand ratio.

Proof of Lemma 4.4.

Given that customer valuations are additive with a belief and an idiosyncratic component, the optimal price (numerator of price ratio) can be similarly decomposed as:

The expected price ratio for is:

Given that the denominators in both terms are positive and , each of those terms can be upper bounded by , concluding the proof. ∎

Proof of Lemma 4.5.

For every number of positive reviews , we distinguish two cases based on where the maximum in lies. If the demand ratio is equal to . Otherwise,

∎

4.4 Broader Implication: Cost of Ignoring State-dependent Customer Behavior

Suppose a platform uses , and they are not aware of the phenomenon that customer’s purchase decisions depend on the state of reviews — they instead assume the purchase behavior is constant (i.e., purchase probability does not depend on the state of the newest reviews). Then, if the platform uses a standard data-driven approach to optimize prices (e.g., do price experimentation and estimate demand from data), the optimal revenue is . In contrast, a platform can estimate separate demands for each state of reviews and employ a dynamic pricing policy to earn . We show, by comparing with , that the revenue loss from not accounting for this state-dependent behavior can be arbitrarily large. The proof of the following result is provided in Appendix D.10.

Theorem 4.6.

For any , there exists an instance such that .

5 Cost of Newest First under Time-Discounting Customers

As discussed in the introduction, customers prefer to read more recent reviews; this explains the practical popularity of . We thus extend the customer model to account for this behavior of preferring newer reviews and analyze the revenue of review ordering policies under this model.

5.1 Model of Time-Discounting Customers

We first define the new behavioral model. For , -time-discounting customers have the following purchase behavior. At round , when presented with reviews which appeared at rounds in the past , the posterior they form is

Comparing to the model in Section 2, customers’ weight on the -th review depends on the number of rounds since the posting of this review . Intuitively, this means that a significance of a review compared to the prior decreases as the review becomes more stale. Formally, a review from rounds ago is discounted by . Note that corresponds to our original model while corresponds to customers who only consider the review from the immediately previous round.

Customers map this posterior to an estimate of the fixed valuation . Using their personal preference and their estimate for the fixed valuation, they form their estimated valuation and purchase the product if and only if where is the price offered by the platform. We assume that is a continuous distribution and is continuous in .

We now discuss how the random ordering policy behaves when . Recall (Section 2.2) that we start with an infinite pool of reviews: where . Then, a review chosen at random from this pool will be “infinitely stale” (i.e., almost surely), and such a review will have a weight of 0 almost surely. Therefore, is equivalent to showing no reviews; i.e., .

We also analyze the policy, which selects reviews uniformly at random from the newest reviews for a window . Intuitively, a higher window corresponds to more randomness in the displayed reviews and interpolates between and .

We denote by the steady-state revenue under -time-discounting customers, review ordering policy , and pricing policy , defined in Eq. (1).131313We note that the discount factor only affects the customer’s belief and the revenue itself is not time-discounted. Since reviews do not affect the customer’s belief under when ,

| (4) |

and we can show that (see Appendix E.1).

Lastly, we define a “review-benefiting” condition where customers are more likely to buy when the weights placed on reviews are higher (Definition 5.1). Without this, it could be better for the platform to intentionally show no reviews; hence this condition effectively states that reviews “help” on average.

Definition 5.1 (Review-benefiting price for an instance).

A price is review-benefiting for an instance if for any set of weights where ,141414 refers to for all , and the inequality is strict for at least one element.

Each term refers to the expected purchase probability given the weight vector for the reviews, where the expectation is over the review ratings . Definition 5.1 states that when the weights are larger, the expected purchase probability should also be larger.

To provide intuition, we discuss two instances that induce review-benefiting prices. The first is when the prior mean is correct () but customers are pessimistic, i.e., their estimate for the fixed valuation is the -quantile of for . In this case, incorporating reviews reduces the variance of the customer’s posterior and hence a higher weight on reviews increases on average. The second example is when customers are risk-neutral, i.e., is the mean of , but the prior mean is negatively biased (). Incorporating more reviews drawn from , on average, increases the mean of the posterior . We formalize these instances in Appendix E.2.

5.2 (Non-)Monotonicity in Revenue with Respect to

We analyze how depends on the window size for different values of the discount factor . We first consider customers who discount extremely: ; i.e., only the previous round’s review is incorporated in the customer’s belief. In Theorem 5.1 (proof in Section E.3), we establish that the revenue of is monotonic in . Since , this implies that for any . Therefore, if customers heavily discount, is indeed the best ordering policy. To ensure that the process of the newest reviews does not get absorbed into any state of reviews, we say that a price is strongly non-absorbing if the purchase probability for any state of reviews and any discount factor lies in (see Definition E.1 for a formal statement).

Theorem 5.1.

For a review-benefiting and strongly non-absorbing price , is strictly decreasing in .

Next, we consider the other extreme of ; this is equivalent to our original model where all reviews are weighted equally. By Theorem 3.1 we have already established that . The following theorem (proof in Section E.4) extends this result by showing that is strictly increasing in the window .

Theorem 5.2.

For any non-degenerate and non-absorbing static price , is strictly increasing in .

Slightly discounting customers.

We have established that the revenue has an opposite relationship in under and . It is natural to ask what happens when . We consider the case when customers employ a discount factor close to 1; i.e., where is small. In the following theorem (proof in Section E.5), we establish that the revenue is no longer monotonic in ; the maximum revenue is achieved by a finite .

Theorem 5.3.

For any problem instance and any non-degenerate, non-absorbing, review-benefiting, and strongly non-absorbing price , there exists such that, for all discount factors , there exist finite with

5.3 Interaction between CoNF and the Discount Factor

Recall that a review-benefiting price for an instance implies that when the review ratings are drawn independently (), higher weights result in a higher purchase probability. Therefore, one may expect that the revenue would be higher for non-discounting customers () than for those that discount (). However, we show below that, under , this intuition does not always hold due to the interaction with the Cost of Newest First.

We focus on a class of instances where a single review is shown (), the customer-specific valuation is uniform ( with ), the fixed valuation is , the prior parameters are (correct prior mean), and is the -quantile of the customer’s belief for , i.e., the customer’s estimate for fixed valuation is pessimistic.

Theorem 5.4.

For any instance in the class and any , there exists a non-absorbing and review-benefiting price such that .

The high-level idea behind this result (proof in Section E.9) is that the impact of the Cost of Newest First is higher when the weights are larger. To see this, suppose a negative review is posted at time , which decreases the purchase probability for the future customers who see this review as the first review. If customers are time-discounting (), then even if this review is the newest review, the weight of this negative review eventually vanishes. On the other hand, if customers do not discount () then the weight of this review stays at 1 as long as this is remains as the newest review. As a result, the negative impact of the Cost of Newest First can outweigh the positive impact of higher weights that a review-benefiting instance offers.

6 Evidence supporting CoNF from Tripadvisor

Tripadvisor is an online platform whose default review ordering policy is . We focused on 109 hotels in the region of Times Square, New York, where we retrieved the newest 1000 reviews for each of these hotels. We searched “Times Square” on Tripadvisor (March 20, 2024) and collected data from the first 21 hotels with more than 1000 reviews.151515We initially retrieved 3 more hotels that had less than 1000 reviews (respectively 394, 770, and 957) but later removed them to have a consistent rule. All of those three hotels exhibit CoNF and thus including them would only strengthen our empirical findings. Subsequently, we made the same query and collected 88 additional hotels (August 6, 2024). A hotel’s page on Tripadvisor displays the average numerical rating of all reviews, as well as details of the first 10 reviews. More reviews can be shown if the user clicks for the next page of reviews. Each review has a rating (an integer between and ), the date the review was written, information on the user who wrote the review, as well as the text of the review.

We validate our theoretical findings using this dataset. Recall that Theorem 3.3 states that the average number of positive reviews from the first reviews is smaller under compared to . We corroborate this result by computing the empirical distributions for each hotel (similar to Figure 2). Since the hotel’s page on Tripadvisor shows 10 reviews by default, we use .

For each hotel, we compute two empirical distributions, which we call and . Let and be the dates of when the earliest and the latest review was written (among the reviews retrieved for this hotel). For each date between and , we compute what the 10 newest reviews were on that date and compute their average rating; this becomes a sample in our empirical distribution . The number of samples is thus simply the number of days between and , which, on average, corresponds to years. The empirical distribution is computed by randomly sampling 10 reviews out of the all the reviews retrieved from the particular hotel and computing their average rating, where the number of samples is equal to that of .

Results.

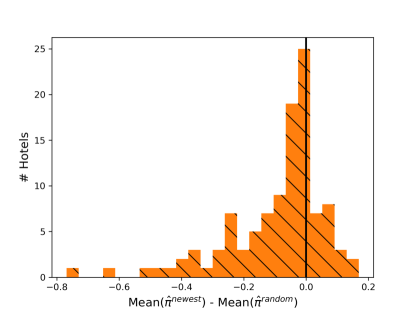

To validate our theoretical findings, we consider a null hypothesis positing that the probability of having higher mean than is exactly . In our data, we observe that, for 79 out of 109, the mean of is strictly smaller than that of which implies a p-value of (and thus rejects the null hypothesis). On average, the mean of is smaller than that of by , or 0.092 points out of 5 in absolute terms. Figure 3 plots a histogram of the difference between these means for the 109 hotels.

Next, in Figure 4, we plot the full distributions of and for four hotels (in Appendix F, we present the remaining 105 hotels); this is analogous to Figure 2. We observe that consistently has heavier left tails, while has heavier right tails. This observation matches the theoretical implication of our model (Proposition 3.4).

7 Conclusions

In this paper, we model the idea that customers read only a small number of reviews before making purchase decisions. This model gives rise to the Cost of Newest First, the idea that, when reviews are ordered by newest first, negative reviews will persist as the newest review longer than positive reviews. This phenomenon does not arise in models from the existing literature, since prior works assume that customers incorporate either all reviews or a summary statistic of all reviews into their beliefs. We show that incorporating randomness into the review ordering or using dynamic pricing can alleviate the negative impact of the Cost of Newest First.

Our work opens up a number of intriguing avenues for future research. First, existing literature on social learning studies the self-selection bias (which we do not consider in our model) – how does this self-selection bias interact with the Cost of Newest First? Second, in terms of operational decisions, a platform contains multiple products — should it take the state of reviews into consideration when making display or ranking decisions? Third, given this bounded rationality behavior, are there alternative methods of of disseminating relevant information from reviews? For example, one could succinctly summarize information from all reviews (via, e.g, generative AI) to be the most helpful for each customer. Fourth, we assume that the true quality does not change over time (which enables us to characterize the closed-form expression of the corresponding steady state). Given that changes in the product quality are one of the reasons behind the ubiquitous use of Newest First, it would be interesting to revisit the Cost of Newest First in such dynamic environments. Lastly, on the theoretical side, our analysis fully characterizes the steady state of a stochastic process whose state remains unchanged with some state-dependent probability (Lemma C.3 which is the crux in the analysis of Lemma 3.1). It would be interesting to apply this result to other settings that exhibit a similar structure.

Acknowledgements.

We thank the anonymous reviewers from the 25th ACM Conference on Economics and Computation (EC 2024) for their thorough feedback that greatly improved the presentation of the paper. We are also grateful to the Simons Institute for the Theory of Computing as this work started during the Fall’22 semester-long program on Data Driven Decision Processes.

References

- [AGI11] Nikolay Archak, Anindya Ghose, and Panagiotis G Ipeirotis. Deriving the pricing power of product features by mining consumer reviews. Management science, 57(8):1485–1509, 2011.

- [AMMO22] Daron Acemoglu, Ali Makhdoumi, Azarakhsh Malekian, and Asuman Ozdaglar. Learning from reviews: The selection effect and the speed of learning. Econometrica, 90(6):2857–2899, 2022.

- [Ban92] Abhijit V Banerjee. A simple model of herd behavior. The quarterly journal of economics, 107(3):797–817, 1992.

- [BHW92] Sushil Bikhchandani, David Hirshleifer, and Ivo Welch. A theory of fads, fashion, custom, and cultural change as informational cascades. Journal of political Economy, 100(5):992–1026, 1992.

- [BMZ12] John W Byers, Michael Mitzenmacher, and Georgios Zervas. The groupon effect on yelp ratings: a root cause analysis. In Proceedings of the 13th ACM conference on electronic commerce, pages 248–265, 2012.

- [Bon23] Tommaso Bondi. Alone, together: A model of social (mis)learning from consumer reviews. In Kevin Leyton-Brown, Jason D. Hartline, and Larry Samuelson, editors, Proceedings of the 24th ACM Conference on Economics and Computation, EC 2023, London, United Kingdom, July 9-12, 2023, page 296. ACM, 2023.

- [BPS18] Kostas Bimpikis, Yiangos Papanastasiou, and Nicos Savva. Crowdsourcing exploration. Management Science, 64(4):1477–1973, 2018.

- [BPS22] Etienne Boursier, Vianney Perchet, and Marco Scarsini. Social learning in non-stationary environments. In International Conference on Algorithmic Learning Theory, pages 128–129. PMLR, 2022.

- [BS18] Omar Besbes and Marco Scarsini. On information distortions in online ratings. Operations Research, 66(3):597–610, 2018.

- [CDO22] Ishita Chakraborty, Joyee Deb, and Aniko Oery. When do consumers talk? Available at SSRN 4155523, 2022.

- [CIMS17] Davide Crapis, Bar Ifrach, Costis Maglaras, and Marco Scarsini. Monopoly pricing in the presence of social learning. Management Science, 63(11):3586–3608, 2017.

- [CLT21] Ningyuan Chen, Anran Li, and Kalyan Talluri. Reviews and self-selection bias with operational implications. Management Science, 67(12):7472–7492, 2021.

- [CM06] Judith A Chevalier and Dina Mayzlin. The effect of word of mouth on sales: Online book reviews. Journal of marketing research, 43(3):345–354, 2006.

- [CSS24] Christoph Carnehl, André Stenzel, and Peter Schmidt. Pricing for the stars: Dynamic pricing in the presence of rating systems. Management Science, 70(3):1755–1772, 2024.

- [DLT21] Gregory DeCroix, Xiaoyang Long, and Jordan Tong. How service quality variability hurts revenue when customers learn: Implications for dynamic personalized pricing. Operations Research, 69(3):683–708, 2021.

- [FKKK14] Peter Frazier, David Kempe, Jon Kleinberg, and Robert Kleinberg. Incentivizing exploration. In Proceedings of the fifteenth ACM conference on Economics and computation, pages 5–22, 2014.

- [Gal97] Robert G Gallager. Discrete stochastic processes. Journal of the Operational Research Society, 48(1):103–103, 1997.

- [GHKV23] Wenshuo Guo, Nika Haghtalab, Kirthevasan Kandasamy, and Ellen Vitercik. Leveraging reviews: Learning to price with buyer and seller uncertainty. In Kevin Leyton-Brown, Jason D. Hartline, and Larry Samuelson, editors, Proceedings of the 24th ACM Conference on Economics and Computation, EC 2023, London, United Kingdom, July 9-12, 2023, page 816. ACM, 2023.

- [GI10] Anindya Ghose and Panagiotis G Ipeirotis. Estimating the helpfulness and economic impact of product reviews: Mining text and reviewer characteristics. IEEE transactions on knowledge and data engineering, 23(10):1498–1512, 2010.

- [GPR06] Jacob K Goeree, Thomas R Palfrey, and Brian W Rogers. Social learning with private and common values. Economic theory, 28:245–264, 2006.

- [HC24] Michael Hamilton and Titing Cui. Fresh rating systems: Structure, incentives, and fees. Incentives, and Fees (June 24, 2024), 2024.

- [HPZ17] Nan Hu, Paul A Pavlou, and Jie Zhang. On self-selection biases in online product reviews. MIS quarterly, 41(2):449–475, 2017.

- [IMSZ19] Bar Ifrach, Costis Maglaras, Marco Scarsini, and Anna Zseleva. Bayesian social learning from consumer reviews. Operations Research, 67(5):1209–1221, 2019.

- [Kav21] M Kavanagh. The impact of customer reviews on purchase decisions. Bizrate Insights, available at: https://bizrateinsights.com/resources/the-impact-of-customer-reviews-on-purchase-decisions/ (accessed 4 Feb 2024), 2021.

- [KKM+17] Sampath Kannan, Michael Kearns, Jamie Morgenstern, Mallesh Pai, Aaron Roth, Rakesh Vohra, and Zhiwei Steven Wu. Fairness incentives for myopic agents. In Proceedings of the 2017 ACM Conference on Economics and Computation, pages 369–386, 2017.

- [KMP14] Ilan Kremer, Yishay Mansour, and Motty Perry. Implementing the “wisdom of the crowd”. Journal of Political Economy, 122(5):988–1012, 2014.

- [LDRF+13] Stephan Ludwig, Ko De Ruyter, Mike Friedman, Elisabeth C Brüggen, Martin Wetzels, and Gerard Pfann. More than words: The influence of affective content and linguistic style matches in online reviews on conversion rates. Journal of marketing, 77(1):87–103, 2013.

- [LKAK18] Gaël Le Mens, Balázs Kovács, Judith Avrahami, and Yaakov Kareev. How endogenous crowd formation undermines the wisdom of the crowd in online ratings. Psychological science, 29(9):1475–1490, 2018.

- [LLS19] Xiao Liu, Dokyun Lee, and Kannan Srinivasan. Large-scale cross-category analysis of consumer review content on sales conversion leveraging deep learning. Journal of Marketing Research, 56(6):918–943, 2019.

- [LS16] Ilan Lobel and Evan Sadler. Preferences, homophily, and social learning. Operations Research, 64(3):564–584, 2016.

- [Luc16] Michael Luca. Reviews, reputation, and revenue: The case of yelp. com. Com (March 15, 2016). Harvard Business School NOM Unit Working Paper, (12-016), 2016.

- [LYMZ22] Zhanfei Lei, Dezhi Yin, Sabyasachi Mitra, and Han Zhang. Swayed by the reviews: Disentangling the effects of average ratings and individual reviews in online word-of-mouth. Production and Operations Management, 31(6):2393–2411, 2022.

- [MSS20] Yishay Mansour, Aleksandrs Slivkins, and Vasilis Syrgkanis. Bayesian incentive-compatible bandit exploration. Operations Research, 68(4):1132–1161, 2020.

- [MSSV23] Costis Maglaras, Marco Scarsini, Dongwook Shin, and Stefano Vaccari. Product ranking in the presence of social learning. Operations Research, 71(4):1136–1153, 2023.

- [Mur19] Rosie Murphy. Local consumer review survey 2019. Technical report, National Bureau of Economic Research, 2019.

- [PSX21] Sungsik Park, Woochoel Shin, and Jinhong Xie. The fateful first consumer review. Marketing Science, 40(3):481–507, 2021.

- [RHP23] Hang Ren, Tingliang Huang, and Georgia Perakis. Impact of social learning on consumer subsidies and supplier capacity for green technology adoption. Available at SSRN 4335284, 2023.

- [Say18] Amin Sayedi. Pricing in a duopoly with observational learning. Available at SSRN 3131561, 2018.

- [SR18] Sven Schmit and Carlos Riquelme. Human interaction with recommendation systems. In International Conference on Artificial Intelligence and Statistics, pages 862–870. PMLR, 2018.

- [SS00] Lones Smith and Peter Sørensen. Pathological outcomes of observational learning. Econometrica, 68(2):371–398, 2000.

- [ZZ10] Feng Zhu and Xiaoquan Zhang. Impact of online consumer reviews on sales: The moderating role of product and consumer characteristics. Journal of marketing, 74(2):133–148, 2010.

Appendix A Formal definition of the random ordering policy (Section 2.2)

We now show that the policy can be defined as the limit of as . For a vector of review ratings , we denote . Proposition A.1 implies that as , the draws from across different rounds are independent and the distribution approaches the distribution of .

Proposition A.1.

For any review rating vectors and rounds , the distribution of reviews by approaches the one of as , i.e.,

We first show that as goes to infinity, the reviews selected by at each round come from the infinite pool of reviews with high probability. Let be the largest integer such that and let be large enough so that . We define as the event that for every the reviews selected by come from the set . Lemma A.1 shows that happens with high probability.

Lemma A.1.

. Furthermore, .

Given that selects from the infinite negative pool of reviews with high probability (if holds), we now derive a concentration bound for the reviews in this pool. Recall that for . We partition those reviews into groups each containing reviews. Let be the event that, for each group, the average review rating concentrates around the group’s mean, i.e.

Our next lemma shows that the concentration event happens with high probability.

Lemma A.2.

. Furthermore, .

In order to decompose the left-hand-side of Proposition A.1 into a product of probabilities, we show the following independence lemma.

Lemma A.3.

Let . Then conditioned on and , the events for are independent.

Having shown independence across rounds, we prove that, for any round , is close to . Let be the set of review rating sequences for which event holds i.e.

Our next lemma shows that if the events and hold, then for any round , the distribution of is close to the distribution of . To ease notation, we let and .

Lemma A.4.

There exists some function satisfying such that assuming that and hold, for any and :

Proof of Proposition A.1.

By Lemma A.1 and Lemma A.2, we can upper bound the probability that neither of nor holds by

| (5) |

We thus assume that and holds which means we focus on sequences . By the law of total probability and the independence of across rounds (i.e. Lemma A.3):

| (6) | ||||

By Lemma A.4, we can upper and lower bound this decomposition by

| (7) |

Recall that consists of all sequences that satisfy the event . Summing across those sequences and using the independence between the choice of (which determines ) and the values of (which determine ), we obtain

| (8) |

We conclude the proof by combining (5), (6), (7), (8) and using the fact that . ∎

A.1 High probability bound on (Proof of Lemma A.1)

Proof of Lemma A.1.

Fix a particular round . Note that since , the most recent reviews that considers contain . The probability that all reviews come from that set is . For each round in , the subset of reviews is independently drawn by . Thus, . Next notice that and therefore, showing the second part. ∎

A.2 Concentration for infinite pool (Proof of Lemma A.2)

Proof of Lemma A.2.

For a fixed , by Chernoff bound, it holds that

By union bound on the groups, the event has probability at least . Note that , which yields the second part. ∎

A.3 Independence of across rounds (Proof of Lemma A.3)

Proof of Lemma A.3.

By definition, samples a -sized subset of reviews independently at every round. Thus, conditioning on the subset being sampled from , i.e. , and also conditioning on the exact values of these ratings, i.e. , the draws of are independent for . ∎

A.4 Single round approximation (Proof of Lemma A.4)

Let be the review ratings chosen from the most recent reviews. Recall that when holds, selects reviews from and that . Let for be a partition of all reviews into groups of reviews each. We first show that the reviews drawn by come from different groups with high probability. Let be the event that no two indices are such that and belong to the same group for some . Our next lemma lower bounds the probability of .

Lemma A.5.

Assume that and hold. The probability of any two selected indices being of different groups is: and thus .

Proof.

Let be the event that . Notice that is exactly the event that none of the hold. Further, note that implies that since we output an ordered set of reviews by recency. There are thus ways to choose to be in the same group . Hence the probability of is at most

as there are at most ways to choose and at most ways to choose . Using the inequalities , we obtain that

since . Thus, via union bound over and , i.e., events, the probability of is lower bounded as follows

∎

When the event holds then the reviews for come from different groups . We show that when this happens the values of the reviews are independent. Let be the event that review comes from group for . The next lemma shows that conditioned on the event , the values of are independent.161616This is not the case without conditioning on . As an example, consider two ordered reviews drawn uniformly from the three ordered review ratings . Conditioned on then deterministically while conditioned on then . As a results and are correlated. Recall that implies that .

Lemma A.6.

Let be group indices with . Conditioned on , , and , for any vector of review ratings , the events for are independent. Furthermore,

Proof.

For any specific review ratings , applying Bayes rule

There are choices for the set of ratings so that for and total number of choices. Hence holds with probability . Given that there is exactly one choice for the reviews which satisfies :

| (9) |

Since this holds for any we obtain independence of for . By summing (9) over , for any particular , we have . Therefore, the probability that has a particular value is equal to the fraction of which have value i.e.

∎

We next show that conditioned on the events ,, and the distribution of is close to the distribution of . Given that the latter consists of i.i.d. , for vector of review ratings . Recall that . Using the independence acorss different groups (Lemma A.6), the following lemma shows that has a similar decomposition as .

Lemma A.7.

Conditioned on , , and , for any vector of review ratings , is lower bounded by and upper bounded by

Proof.

Using Lemma A.6:

As , we have that for all . Applying these inequalities for each yeilds

for any . As is the union of events for all indices , this implies

∎

Proof of Lemma A.4.

The law of total probability yields the following decomposition

By this decomposition and Lemma A.7, we can lower bound by

and upper bound the same probability by

Therefore,

where

Recall that . Since (Lemma A.5) and , we obtain that for any because

As a result, satisfies the desired property and concludes the proof. ∎

Appendix B Generalizing beyond Beta-Bernoulli distributions (Remark 2.1)