Regulating stochastic clocks

This version: )

Abstract

Stochastic clocks represent a class of time change methods for incorporating trading activity into continuous-time financial models, with the ability to deal with typical asymmetrical and tail risks in financial returns. In this paper we propose a significant improvement of stochastic clocks for the same objective but without decreasing the number of trades or changing the trading intensity. Our methodology targets any Lévy subordinator, or more generally any process of nonnegative independent increments, and is based on various choices of regulating kernels motivated from repeated averaging. By way of a hyperparameter linked to the degree of regulation, arbitrarily large skewness and excess kurtosis of returns can be easily achieved. Generic-time Laplace transforms, characterizing triplets, and cumulants of the regulated clocks and subsequent mixed models are analyzed, serving purposes ranging from statistical estimation and option price calibration to simulation techniques. Under specified jump–diffusion processes and tempered stable processes, a robust moment-based estimation procedure with profile likelihood is developed and a comprehensive empirical study involving S&P500 and Bitcoin daily returns is conducted to demonstrate a series of desirable effects of the proposed methods.

MSC2020 Classifications: 60E07; 60G51; 60H30

JEL Classifications: C13; C65; G12

Keywords: Asymmetrical and tail risks; Lévy subordinators; regulating kernels; tempered stable processes; moment-based estimation; profile likelihood

1 Introduction

Financial returns have long been documented to have excessive skewness and kurtosis relative to those of an (un)conditional Gaussian distribution, leading to asymmetrical and tail risks; see, among others, [Bollerslev, 1987] [16], [Mittnik et al., 2000] [49], [Jondeau and Rockinger, 2003] [35], and [Ornthanalai, 2014] [51]. This phenomenon appears to be even more salient in the recently burgeoning cryptocurrency market which exhibits very high volatility due to its heavy reliance on supply and demand and market attention; see [Troster et al., 2019] [63], [Gkillas and Katsiampa, 2018] [30], [Chaim and Laurini, 2019] [20], and [Liu and Tsyvinski, 2021] [42], e.g., for the major cryptocurrencies including Bitcoin.

In continuous-time modeling, a well-known method for incorporating distributional asymmetry and heavy tails is to replace the usual, constantly forward-moving clock under which the underlying stochastic process is monitored with a generally independent nondecreasing stochastic process. The latter process is termed a “stochastic clock” and can be linked to trading volumes or the number of trades (see [Clark, 1973] [23], [Ané and Geman, 2000] [5], [Geman et al., 2001] [29], and [Geman, 2008] [28]). Stemming from the celebrated Dambis–Dubins–Schwarz theorem of time change, [Monroe, 1978] [50] first gave the possibility to represent any semimartingale as a time-changed Brownian motion. When the stochastic clock is modeled by a nonnegative process with independent and stationary increments, namely a Lévy subordinator, such a representation has had striking consequences in generating a variety of purely discontinuous Lévy processes as mixed models, which have flourished for the last two decades in time series econometrics, option pricing, and portfolio management, some recent contributions including [Madan et al., 2019] [47], [Aguilar et al., 2020] [2], and [Fallahgoul and Loeper, 2021] [27].

The key idea behind using stochastic clocks in the absence of a drift component in producing large skewness and kurtosis is rather comprehensible: Pure-jump stochastic clocks progress in a staircase-like manner and are less active – and less uniform – than the usual “sloped” clock of calendar time, and hence possess relatively slower local speed, representing trading activity that does not take place in a perfectly continuous manner, which enables them to adequately tell apart periods of intensive trading and other relatively calmer ones. Perhaps the two most predominant clocks of this type are the gamma process and the inverse Gaussian process, which were studied in [Madan et al., 1998] [46] and [Barndorff-Nielsen, 1997] [7], respectively, to time-change a drifted Brownian motion for building discontinuous models in dealing with skewed and leptokurtic financial returns.111The same processes also play an important role in many nonfinancial fields, especially in reliability engineering to model the degradation phenomena of structural components (see the overview by [Ye and Xie, 2015] [70]).

Noteworthily, when working with ordinary stochastic clocks under Lévy subordinators, the asymmetrical and tail risks of returns are largely controlled by the number of trades occurring for a significant period of time (i.e., the aggregate level of trading activity) through an infinite-divisibility (i.e., time-multiplicative) parameter (as mentioned in the overview in [Schoutens, 2003, Chap. 4] [59]), or the long-term trading intensity (equivalently, the variation of trading volumes) via an -stability index (in the case of the stable family; see [Samorodnitsky and Taqqu, 1994] [57] e.g.). More specifically, the matching of a high empirical kurtosis level will require decreasing the value of the infinite-divisibility parameter which is a direct measurement of the amount of jumps,222The intuition is that as such a parameter tends to zero in value, the corresponding distribution becomes degenerate. or altering the stability index which is heavily tied to the microstructure or the local regularity of sample paths. Such an operation seems totally innocuous when return distributions are analyzed statically, after imposing assumptions of i.i.d. samples. However, in reality, the aggregate number of trades cannot be expected to be unlimitedly small, or close to zero, leading effectively to degeneracy, or trading halts; on the other hand, the long-term trading intensity is generally specified a priori without being optimized and may be estimated in a dynamical fashion using techniques of empirical power variations (see, e.g., [Aït-Sahalia and Jacod, 2009] [3], [Todorov and Tauchen, 2011] [62], [Jing et al., 2012] [34], and [Todorov, 2021] [61]), which of course varies with the frequencies at which data are observed. With restrictions on these two important dimensions, nearly all the noticed Lévy models will not function well in coping with diverse asymmetrical and tail risks of returns.

In connection with this, we are motivated to consider yet another possibility for the same purpose, by changing the size of local movements of a stochastic clock instead of decreasing their amount or adjusting the corresponding activity level. From the perspective of trading activity, this would mean that the spread of trade sizes may be enlarged at will without having to alter the level of trading intensity or stick to an implausibly small number of trades. In doing so, we prefer to operate in a continuous-time environment because discrete-time analogies are easy to develop subsequently, whereas it will be understandably difficult to go in the opposite direction, e.g., to ensure infinite divisibility in finite dimensions.

Besides, consideration of such a possibility will be beneficial in unraveling the microstructure of returns from low-frequency data via a connection to phenomena that trigger abnormal trading volumes, with ample empirical evidence. For instance, the goal to increase the sparsity of trade size distributions is in agreement with the presence of large speculators in traditional and cryptocurrency markets (mentioning, e.g., [Chang et al., 1997] [21] and [Blau, 2017] [14], respectively) or the prevalence of trade-size clustering (referring to [Alexander and Peterson, 2008] [4] and [Chen, 2019] [22]). In this regard, the linkage between skewed and leptokurtic returns and the theoretical moments of the driving stochastic clock is simply embodied by the famous price–volume relationship (see, e.g., [Karpoff, 1987] [37] and [Richardson and Smith, 1994] [55]).

With the foregoing aspects in mind, in this paper we aim to propose a unified approach towards regulating any existing stochastic clock without impairing important fundamental properties. In this context, the act of “regulating” can be understood in the ordinary sense – a stochastic clock is continually adjusted with the intent of achieving a desirable local speed, making it more reliable for capturing the differences in trading activity over time. As a starting point, however, our methodology is concentrated on the aforesaid Lévy subordinators but will be easily extendable to processes of independent but time-inhomogeneous increments, or Sato processes (see [Sato, 2006] [58] and [Eberlein and Madan, 2009] [26]), all of which can be subsequently applied to build structurally more complex stochastic clocks with mean-reverting acceleration and continuous movements that can deal with volatility clustering (see [Carr and Wu, 2004] [19]). The regulated stochastic clocks have essentially the same functionalities as the originals, and can be used to time-change diffusion processes to spawn multifarious semimartingales with discontinuities, albeit with much larger capacity in dealing with asymmetrical and tail risks.

That being said, our approach can also be exploited to generate a rich class of unexplored Lévy processes comfortable for financial modeling. As expected, this newfound dimension is encoded into a hyperparameter representing the degree of regulation, i.e., how much slower the regulated clock is compared with the unregulated one, and kept as independent as possible from the roles of other shape parameters. The resultant processes are shown to be analytically tractable whether it be statistical estimation or risk-neutral valuation of options that is of interest.

The remainder of this paper is structured as follows. In Section 2 we present our main methodology in three recipes, all of which serve to regulate a stochastic clock to any intended degrees. The effect of clock regulation on the jump behaviors depicting corresponding evolution of trading activity is analyzed (Theorem 1, Theorem 2, and Corollary 1) and the impact on asymmetry and tail heaviness of the original distribution is examined in detail (Corollary 2). Then, we present in Section 3 two simple ways for utilizing the (un)regulated stochastic clocks in order to construct real-valued mixed models. In Section 4, we demonstrate clock regulation on two important special cases featuring jump–diffusion models and purely discontinuous models and discuss their potential applications in finance as well as other fields. Section 5 outlines two possible candidates for optimizing the degree of regulation: one employing a robust moment-based estimation procedure combined with profile log-likelihood and the other using option price calibration with numerical Fourier inversion techniques, which underlie our empirical study in Section 6 concerning S&P500 and Bitcoin returns and Bitcoin options. Conclusions are drawn in Section 7 along with a summary of the properties of the three recipes and highlights on future research directions. All mathematical proofs are presented at the end of the paper, in Appendix A.

2 Regulated stochastic clocks

As already noted, we shall develop our methodology using Lévy processes exclusively. By having independent and stationary increments, such processes are easy to manage and sit at the core of statistical estimation with i.i.d. temporal data. To begin with, we outline some basic intuition.

Let be a Lévy subordinator (nondeterministic by default), acting as a stochastic clock. The objective of regulation lies in properly compressing the amplitude of its moderate jumps (for moderate values the jump component ), and an attendant consequence is that the finite-dimensional distribution of will tend to have greater asymmetry and a heavier right tail, as measured by the skewness and kurtosis. Thus, suppose that is the Laplace transform (LT) of the random variable for generic , assumed to be definable in a neighborhood of the origin (in ), and then with the canonical expansion

| (2.1) |

in terms of corresponding cumulants , (with ), the objective is converted to finding, for a fixed , a linear functional such that, from (2.1),

where the time-invariant factors ’s satisfy and , . These relations will immediately render cumulants of larger (up to four) orders more reduced. Although there are obviously infinitely many possible ways to construct such a functional, should be conceptually matched with a recipe operating on the sample paths to which the collection of LTs correspond; otherwise temporal structures represented by path properties will be difficult to justify if possible at all. In what follows we are going to present three utterly simple and closely related recipes of this nature, by exploiting continuous temporal averaging.

2.1 Repeated averaging-induction: Three recipes

We design our first recipe as follows. Set and, for any , repeatedly define the running averages

| (2.1.1) |

For each , is a stochastic process having -a.s. continuous sample paths, where continuity at 0 follows by the dominated convergence theorem. More specifically, the sample paths belong to the class of ()th-order differentiable functions for , -a.s., as a result of repeated integration.

Since (2.1.1) operates a linear functional, it is clear that for every and fixed the random variable has an infinitely divisible distribution, which induces a unique Lévy process that is also nonnegative, which we denote as

| (2.1.2) |

By nonnegativity every can be used as a different stochastic clock, and will be referred to as the type-I regulated -clock of degree .

The intuition behind the first recipe is rather clear: Averaging in time has a natural effect of contracting moderate values of the sample paths and continuing to do so will tend to enlarge such an effect. To give some remarks, in the special case , the process is precisely the running average of , which is heavily tied to linear integral functionals of Lévy processes; such integrals have been widely applied to trace the cumulative patterns of various stochastic systems; some notable examples include the total cost of random epidemics (see, e.g., [Downton, 1972] [25] and [Pollett, 2003] [54]), cumulation of count data generalized to non-integer values ([Orsingher and Polito, 2013] [52]) or count data with overdispersion ([Xia, 2019] [67]), and the modeling of structural degradation phenomena in the presence of memory effects (see [Tseng and Peng, 2004] [64] and [Xia, 2021, Sect. 4.1] [68]).

Note that the averaging–induction procedure also works for any integer , and hence it is intuitive to consider inducing a Lévy process for each using (2.1.2), before initiating a subsequent averaging step (2.1.1). In this way the integrand in the averaging step can be made a Lévy process even for , and each resultant averaged process will correspond to the linear functional of a certain Lévy process. Such an idea leads to our second recipe. Likewise, set , and then repeatedly utilize the first recipe for every in the following fashion:

| (2.1.3) |

where ’s are induced Lévy processes such that

It is clear that the averaged processes and are indistinguishable, and so are the induced processes and , but for they are different with dissimilar path properties – the sample paths will remain in the class (-a.s.) for .

It can be shown (see the proof of Theorem 1 in Appendix A) that the second recipe can be essentially thought to average the log-LT, while in comparison the first recipe, by construction, has the averaging effect on the sample paths. We will refer to the process , , as the type-II regulated -clock of degree .

In the averaging step (2.1.1), if we stack up the time scale () outside of the integral operators for every , the averaging procedure becomes a folded cumulation with a one-time power scaling, and we shall have our third recipe. Set and define the quasi-averages

| (2.1.4) |

which has an infinitely divisible distribution for the same reason as in (2.1.1), and induce a unique nonnegative Lévy process,

referred to as the type-III regulated -clock of degree .

It is obvious that the processes and have the same degree of path smoothness but are guaranteed to coincide (up to indistinguishability) only if . Besides, the distribution of is also infinitely divisible for every and fixed .

We present some general formulae for the LTs of the three types of regulated stochastic clocks in Theorem 1, which are naturally extended to non-integer-valued as well. This aspect hints at the extension of the three recipes to the sense of averaging of fractional degrees and will be considered in the optimization of the regulation degree .

Theorem 1.

For generic and any , the LTs of , , and , are given by

| (2.1.5) |

respectively, where and symbolize, respectively, the usual gamma function and the (upper) incomplete gamma function.

In any case, the recipes have given rise to three families of stochastic clocks, controlled by the degree of regulation. The effect of operating the three recipes on the unregulated clock is twofold – on path properties and distributional properties, as we are bound to investigate next.

2.2 Characterizing triplets

From their primary motivation, the three recipes are all supposed to compress the jumps of into extreme values. To confirm such effects, it is necessary to derive the characterizing triplets of the regulated clocks ’s, ’s, and ’s governing their sample path properties. Doing so will also be helpful for developing simulation methods, the main reason being that the LTs that we have obtained in (1), having exponentiated integrals, are generally difficult to invert analytically, thus circumventing the implementation of inverse sampling methods.

First, there is no Brownian component in ’s, ’s or ’s and we assume without loss of generality that there is no drift as well, so that we can concentrate on the corresponding Lévy measure. More specifically, suppose that the LT takes the following general form due to the Lévy–Khintchine representation:

with the characterizing triplet , for some Lévy measure333The notation will occasionally be used for the Lévy measure of in the mathematical proofs (Appendix A) to avoid ambiguity. imposed on such that and . Then, the characterizing triplets of , , and , given , are denoted as , , and respectively, which make the representations

| (2.2.1) |

Theorem 2.

For any , we have

| (2.2.2) |

where is the inverse regularized (upper) incomplete gamma function.444It is understood as the unique solution to the transcendental equation for ; see [DiDonato and Morris, 1986] [24].

Furthermore, if is absolutely continuous with respect to Lebesgue measure, then

| (2.2.3) |

with .

We remark that the Lévy measures ’s, ’s, and ’s from (2), for , are all absolutely continuous because of integration, and thus their associated Lévy densities on the left-hand side of (2) exist unconditionally. More importantly, we have the following equalities among their Blumenthal–Getoor indices ([Blumenthal and Getoor, 1961] [15]).

Corollary 1.

For any , it holds that

| (2.2.4) |

and similarly .

Corollary 1 means that none of the three recipes alters the path regularity of , which is beyond doubt a very desirable property as there is never an intention of changing the jump activity of the underlying models connected with trading intensities (recalling Section 1). On the other hand, all of the induced Lévy measures govern jumps of arbitrarily large amplitudes, whereas their actual weights (namely likelihood) will depend on the functional form of (or that of the LT), subject to further adjustment of its parameters, and through the foregoing relations. This aspect will be clearer as we move to specific distribution families of interest in Section 4.

To gain additional insight into how the three recipes distort the Lévy measures , , and from a comparative angle, it is first observed from (2) in Theorem 2 that these Lévy measures do coincide if and only if . Upon the substitution , they can be viewed as fractional integrals of the Lévy measure of under different kernels, which with fixed boil down to the functions , , and , respectively, defined for . Interestingly, we then observe that the first two functions are precisely the derivatives in magnitude of and , respectively, which happen to be inverses of each other. Put differently, the effects on the (average-induced) Lévy measures from the first two recipes are perfectly complementary, in the sense that neither dominates the other. Differently, the third function integrates in magnitude to , which is not in direct comparison with the others, for the third recipe, strictly speaking, does not embody a running average for . This discussion is further illustrated in Figure 1, with five integer degrees of regulation. We see that the first recipe, which averages the sample paths, has a larger impact (distortion) when is concentrated on small values of , relative to the second, which at bottom averages the log-LT. In addition, the larger the regulation degree, the faster the impact differences are reflected.

2.3 Asymmetry and tail heaviness

The static effect from operating the three recipes is to enlarge the asymmetry and (right) tail heaviness of the distribution of the unregulated clock for any fixed . With the LTs in (1) at hand, computation of the statistics of the corresponding regulated clocks ’s and ’s is straightforward. More particularly, we shall focus on the impact of regulation on skewness and excess kurtosis. Let us restate from (2.1) that the corresponding cumulants are defined to be the series coefficients and in

with . The next corollary explains how the cumulants vary with the regulation degree .

Corollary 2.

For any , we have the cumulant reduction relations

| (2.3.1) |

with the sequence

| (2.3.2) |

which is rational for .

Using Corollary 2, the relations for the mean, variance, skewness and excess kurtosis of the type-I -degree regulated -clocks are given by

| (2.3.3) |

Since the integrand in (2.3.2) admits the series representation ([Abramowitz and Stegun, 1972, Eq. 6.5.29] [1])

carrying out the integral over gives

| (2.3.4) |

and hence the sequence decays exponentially as increases for and (strictly) faster for . This indicates that the first recipe shrinks the cumulants of with acceleration – more aggressively so as regulation continues with . Note that for the exponential decay is in fact an equality . Looking at (2.3) and (2.3.4) we can also claim that the type-I regulated clocks have at least exponentially decaying mean and variance but faster-than-exponentially increasing skewness and excess kurtosis, with respect to the degree of regulation, other things (e.g., parameter values) held equal.

In the case of the type-II regulated clocks, the counterpart of (2.3) for is

| (2.3.5) |

Intuitively, this signifies that the cumulant-reduction effect of the second recipe is uniform, in the sense that for each additional round of regulation, the mean and variance are reduced by fixed proportions ( and , respectively) while the skewness and excess kurtosis are simultaneously enlarged by fixed proportions ( and , respectively). In consequence, for the type-II regulated -clocks the mean and variance decay exactly exponentially and so do the skewness and excess kurtosis increase, other things equal.

As for the type III, we have similarly from Corollary 2 the quotient , , and subsequently the following moment relations for :

| (2.3.6) |

Upon comparing the above quotient with (2.3.4), with as it is seen that the third recipe generates an even severer cumulant-reduction effect than the first recipe does. However, the skewness and excess kurtosis are enlarged with deceleration, noted that and , as . Put together, the type-III regulated -clocks have mean and variance of faster-than-exponential decay whereas the skewness and excess kurtosis exhibit slower-than-linear growth, which properties are in stark contrast with those of the first two types.

On paper, if we do not alter the parameter (if any) values of , then all three recipes are able to effectively enlarge the asymmetry and tail heaviness of its distribution, with the first having the most significant effect, whereas the downside is that the mean and variance are reduced at the same time. The latter effect is, of course, undesirable for applications, and eluding it will require at least two independent parameters so that the mean and variance can be held constant across the regulation degree . More specifically, when a real-valued model is to be constructed from (see Section 3), with the aid of an additional location parameter the mean can be readily fixed by way of centralization, and so the other parameter will most likely (and ideally) be a scale parameter, to which the standard deviation is proportional and the skewness and excess kurtosis are immune. Such a requirement becomes rather standard in statistical inference, and in consequence the skewness and excess kurtosis relations stated in (2.3), (2.3.5), and (2.3) provide useful implications. We remark, however, that if the mean is to be kept invariant to regulation by way of a shape parameter of (oftentimes existent for one-sided distributions) then changing its value is likely to enlarge skewness and excess kurtosis at rates different from those in (2.3) and (2.3.5), despite exponential growth rates. Such a situation cannot be analyzed from a universal viewpoint and will again depend on the functional form of the LT , with respect to the shape parameter. More details are provided in Section 4.

Similarly, the results for the statistics stated in this section can be naturally extended for fractional degrees of regulation. In Figure 2 we give a joint plot of the enlargement effect on asymmetry and tail heaviness for the two recipes with real regulation degrees , by using (2.3), (2.3.5), and (2.3) in sequence.

3 Time-changed processes

As aforementioned, the functionality of the regulated clocks ’s, ’s, and ’s is meant to be the same as that of – mathematically, to adjust the time underlying a (continuous) base process and generate a wide class of models for real-valued temporal data such as financial returns. In the following we shall consider two well-known base processes for the mixture, which are also shown to retain, leastways in part, the enlargement effect on asymmetry and tail heaviness through the clock regulation.

3.1 Constant mixtures

The simplest base process is beyond doubt a (deterministic) drift up to positive scaling, and time-changing it by the clock gives none but itself. Then, in order to create a real-valued random variable from it suffices to take the difference of two of its independent copies. Specifically, let be an independent copy of , and then define the difference process

| (3.1.1) |

where is a location parameter and are additional scale parameters. Then is a purely discontinuous real-valued Lévy process admitting the LT (fixing )

| (3.1.2) |

where the domain of can be extended to a neighborhood of provided that (2.1) holds.

Note that since the integral operator is for every a linear isometry over the space of bounded functions, considering such independent differences under the -degree regulated clocks is no different from operating the three recipes on the initial difference process . As a result, we can define the corresponding difference processes under each , , and , denoted , , and , respectively, in the same way as in (3.1.1).

Corollary 3.

For generic and any , the LTs of the constant mixtures subject to clock regulation are given by

| (3.1.3) |

Besides, by independence the th cumulant of for fixed is nothing but and similarly for and . If the mean and variance of and are kept constant by adjusting, respectively, the location parameter and a scale parameter of , then the skewness and excess kurtosis increase at precisely the same rates as those of stated in (2.3), (2.3.5), and (2.3), respectively. Therefore, the constant mixture approach also preserves enlargement effects on asymmetry and tail heaviness of the constituent subordinator , regardless of the additional parameters , , and .

Simplicity notwithstanding, a major drawback of this approach, due to linearity, is that it inevitably inherits the path regularity of into the processes ’s, ’s, and ’s, as the next corollary shows.

Corollary 4.

For any , we have .

3.2 Gaussian mixtures

Alternatively, one can construct a real-valued random variable by using it as a scale parameter for an independent Gaussian random variable – a technique called “Gaussian mixture,” which is implemented here by way of using to time-change a Brownian motion with drift (see, e.g., [Barndorff-Nielsen, 1997, Sect. 3.1] [7] and [Madan et al., 1998, Sect. 2] [46]). To be precise, let be a standard Brownian motion independent of , and define the mixed process

| (3.2.1) |

where is a location parameter and is a Brownian drift parameter representing signed random momenta. The dispersion of the Brownian motion can be fixed at for simplicity as long as has a scale parameter, which is already able to capture jump volatility. Then, is also a purely discontinuous real-valued Lévy process. Upon applying the tower property of conditional expectations, the LT of for fixed is found to be

| (3.2.2) |

Again, a partial domain extension into is possible with (2.1).

In a similar fashion, we can time-change the Brownian motion with drift by the regulated clocks, though this would not be equivalent to operating the two recipes on . The resultant processes are denoted as, respectively, , , and , with the LTs () states as follows.

Corollary 5.

For generic and any , the LTs of the Gaussian mixtures subject to clock regulation are given by

| (3.2.3) |

From Corollary 5, an application of Faà di Bruno’s formula yields the cumulants of in terms the finite sums

where ’s are partial Bell polynomials. In particular, by the order of the first four cumulants are: , , , and , in order. Similar results hold for and . Notably, the elegance of the Gaussian mixture (3.2.1) lies in that the additional parameter in its own right acts as a scaling factor on , so that scaling is fundamentally linked to doing , making it a feasible task to control the variance of (and that of and ) to be invariant to clock regulation, while the invariance of the mean is taken care of by the location parameter . The consequence is that the skewness and kurtosis relations in (2.3), (2.3.5), and (2.3) set the upper bounds for those (lower-bounded by 1) of the Gaussian-mixed processes, whose exact rates of increase are subject to the value of .

The main reason to consider Gaussian mixtures is that they allow for processes with infinite-variation sample paths. Indeed, it can be shown (see Appendix A) that the Blumenthal-Getoor indices of the Gaussian mixtures are precisely double that of .

Corollary 6.

For any we have .

Therefore, as long as , , and hence , , and , , on the regulated clocks, will all have jumps of infinite variation. The same idea goes for the Gaussian mixtures on the regulated clocks. This property overcomes the limitation of the constant mixtures and is particularly attractive when flexibility to include highly active jumps in asset returns is required for model formulation.

4 Some important special cases

We now consider two specific distributions of the unregulated clock for practical interests. By infinite divisibility we fix time at unless otherwise specified. Explicit formulae will be presented for the distributions of all three types of regulated clocks, as well as their time-changed processes.

4.1 Poisson process

Let the LT of be given by with shape parameter (Poisson intensity). Then we have the following specialized formulae.

Proposition 1.

If is a Poisson process with intensity , then for any ,

| (4.1.1) |

where denotes the generalized hypergeometric function (see [Slater, 1966] [60]); also,

| (4.1.2) |

It is an easy implication from Proposition 1 that the type-I regulated clock is of compound Poisson type: In light of the discussion in Subsection 2.2 and with inverse sampling in mind,

| (4.1.3) |

where is a sequence of i.i.d. standard uniform random variables. The transformed variable representing the jump amplitudes reduces to the standard uniform for and takes values in for all values of . In particular, is a compound Poisson-uniform process, which result has been discovered as a special case of fractionally integrated Poisson processes in [Orsingher and Polito, 2013] [52].

The first LT (1) cannot be evaluated explicitly555Apparently, this is caused by the lack of an explicit antiderivative of the function , . Even so, one can always derive alternative series representations for the log-LT. except for , in which case it is . Nonetheless, the first integral in (1) is very amenable to numerical computations using a standard Gauss–Kronrod quadrature rule because the integrand is an increasing function (of ) with values in for any .

Likewise, under the second recipe, the following representation exists for :

| (4.1.4) |

which is also a compound Poisson process. Similar to the type I, the jump amplitudes are all valued in , and are standard uniformly distributed for .

For the same reason as the first, the second LT in (1) can be efficiently carried out as a numerical integral thanks to the monotonicity and boundedness of the integrand, while an explicit expression has been given for integer regulation degrees. Only for two degree values can it be expressed in terms of more elementary functions. Of course, if , we have the compound Poisson-uniform LT . If , one can consult [Bateman, 1954, Eq. 4.6.1 and Eq. 4.6.2] [10] to obtain

where is known as the Euler–Mascheroni constant.

Due to simplicity, the third LT in (1) (under the third recipe) permits explicit evaluation for any real regulation degree, from which we have the representation

| (4.1.5) |

showing that is a compound Poisson process with -scaled beta()-distributed jumps. Unlike the other two types, due to such scaling the support of the jump amplitudes of shrinks with , and converges to the origin in its lower limit.

According to (4.1.3), (4.1.4), and (4.1.5), we conclude that when is a Poisson process, all three types of regulated clocks follow compound Poisson processes with bounded jumps. These representations provide easy ways for conducting simulations. Also, the two corresponding transformations under the first two recipes form inverse functions of each other, in line with the demonstration by Figure 1.

In financial applications, compound Poisson processes with finite jump amplitudes, coupled with an independent Brownian motion, form adequate jump–diffusion models for log-price dynamics when sudden movements in returns are believed not to be arbitrarily large in reality; see [Yan and Hanson, 2006] [69] and also [Baustian et al., 2017] [12]. These models are built from uniform distributions and are deemed to enlarge the tail heaviness of Gaussian distributions to an extent comparable to normally or double-exponentially distributed jumps (e.g., [Kou, 2002] [40]). Noted that is a compound Poisson-uniform process, they can be simply expressed in terms of

| (4.1.6) |

for a rate (reciprocal scale) parameter and a Brownian dispersion parameter . Since the continuous part is immune to regulation by the stability of the Gaussian distribution, clock regulation can still be understood on the entire jump–diffusion process . Viewing from the representations (4.1.3), (4.1.4), and (4.1.5), the effect of regulation is then to assign greater (probabilistic) weights to smaller price jumps, and the consequent jump amplitude distribution, which possesses a strictly decreasing density over a finite domain, is a “give-and-take” between the uniform and the exponential family.

To give an example, let us consider the scaled clock , where is for every a rate parameter (assuming for simplicity), and derive from it the regulated clocks , , and accordingly, whose constant mixtures are constructed following Subsection 3.1, with and . Then the processes , , and are centered symmetric compound Poisson processes with intensity and positive and negative jumps equally distributed in magnitude. To fix the variance of (at generic time) over , it suffices to set , for , , and for , . Then, as increases, the domain of jump amplitudes spreads out, albeit bounded, and the probability of smaller jumps also rises, as Figure 3 shows. Therefore, , , and all constitute a rich class of desirable models, when return jumps are known to be bounded in size but unevenly distributed.

Moreover, if and are two independent Poisson processes with possibly different intensities, say , the modified constant mixture666The superscript is expanded to include the process because here it is not an exact copy of . with parameters , , and is seen to be a scaled Skellam process which has jumps of fixed amplitude (equal to ). This type of discrete-valued processes have gained popularity in modeling tick-by-tick price changes with high-frequency data, as pioneered in [Barndorff-Nielsen et al., 2011] [9]. Recent developments have dealt with stochastic-volatility extensions for memory effects; see, e.g., [Kerss et al., 2014] [38], and [Gupta et al., 2020] [33], the latter also having studied associated running average processes beside discussing natural applications to scoring in ball sports. In connection with this, the process (), up to scaling by a positive number, defines exactly the -degree running average of (by linearity) and enables analysis of arbitrarily long-term behaviors of such phenomena (tick price changes versus scoring gaps). On the other hand, the scaled Lévy processes , , and of possibly fractional degrees , when applied for the same modeling purposes, allow for imprecision (e.g., ambiguity between change versus no change) in possible outcomes, by assigning positive probability to jumps of amplitudes strictly less than . In consequence, these possible outcomes are extended to real values to balance out false judgments, but still cannot fall out of their constructional range (tick sizes or score scales). In particular, the extent of imprecision is directly related to – if , ambiguity in favor of no change stays minor. Obviously, in the limit as the original discrete-valued processes are restored.

4.2 Tempered stable subordinators

Tempered stable distributions are an infinitely divisible family that was initially introduced in [Koponen, 1995] [39] from a procedure incorporating the finite moments property of Gaussian processes into Lévy stable processes, where it bore the name “truncated Lévy flights.” It is most commonly known in its one-sided form, characterized by up to three parameters (shape), (rate) and (family), with which the corresponding Lévy processes are often called tempered stable subordinators and so are readily usable as stochastic clocks. We refer to [Schoutens, 2003, Sect. 5.3.6] [59], [Rosiński, 2007] [56], and [Küchler and Tappe, 2013] [41] for a comprehensive treatment of these processes; see also [Grabchak, 2021] [31] for their discrete-valued analogy. The tempered stable family includes several commonly used subordinators as special cases, such as the gamma process () and the inverse Gaussian process (). If is a tempered stable subordinator with parametrization , its LT (at ) is given by

which is right-continuous at . The Lévy density of exists and equals , .

For , the indistinguishable order-1 regulated clocks , , and have been studied in depth in [Xia, 2021] [68], by the name of “average-tempered stable subordinators.” For all other values of , in the presence of the gamma-related functions, for the type I it does not seem possible to further write the corresponding formulae in (1) and (2) explicitly, whereas both in the present form can be computed numerically with high efficiency thanks to the positivity and boundedness of the integrands.

In contrast, the formulae in (1) and (2) for the type-II clocks are reducible to some closed-form expressions provided , by exploiting series representations of the integrands; further, due to the constructional simplicity of the type III, its corresponding formulae readily permit explicit evaluation, even for fractional degrees, which results are given in Proposition 2.

Proposition 2.

If is a tempered stable subordinator with with parametrization , then for any ,

| (4.2.1) |

where the poly-logarithm, and where analytic continuation is understood in each slit region and , , respectively, and

| (4.2.4) | ||||

| (4.2.5) |

where denotes the Meijer G-function (see the proof in Appendix A).

Note that if , then with and the elementary formulae follow:

as were initially obtained in [Xia, 2021, Thm. 1 and Corol. 2] [68]. For rational values of the family parameter , it is possible to rewrite (2) in terms of multiply nested sums of poly-logarithms; see, e.g., [Kalmykov and Kniehl, 2009] [36]. However, it is our preference not to straggle into those representations which are extremely lengthy in general, as interest is more for computational efficiency. For example, the following elementary formula applies to in the special case , corresponding to the inverse Gaussian process:

It can be easily verified using the antiderivative of in ; see [Gradshteyn and Ryzhik, 2007, Eq. 2.725] [32].

Also, we note that none of the Lévy densities given in (4.2.4) is integrable on , meaning that the processes ’s all have essentially infinite jump activity, as discussed earlier; in particular, for the tempered stable subordinator . In the special case , the first formula in (4.2.4) reduces to

corresponding to the Lévy density derived in [Xia, 2021, Corol. 1] [68], while for , the formula (4.2.4) stands and cannot be simplified to more elementary functions.777The first formula (4.2.4) is not really useful beyond deciphering the functional form of the induced Lévy densities; more specifically, because the G-function is defined through complex line integration by most computer algebra systems, its implementation is understandably much less computationally efficient relative to its numerical counterpart (via (2) by the quadrature rule), which also accommodates fractional values of .

Unlike the other two, the third recipe benefits by having no effect of increasing the computational complexity of the LT when operating on a tempered stable subordinator,888Numerical computations through the formulae (2) and (4.2.4) still intensify with the regulation degree which controls the dimensionality of the hypergeometric functions. and by this advantage the formulae (2) can be confidently applied to characteristic function-based optimization problems such as calibrating the parameters of a market model on strings of derivatives prices using numerical Fourier transforms.

Because the LTs , , and (fixing ) are all analytic in the complex plane except for a branch point on the negative real axis, the corresponding inverses (i.e., (a posteriori existent) density functions) can be found via a standard deformation argument employing a counterclockwise keyhole contour avoiding the cut extending to . Consequently, we obtain the following formulae:

| (4.2.6) |

for , where the real and imaginary parts are efficiently computable according to Theorem 1.999From a computational viewpoint, the formulae in (4.2) are stabler than performing a numerical inverse Fourier transform and allow the density functions to evaluated (or plotted) on a fine grid. In particular, for we have, after the substitution

| (4.2.7) |

and for any , with ,

| (4.2.8) |

Despite stability, implementation of (4.2) will require some effort for since the hypergeometric functions need to be computed by analytic continuation of the definitional series which are only convergent within , while there is no such issue for (4.2) because of fixed dimensionality of the hypergeometric functions.

With its overall flexibility and explicitness, processes with marginal tempered stable distributions are of great applicability in operations research, especially in the fields of reliability engineering and mathematical finance; we mention [van Noortwijk, 2009] [65], [Wang and Xu, 2015] [66], and [Ye and Xie, 2015] [70] for résumés on related structural degradation models and [Boyarchenko and Levendorskii, 2000] [17] and [Carr et al., 2002] [18] for derivatives pricing theory. For Gaussian mixtures, the path regularity is directly captured by the family parameter . Recalling that , for any (by Corollary 6), if , then the mixed processes , , and all have sample paths of finite variation, while the paths are of infinite variation for . In the special cases and , becomes the variance gamma process and the normal inverse Gaussian process, respectively.101010In [Carr et al., 2002] [18], two-sided tempered stable processes were studied under the name “CGMY,” which include the variance gamma process as a special case. However, for such processes cannot be interpreted as Gaussian mixtures of tempered stable subordinators. With the sample paths of the variance gamma process are of finite variation while with those of the normal inverse Gaussian process have infinite variation. In such cases, the processes , , and derived from stochastic clock regulation are natural extensions of the foregoing models with arbitrarily large skewness and kurtosis, the mean and variance fixed and path regularity unchanged.

Subject to the addition parameters , the density function of can be written either with (3.2.2) as the Fourier inverse

| (4.2.9) |

or, after applying the Bayes theorem to (4.2), as the marginalization

| (4.2.10) |

where the use of Fubini’s theorem in the second equality is under the condition that ;111111It can be shown that the polarity of with being a tempered stable subordinator exactly equals that of , which feature is also unaffected by regulation (). similar results hold for the densities and in terms of and , respectively.

It is straightforward to keep the mean and variance of the Gaussian mixture invariant to with the parametrization . One can for example adjust the location and Brownian drift parameters and according to the rules and ;121212Since we know from Subsection 3.2 that the value of directly controls the skewness, this approach can very quickly result in abnormally large asymmetry as increases. to maintain the moderate enlargement effects in (2.3.5), one can as well adjust the location and (tempered stable) rate parameters and by the rules and , where has unit scale; alternatively, disregarding the additional parameters and one can change the shape and rate parameters and of the unregulated clock , as discussed in Subsection 3.2.131313In contrast to the first, this one tends to give milder-than-moderate enlargement effects and so can fit in with a wide range of values of , hence also more manageable; see Appendix B for details. Along these lines one can come up with many hybrid methods for fixing the mean and variance, e.g., by changing , and powers of simultaneously. Similar arguments go for and .

5 Optimal degrees of regulation

It is time to consider the problem of finding an optimal degree of regulation with available data. Optimization may be accomplished by many different rules, depending on various aspects of the resultant distributions and data types. Instead of a comprehensive analysis, the aim of this section is to discuss two popular and comfortable methods that can justify values significantly deviating from zero (unregulated case) with due contrast control. The methods by themselves accommodate both the constant mixture and the Gaussian mixture .

5.1 Moment-based estimation

In financial modeling, it is a standard assumption that a probability distribution of asset returns can be defined by the knowledge of their first several (usually four) moments; see, e.g., [Ané and Geman, 2000] [5]. This suggests that one can use the first sample moments – in particular the sample mean, variance, skewness, and excess kurtosis – to retrieve certain model parameters, and underlies our moment-based estimation procedure, which goes as follows.

We start by fixing a truncated and discretized domain of degrees of regulation, and conduct moment-based estimation of the model parameters for each , with corresponding to the unregulated case. Recall that regulation leads to simple cumulant reduction relations (Corollary 2), with regulation type-specific coefficients

| (5.1.1) |

so it is most convenient to construct corresponding moment conditions from the model cumulants; for similar estimation procedures in the literature we refer to [Beckers, 1981] [13] and [Bandi and Nguyen, 2003] [6]. After experimenting with every member in , the optimal value of is identified (a posteriori) based on the maximal profile likelihood as a criterion for model selection. The reason behind choosing moment-based estimation over maximum likelihood estimation is twofold: It is much more computationally efficient because the density function of Lévy models are generally difficult to obtain in closed form (e.g., see [Schoutens, 2003, Chap. 4] [59]), with or without clock regulation; it is also more robust by making fewer assumptions for the underlying data-generating mechanism as only a finite number of moments are utilized.

Suppose that we have obtained an i.i.d. sample of some log-returns , with being the sample size, at a uniform frequency in fractions of a year; from now on we shall write as , , , and the sample mean, variance, skewness, and excess kurtosis, respectively, and , for , the mixed model cumulants with regulation degrees . Then, the four moment conditions can be written

| (5.1.2) |

First, we take to be a Poisson process and its constant mixture plus an independent Brownian motion, as discussed in Subsection 4.1. From (4.1.3), (4.1.4), and (4.1.5) we know that in this case the model is of jump–diffusion type with bounded (distorted uniform) jumps. For convenience, we shall focus on downside jumps, in view of excessive tail risk, by imposing the auxiliary parameter values and in (3.1.1). Note that the mixed model with clock regulation has a total of four parameters to be estimated, including an infinite-divisibility parameter , a rate parameter , a location parameter , and a Brownian dispersion parameter , all of which are subscripted by the corresponding degree of regulation, .

Proposition 3.

In terms of the above estimates, the profile likelihood function under the mixed model (with an -degree regulated clock) can be directly computed using the Bernoulli approximation technique in [Kou, 2002, Eq. (5)] [40] as

provided that is small – e.g., as in the case of daily data, where the Lévy density represents any one of , , and (with scaling factor ) in Proposition 1 according to the type of regulation. Whichever model yields the largest value of is taken as the best.

Second, we let be a tempered stable subordinator and construct its Gaussian mixture . The family parameter is fixed a priori for its special connection to local path regularity, which leaves us with also four parameters to be estimated – (with regulation degree subscripts) the infinite-divisibility parameter , rate parameter , location parameter , and the Brownian drift parameter . In this case, the moment-based estimators can be shown to be generally unique under the conditions in (5.1.2).

Proposition 4.

Given any regulation degree , under the Gaussian-mixed tempered stable model with and parametrization , the moment-based estimators are given by the conditions

| (5.1.4) |

where and solves the rational equation

| (5.1.5) |

with

5.2 Model calibration on option prices

Alternatively, instead of estimating parameters from sample moments, one can recover them by model calibration on option price data. With the assumption of no-arbitrage, such an exercise will require that the LT be evaluated under some risk-neutral probability measure (other than ) under which the asset price is discounted at some (supposedly) constant risk-free rate . Allowing for calibration efficiency, here we concentrate on the type-II and type-III regulated clocks which permit some explicit formulae when acting on Gaussian mixtures of tempered stable subordinators (recall Subsection 4.2). By way of the “mean-correcting measure” outlined in [Schoutens, 2003, Sect. 6.2.2] [59], we can then directly assume that the LT of the log asset price at time under the measure is given by

provided that the denominator in the power is finite, where is the constant risk-free rate in the associated money market and is the same select domain of the regulation degree for experiments.

Then, the no-arbitrage price of a European-style call option written on at time with strike price and maturity fixed is given by

| (5.2.1) |

where is the (constant) dividend yield and

are associated risk-neutralized in-the-money probabilities.

Suppose that we have obtained contemporaneous market quotes of call options on for various strike prices and maturities, denoted as . Focusing on the Gaussian mixed model where is the tempered stable subordinator with a fixed family parameter , then after mean correction there will be only three parameters, , , and (with degree subscripts as before), whose (locally) optimal values can be found by solving the following minimization problem:

| (5.2.2) |

where the objective function is the mean absolute percentage error (MAPE) measuring average pricing errors and the summation runs over all available strikes and maturities. The best model is then characterized by imposing the criterion on the right side of (5.2.2). A similar exercise using put options is immediate by applying a standard parity argument to (5.2.1). Nevertheless, compared with moment-based estimation, calibration is expected to be less robust because it generally constitutes a highly non-convex optimization problem which must be solved numerically.

6 Empirical modeling

In this section we demonstrate the effect of clock regulation on real financial returns. We focus on the equity market and the cryptocurrency market; in particular, we have collected S&P500 index and Bitcoin price data on the daily basis over the 2020 calendar year (data source: Yahoo Finance) and have computed corresponding log-returns. The two data sets hence have sample sizes () of 252 and 366, respectively, with .

In accordance with the moment-based estimation procedures discussed in Subsection 5.1, our empirical study will feature two exercises, one using the constant mixture of a Poisson process augmented by an independent Brownian motion and the other using the Gaussian mixture of a tempered stable subordinator, respectively. We highlight that the first exercise is interesting for modeling (presumably) bounded jumps in asset returns ([Yan and Hanson, 2006] [69] and [Baustian et al., 2017] [12]) and aims to compare the distorted jump distributions with commonly used uniform distributions; the second, on the other hand, is especially significant for possible improvement of tempered stable processes ([Rosiński, 2007] [56] and [Küchler and Tappe, 2013] [41]) in terms of flexibility, by investigating how the degree of regulation affects the model fit subject to moment matching for different choices of the family parameter .

First, we report the four sample statistics of the collected return data in Table 1. Relative to the S&P500, Bitcoin returns have clearly exhibited a much larger (absolute) skewness and excess kurtosis, speaking to high asymmetrical and tail risk.

| Data set | mean | variance | skewness | excess kurtosis |

|---|---|---|---|---|

| S&P500 | 0.000564705 | 0.00047912 | 8.46843 | |

| Bitcoin | 0.00384156 | 0.00160601 | 50.8679 |

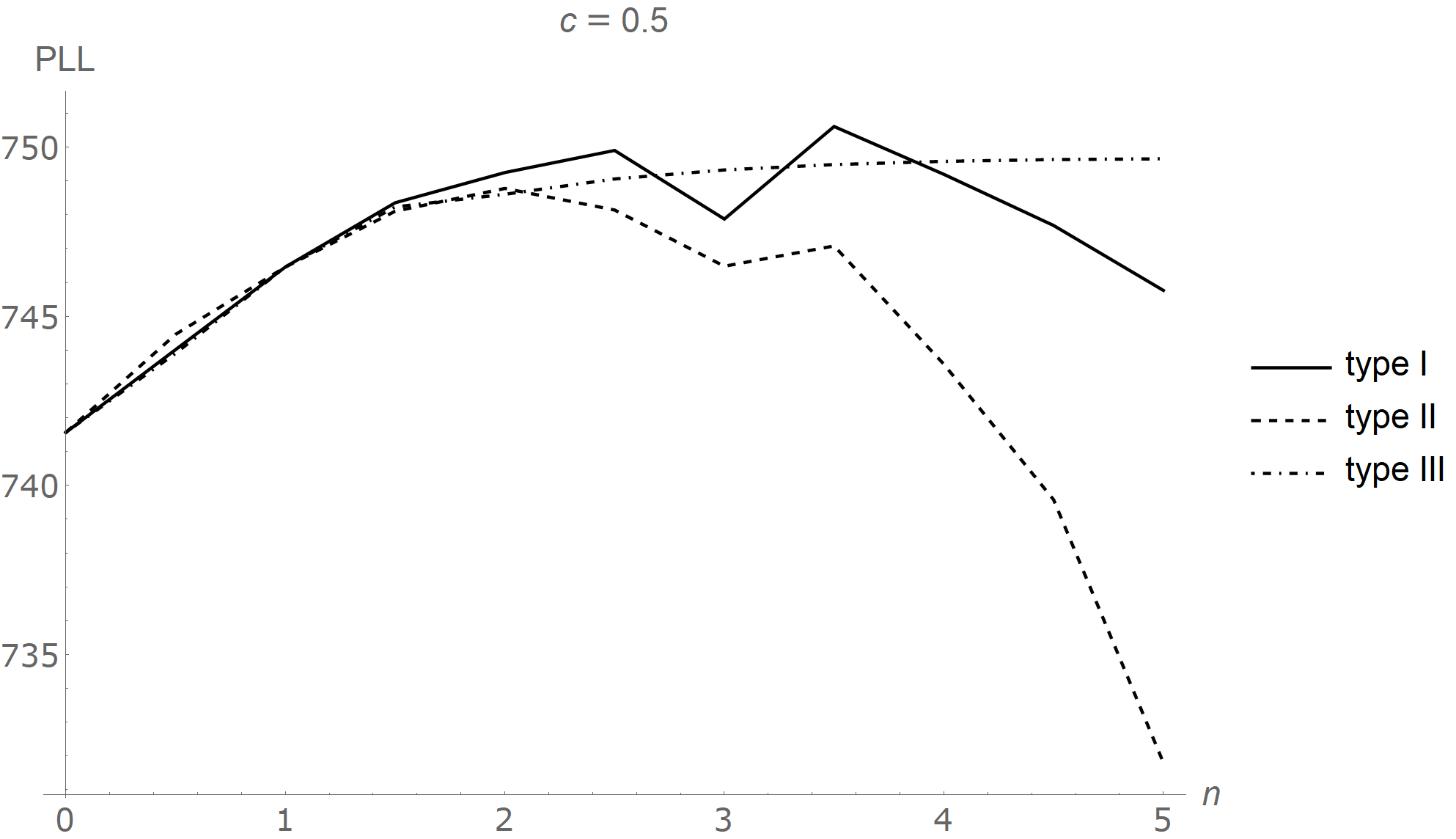

In both exercises, the choice of the degree domain is with fixed modulus to ease comparison. In the first exercise, the exponential jump–diffusion model ([Kou, 2002] [40]) is also included as a contrast model because the distorted uniform distributions due to regulation have exponential shapes. In the second exercise, we experiment with four values of : 0 (variance gamma), 0.25, 0.5 (normal inverse Gaussian), and 0.75. Estimation results are presented in ten (sub)tables – Table 2, Table 3, Table 4, Table 5, Table 6, Table 7, Table 8, Table 9, Table 10, and Table 11, and are comprised of parameter estimates and the profile log-likelihood (PLL), , for every . In each model setting (including each chosen value of ), the model with the highest PLL value for a certain regulation type is marked “” and that with the highest PLL value taking into account all three types is marked “.” To enhance visual impact, changes in the PLL are plotted separately in Figure 4, Figure 6, and Figure 7.

Furthermore, we provide Figure 5, Figure 8, and Figure 9 to compare the estimated density functions of the best fit model (namely the one with the highest PLL value across all three types) and the original model () against the empirical kernel density function which is estimated using the Gaussian kernel, i.e.,

the optimal bandwidth is determined by the Silverman rule of thumb:

where is the interquartile range (the difference between the third and the first quartiles).

*

| type I | PLL | |||||

|---|---|---|---|---|---|---|

| 0 | 0.228049 | 4.64498 | 0.191402 | 0.331917 | 605.28 | |

| 1 | 0.467045 | 3.71599 | 0.205148 | 0.330853 | 620.36 | |

| 2 | 1.03524 | 3.37102 | 0.219081 | 0.330044 | 621.566 | |

| 3 | 2.27627 | 3.11901 | 0.233531 | 0.329334 | 622.22 | |

| 4 | 4.98085 | 2.91283 | 0.249179 | 0.328666 | 622.669 | |

| 5 | 10.8658 | 2.73578 | 0.266423 | 0.328018 | 623.007 | |

| 6 | 23.6553 | 2.5796 | 0.285589 | 0.327377 | 623.276 | |

| 7 | 51.4231 | 2.43945 | 0.306992 | 0.326739 | 623.496 | |

| 8 | 111.664 | 2.31218 | 0.330954 | 0.326099 | 623.68 | |

| 9 | 242.275 | 2.19558 | 0.357827 | 0.325455 | 623.837 | |

| 10 | 525.314 | 2.08804 | 0.387992 | 0.324803 | 623.972 | |

| type II | PLL | |||||

| 0 | 0.228049 | 4.64498 | 0.191402 | 0.331917 | 605.28 | |

| 1 | 0.467045 | 3.71599 | 0.205148 | 0.330853 | 620.36 | |

| 2 | 0.956508 | 2.97279 | 0.222744 | 0.329716 | 621.973 | |

| 3 | 1.95893 | 2.37823 | 0.245267 | 0.328497 | 622.917 | |

| 4 | 4.01189 | 1.90259 | 0.274096 | 0.327193 | 623.557 | |

| 5 | 8.21634 | 1.52207 | 0.310998 | 0.325796 | 624.018 | |

| 6 | 16.8271 | 1.21765 | 0.358232 | 0.3243 | 624.359 | |

| 7 | 34.4618 | 0.974124 | 0.418691 | 0.322695 | 624.612 | |

| 8 | 70.5779 | 0.779299 | 0.496079 | 0.320976 | 624.798 | |

| 9 | 144.543 | 0.623439 | 0.595135 | 0.319131 | 624.935 | |

| 10 | 296.025 | 0.498751 | 0.721927 | 0.317151 | 625.046 | |

| type III | PLL | |||||

| 0 | 0.228049 | 4.64498 | 0.191402 | 0.331917 | 605.28 | |

| 1 | 0.467045 | 3.71599 | 0.205148 | 0.330853 | 620.36 | |

| 2 | 0.751093 | 1.80638 | 0.211606 | 0.330498 | 620.954 | |

| 3 | 1.038 | 0.595511 | 0.214933 | 0.330338 | 621.161 | |

| 4 | 1.32573 | 0.148002 | 0.216952 | 0.330247 | 621.267 | |

| 5 | 1.6138 | 0.029492 | 0.218306 | 0.330189 | 621.33 | |

| 6 | 1.90206 | 0.00490304 | 0.219277 | 0.330148 | 621.373 | |

| 7 | 2.19041 | 0.000699163 | 0.220007 | 0.330118 | 621.404 | |

| 8 | 2.47883 | 0.000087275 | 0.220576 | 0.330095 | 621.427 | |

| 9 | 2.7673 | 0.221031 | 0.330077 | 621.445 | ||

| 10 | 3.05579 | 0.221404 | 0.330062 | 621.459 | ||

| exponential | - | 2.43253 | 18.5799 | 0.273228 | 0.326566 | 624.048 |

PLL: profile log-likelihood

| type I | PLL | |||||

|---|---|---|---|---|---|---|

| 0 | 0.766746 | 1.99897 | 1.78958 | 0.62922 | 641.506 | |

| 1 | 1.5703 | 1.59918 | 1.89698 | 0.618971 | 736.065 | |

| 2 | 3.48068 | 1.45072 | 2.00583 | 0.611076 | 736.11 | |

| 3 | 7.65327 | 1.34227 | 2.11873 | 0.604087 | 736.174 | |

| 4 | 16.7466 | 1.25354 | 2.24098 | 0.597444 | 736.2 | |

| 5 | 36.533 | 1.17735 | 2.3757 | 0.590935 | 736.171 | |

| 6 | 79.5338 | 1.11014 | 2.52544 | 0.584454 | 736.08 | |

| 7 | 172.894 | 1.04982 | 2.69265 | 0.577936 | 735.924 | |

| 8 | 375.437 | 0.995048 | 2.87986 | 0.571337 | 735.702 | |

| 9 | 814.575 | 0.944869 | 3.08981 | 0.564624 | 735.414 | |

| 10 | 1766.21 | 0.89859 | 3.32547 | 0.557771 | 735.063 | |

| type II | PLL | |||||

| 0 | 0.766746 | 1.99897 | 1.78958 | 0.62922 | 641.506 | |

| 1 | 1.5703 | 1.59918 | 1.89698 | 0.618971 | 736.065 | |

| 2 | 3.21597 | 1.27934 | 2.03445 | 0.607849 | 736.076 | |

| 3 | 6.5863 | 1.02347 | 2.21041 | 0.595756 | 736.101 | |

| 4 | 13.4887 | 0.81878 | 2.43565 | 0.582581 | 735.963 | |

| 5 | 27.6249 | 0.655024 | 2.72395 | 0.568191 | 735.511 | |

| 6 | 56.5759 | 0.524019 | 3.09297 | 0.552428 | 734.623 | |

| 7 | 115.867 | 0.419215 | 3.56532 | 0.535103 | 733.21 | |

| 8 | 237.297 | 0.335372 | 4.16992 | 0.515982 | 731.201 | |

| 9 | 485.983 | 0.268298 | 4.94382 | 0.494772 | 728.473 | |

| 10 | 995.294 | 0.214638 | 5.9344 | 0.471097 | 724.378 | |

| type III | PLL | |||||

| 0 | 0.766746 | 1.99897 | 1.78958 | 0.62922 | 641.506 | |

| 1 | 1.5703 | 1.59918 | 1.89698 | 0.618971 | 736.065 | |

| 2 | 2.52532 | 0.777379 | 1.94743 | 0.615517 | 736.092 | |

| 3 | 3.48997 | 0.256279 | 1.97342 | 0.613954 | 736.116 | |

| 4 | 4.45737 | 0.0636928 | 1.9892 | 0.613067 | 736.131 | |

| 5 | 5.42592 | 0.0126919 | 1.99977 | 0.612496 | 736.141 | |

| 6 | 6.39508 | 0.00211003 | 2.00736 | 0.612097 | 736.148 | |

| 7 | 7.36459 | 0.000300886 | 2.01306 | 0.611803 | 736.153 | |

| 8 | 8.33432 | 0.0000375589 | 2.01751 | 0.611578 | 736.157 | |

| 9 | 9.30419 | 2.02107 | 0.611399 | 736.16 | ||

| 10 | 10.2742 | 2.02398 | 0.611254 | 736.162 | ||

| exponential | - | 8.17863 | 7.9959 | 2.42886 | 0.576157 | 735.574 |

PLL: profile log-likelihood

*

| (VG) | ||||||

| type I | PLL | |||||

| 0 | 94.8367 | 811.158 | 0.744442 | 654.012 | ||

| 1 | 128.456 | 549.545 | 0.752422 | 662.425 | ||

| 2 | 203.096 | 434.589 | 0.760763 | 666.79 | ||

| 3 | 334.145 | 357.634 | 0.7691 | 668.065 | ||

| 4 | 561.015 | 300.338 | 0.777794 | 667.986 | ||

| 5 | 954.266 | 255.534 | 0.787051 | 667.252 | ||

| 6 | 1638.64 | 219.491 | 0.797029 | 666.333 | ||

| 7 | 2835.01 | 189.959 | 0.807875 | 665.136 | ||

| 8 | 4935.86 | 165.446 | 0.81974 | 662.129 | ||

| 9 | 8641.45 | 144.906 | 0.832792 | 662.009 | ||

| 10 | 15206.5 | 127.574 | 0.847223 | 660.34 | ||

| type II | PLL | |||||

| 0 | 94.8367 | 811.158 | 0.744442 | 654.012 | ||

| 1 | 128.456 | 549.545 | 0.752422 | 662.425 | ||

| 2 | 174.38 | 373.157 | 0.761651 | 666.218 | ||

| 3 | 237.339 | 254.059 | 0.772375 | 667.676 | ||

| 4 | 324.016 | 173.515 | 0.784904 | 667.625 | ||

| 5 | 443.949 | 118.945 | 0.799644 | 666.73 | ||

| 6 | 610.907 | 81.8998 | 0.817127 | 665.336 | ||

| 7 | 845.057 | 56.6956 | 0.838074 | 663.626 | ||

| 8 | 1176.48 | 39.5076 | 0.863484 | 661.708 | ||

| 9 | 1651.07 | 27.7586 | 0.894794 | 659.645 | ||

| 10 | 2340.97 | 19.7109 | 0.93414 | 657.469 | ||

| type III | PLL | |||||

| 0 | 94.8367 | 811.158 | 0.744442 | 654.012 | ||

| 1 | 128.456 | 549.545 | 0.752422 | 662.425 | ||

| 2 | 174.86 | 249.402 | 0.756665 | 665.585 | ||

| 3 | 223.022 | 79.5317 | 0.758921 | 666.776 | ||

| 4 | 271.766 | 19.384 | 0.760309 | 667.32 | ||

| 5 | 320.774 | 3.81341 | 0.761249 | 667.615 | ||

| 6 | 369.923 | 0.628261 | 0.761926 | 667.795 | ||

| 7 | 419.157 | 0.0889868 | 0.762437 | 667.915 | ||

| 8 | 468.446 | 0.0110503 | 0.762836 | 667.999 | ||

| 9 | 517.773 | 0.0012214 | 0.763157 | 668.061 | ||

| 10 | 567.126 | 0.000121622 | 0.76342 | 668.108 | ||

VG: variance gamma — PLL: profile log-likelihood

| type I | PLL | |||||

| 0 | 11.8708 | 621.521 | 0.755058 | 668.251 | ||

| 1 | 17.7616 | 422.34 | 0.764691 | 668.672 | ||

| 2 | 29.8475 | 335.05 | 0.774806 | 668.277 | ||

| 3 | 51.6775 | 276.597 | 0.784966 | 667.305 | ||

| 4 | 90.8543 | 233.057 | 0.795618 | 666.07 | ||

| 5 | 161.326 | 198.997 | 0.807023 | 664.739 | ||

| 6 | 288.564 | 171.591 | 0.819393 | 661.032 | ||

| 7 | 519.198 | 149.132 | 0.832928 | 652.583 | ||

| 8 | 938.875 | 130.495 | 0.847844 | 660.391 | ||

| 9 | 1705.49 | 114.887 | 0.864387 | 659.088 | ||

| 10 | 3111.25 | 101.731 | 0.882844 | 657.695 | ||

| type II | PLL | |||||

| 0 | 11.8708 | 621.521 | 0.755058 | 668.251 | ||

| 1 | 17.7616 | 422.34 | 0.764691 | 668.672 | ||

| 2 | 26.6293 | 287.789 | 0.775895 | 668.241 | ||

| 3 | 40.0192 | 196.745 | 0.789001 | 667.224 | ||

| 4 | 60.311 | 135.026 | 0.804439 | 665.812 | ||

| 5 | 91.1977 | 93.0987 | 0.82278 | 664.09 | ||

| 6 | 138.465 | 64.553 | 0.844796 | 662.253 | ||

| 7 | 211.286 | 45.0713 | 0.871567 | 660.317 | ||

| 8 | 324.434 | 31.744 | 0.904647 | 657.45 | ||

| 9 | 502.195 | 22.6087 | 0.946369 | 655.531 | ||

| 10 | 785.628 | 16.3417 | 1.0004 | 655.78 | ||

| type III | PLL | |||||

| 0 | 11.8708 | 621.521 | 0.755058 | 668.251 | ||

| 1 | 17.7616 | 422.34 | 0.764691 | 668.672 | ||

| 2 | 29.4917 | 191.979 | 0.769827 | 668.582 | ||

| 3 | 50.086 | 61.2722 | 0.772562 | 668.423 | ||

| 4 | 86.8967 | 14.9415 | 0.774248 | 668.29 | ||

| 5 | 154.046 | 2.94048 | 0.775389 | 668.186 | ||

| 6 | 278.893 | 0.484571 | 0.776211 | 668.103 | ||

| 7 | 515.191 | 0.0686477 | 0.776833 | 668.038 | ||

| 8 | 970.033 | 0.00852589 | 0.777318 | 667.985 | ||

| 9 | 1859.66 | 0.000942492 | 0.777708 | 667.941 | ||

| 10 | 3626.32 | 0.0000938585 | 0.778028 | 667.904 | ||

PLL: profile log-likelihood

| (NIG) | ||||||

| type I | PLL | |||||

| 0 | 1.3704 | 432.849 | 0.777245 | 667.041 | ||

| 0.5 | 1.72512 | 343.139 | 0.783233 | 666.37 | ||

| 1 | 2.26522 | 296.003 | 0.790516 | 665.447 | ||

| 1.5 | 3.01643 | 262.598 | 0.797581 | 664.544 | ||

| 2 | 4.04629 | 236.4 | 0.804581 | 663.674 | ||

| 2.5 | 5.45309 | 214.807 | 0.811644 | 662.832 | ||

| 3 | 7.37333 | 196.483 | 0.818859 | 662.016 | ||

| 3.5 | 9.99496 | 180.635 | 0.826291 | 661.22 | ||

| 4 | 13.5762 | 166.743 | 0.833993 | 660.442 | ||

| 4.5 | 18.472 | 154.447 | 0.842012 | 659.68 | ||

| 5 | 25.17 | 143.48 | 0.850391 | -6.08376 | 658.933 | |

| type II | PLL | |||||

| 0 | 1.3704 | 432.849 | 0.777245 | 667.041 | ||

| 0.5 | 1.76152 | 357.786 | 0.783616 | 666.261 | ||

| 1 | 2.26522 | 296.003 | 0.790516 | 665.447 | ||

| 1.5 | 2.9143 | 245.126 | 0.797999 | 664.604 | ||

| 2 | 3.75125 | 203.209 | 0.806132 | 663.738 | ||

| 2.5 | 4.83121 | 168.655 | 0.814989 | 662.853 | ||

| 3 | 6.22584 | 140.155 | 0.824658 | 661.951 | ||

| 3.5 | 8.02838 | 116.634 | 0.835242 | 661.036 | ||

| 4 | 10.3604 | 97.2105 | 0.846859 | 660.108 | ||

| 4.5 | 13.3806 | 81.1608 | 0.859651 | 659.17 | ||

| 5 | 17.2969 | 67.8906 | 0.87379 | 658.222 | ||

| type III | PLL | |||||

| 0 | 1.3704 | 432.849 | 0.777245 | 667.041 | ||

| 0.5 | 1.68675 | 371.306 | 0.784277 | 666.26 | ||

| 1 | 2.26522 | 296.003 | 0.790516 | 665.447 | ||

| 1.5 | 3.173 | 210.414 | 0.7947 | 664.868 | ||

| 2 | 4.58808 | 135.007 | 0.797632 | 664.453 | ||

| 2.5 | 6.81669 | 79.3114 | 0.799788 | 664.144 | ||

| 3 | 10.3757 | 43.1666 | 0.801435 | 663.907 | ||

| 3.5 | 16.1436 | 21.9721 | 0.802734 | 663.719 | ||

| 4 | 25.6301 | 10.5381 | 0.803784 | 663.567 | ||

| 4.5 | 41.459 | 4.7913 | 0.804649 | 663.442 | ||

| 5 | 68.2414 | 2.07545 | 0.805375 | 663.337 | ||

NIG: normal inverse Gaussian — PLL: profile log-likelihood

| type I | PLL | |||||

| 0 | 0.127463 | 248.604 | 0.852286 | 654.027 | ||

| 0.1 | 0.134541 | 233.914 | 0.853433 | 653.976 | ||

| 0.2 | 0.142421 | 222.685 | 0.855778 | 653.863 | ||

| 0.3 | 0.151034 | 213.54 | 0.858568 | 653.721 | ||

| 0.4 | 0.160364 | 205.785 | 0.861531 | 653.566 | ||

| 0.5 | 0.170423 | 199.021 | 0.864556 | 653.405 | ||

| 0.6 | 0.181235 | 193.002 | 0.867597 | 653.242 | ||

| 0.7 | 0.192836 | 187.563 | 0.870632 | 653.079 | ||

| 0.8 | 0.205268 | 182.593 | 0.873656 | 652.917 | ||

| 0.9 | 0.218579 | 178.007 | 0.876666 | 652.757 | ||

| 1 | 0.232824 | 173.745 | 0.879663 | 652.599 | ||

| type II | PLL | |||||

| 0 | 0.127463 | 248.604 | 0.852286 | 654.027 | ||

| 0.1 | 0.135368 | 239.776 | 0.854794 | 653.885 | ||

| 0.2 | 0.143766 | 231.278 | 0.857349 | 653.743 | ||

| 0.3 | 0.152687 | 223.097 | 0.859953 | 653.601 | ||

| 0.4 | 0.162164 | 215.22 | 0.862607 | 653.458 | ||

| 0.5 | 0.172233 | 207.637 | 0.865313 | 653.316 | ||

| 0.6 | 0.182929 | 200.335 | 0.868072 | 653.173 | ||

| 0.7 | 0.194293 | 193.306 | 0.870884 | 653.03 | ||

| 0.8 | 0.206367 | 186.537 | 0.873753 | 652.887 | ||

| 0.9 | 0.219194 | 180.02 | 0.876679 | 652.743 | ||

| 1 | 0.232824 | 173.745 | 0.879663 | 652.599 | ||

| type III | PLL | |||||

| 0 | 0.127463 | 248.604 | 0.852286 | 654.027 | ||

| 0.1 | 0.132234 | 240.172 | 0.853793 | 653.96 | ||

| 0.2 | 0.13829 | 233.905 | 0.856772 | 653.818 | ||

| 0.3 | 0.14551 | 228.168 | 0.86014 | 653.65 | ||

| 0.4 | 0.153881 | 222.222 | 0.863506 | 653.475 | ||

| 0.5 | 0.163442 | 215.729 | 0.86672 | 653.305 | ||

| 0.6 | 0.174271 | 208.561 | 0.869727 | 653.143 | ||

| 0.7 | 0.186477 | 200.706 | 0.872516 | 652.991 | ||

| 0.8 | 0.200194 | 192.219 | 0.875092 | 652.85 | ||

| 0.9 | 0.21558 | 183.194 | 0.877469 | 652.72 | ||

| 1 | 0.232824 | 173.745 | 0.879663 | 652.599 | ||

PLL: profile log-likelihood

*

| (VG) | ||||||

| type I | PLL | |||||

| 0 | 27.7898 | 56.0074 | 3.00165 | 455.411 | ||

| 1 | 39.9891 | 40.7099 | 3.10861 | 524.494 | ||

| 2 | 67.5402 | 34.7769 | 3.23098 | 601.924 | ||

| 3 | 119.117 | 31.0558 | 3.36652 | 655.587 | ||

| 4 | 215.901 | 28.5552 | 3.52426 | 691.131 | ||

| 5 | 400.41 | 26.9375 | 3.71367 | 715.837 | ||

| 6 | 759.406 | 26.0819 | 3.94698 | 729.963 | ||

| 7 | 1474.97 | 25.9914 | 4.24121 | 737.741 | ||

| 8 | 2941.94 | 26.7808 | 4.62072 | 741.75 | ||

| 9 | 6047.17 | 28.7032 | 5.12027 | 742.155 | ||

| 10 | 12850.6 | 32.2046 | 5.78719 | 740.616 | ||

| type II | PLL | |||||

| 0 | 27.7898 | 56.0074 | 3.00165 | 455.411 | ||

| 1 | 39.9891 | 40.7099 | 3.10861 | 524.494 | ||

| 2 | 58.4843 | 30.162 | 3.24722 | 591.811 | ||

| 3 | 87.4167 | 22.9374 | 3.43303 | 645.474 | ||

| 4 | 134.707 | 18.1054 | 3.69371 | 691.284 | ||

| 5 | 217.137 | 15.123 | 4.08334 | 717.942 | ||

| 6 | 375.668 | 13.859 | 4.72003 | 730.62 | ||

| 7 | 730.375 | 14.9641 | 5.89275 | 730.654 | ||

| 8 | 1689.11 | 21.4225 | 8.28461 | 716.365 | ||

| 9 | 4447.82 | 42.7097 | 12.7363 | 675.673 | ||

| 10 | 11431.1 | 114.716 | 19.1751 | 558.882 | ||

| type III | PLL | |||||

| 0 | 27.7898 | 56.0074 | 3.00165 | 455.411 | ||

| 1 | 39.9891 | 40.7099 | 3.10861 | 524.494 | ||

| 2 | 56.2539 | 19.1976 | 3.16875 | 573.498 | ||

| 3 | 73.0303 | 6.24998 | 3.20178 | 598.04 | ||

| 4 | 89.9752 | 1.543 | 3.22249 | 613.948 | ||

| 5 | 106.996 | 0.306219 | 3.23666 | 623.336 | ||

| 6 | 124.059 | 0.05077 | 3.24696 | 630.002 | ||

| 7 | 141.146 | 0.00722557 | 3.25478 | 635.146 | ||

| 8 | 158.249 | 0.000900634 | 3.26092 | 639.394 | ||

| 9 | 175.363 | 0.0000998491 | 3.26587 | 642.235 | ||

| 10 | 192.485 | 3.26994 | 644.439 | |||

VG: variance gamma — PLL: profile log-likelihood

| type I | PLL | |||||

| 0 | 7.17612 | 47.0281 | 3.1418 | 641.25 | ||

| 1 | 11.3467 | 35.0184 | 3.28923 | 674.554 | ||

| 2 | 20.2654 | 30.7629 | 3.46274 | 703.597 | ||

| 3 | 37.443 | 28.3513 | 3.66136 | 722.383 | ||

| 4 | 70.7801 | 27.0578 | 3.90086 | 734.063 | ||

| 5 | 136.543 | 26.7025 | 4.19975 | 740.223 | ||

| 6 | 268.857 | 27.3237 | 4.5831 | 743.733 | ||

| 7 | 541.024 | 29.136 | 5.08604 | 744.02 | ||

| 8 | 1113.88 | 32.5598 | 5.756 | 741.869 | ||

| 9 | 2344.96 | 38.2747 | 6.65067 | 737.46 | ||

| 10 | 5028.11 | 47.2474 | 7.82714 | 730.984 | ||

| type II | PLL | |||||

| 0 | 7.17612 | 47.0281 | 3.1418 | 641.25 | ||

| 1 | 11.3467 | 35.0184 | 3.28923 | 674.554 | ||

| 2 | 18.2308 | 26.8011 | 3.48754 | 701.452 | ||

| 3 | 29.9485 | 21.3312 | 3.76679 | 721.23 | ||

| 4 | 50.8037 | 18.0118 | 4.18535 | 733.655 | ||

| 5 | 90.4781 | 16.731 | 4.86847 | 737.997 | ||

| 6 | 173.503 | 18.2688 | 6.10689 | 734.271 | ||

| 7 | 364.579 | 25.7088 | 8.51289 | 718.548 | ||

| 8 | 795.808 | 47.4225 | 12.7543 | 682.923 | ||

| 9 | 1616.39 | 110.052 | 18.8531 | 606.713 | ||

| 10 | 2565.25 | 544.578 | 26.6876 | 320.315 | ||

| type III | PLL | |||||

| 0 | 7.17612 | 47.0281 | 3.1418 | 641.25 | ||

| 1 | 11.3467 | 35.0184 | 3.28923 | 674.554 | ||

| 2 | 19.4167 | 16.7381 | 3.37351 | 692.703 | ||

| 3 | 33.5171 | 5.48975 | 3.42025 | 701.522 | ||

| 4 | 58.7421 | 1.36161 | 3.44971 | 706.549 | ||

| 5 | 104.855 | 0.271079 | 3.46994 | 709.757 | ||

| 6 | 190.782 | 0.0450476 | 3.48468 | 711.971 | ||

| 7 | 353.758 | 0.00642237 | 3.49589 | 713.587 | ||

| 8 | 668.049 | 0.000801617 | 3.5047 | 714.816 | ||

| 9 | 1283.77 | 0.0000889697 | 3.51181 | 715.782 | ||

| 10 | 2508.23 | 3.51766 | 716.56 | |||

PLL: profile log-likelihood

| (NIG) | ||||||

|---|---|---|---|---|---|---|

| type I | PLL | |||||

| 0 | 1.69903 | 40.2719 | 3.4866 | 741.57 | ||

| 0.5 | 2.18658 | 34.0606 | 3.60284 | 744.017 | ||

| 1 | 2.95041 | 31.8517 | 3.75372 | 746.459 | ||

| 1.5 | 4.037 | 30.6647 | 3.91344 | 748.356 | ||

| 2 | 5.56725 | 30.0464 | 4.08646 | 749.25 | ||

| 2.5 | 7.72111 | 29.8558 | 4.27762 | 749.903 | ||

| 3 | 10.7581 | 30.0452 | 4.49173 | 747.875 | ||

| 3.5 | 15.0512 | 30.61 | 4.73399 | 750.611 | ||

| 4 | 21.1362 | 31.5722 | 5.01006 | 749.197 | ||

| 4.5 | 29.7841 | 32.9755 | 5.32626 | 747.685 | ||

| 5 | 42.1034 | 34.8824 | 5.68939 | 745.767 | ||

| type II | PLL | |||||

| 0 | 1.69903 | 40.2719 | 3.4866 | 741.57 | ||

| 0.5 | 2.23523 | 35.6267 | 3.60867 | 744.468 | ||

| 1 | 2.95041 | 31.8517 | 3.75372 | 746.459 | ||

| 1.5 | 3.90955 | 28.8422 | 3.92845 | 748.107 | ||

| 2 | 5.20409 | 26.5277 | 4.14219 | 748.78 | ||

| 2.5 | 6.96431 | 24.8739 | 4.40824 | 748.142 | ||

| 3 | 9.37804 | 23.891 | 4.74579 | 746.481 | ||

| 3.5 | 12.7184 | 23.648 | 5.18271 | 747.08 | ||

| 4 | 17.3826 | 24.2981 | 5.75891 | 743.584 | ||

| 4.5 | 23.9386 | 26.1153 | 6.52903 | 739.578 | ||

| 5 | 33.1604 | 29.5378 | 7.56059 | 731.809 | ||

| type III | PLL | |||||

| 0 | 1.69903 | 40.2719 | 3.4866 | 741.57 | ||

| 0.5 | 2.14646 | 37.2922 | 3.62438 | 743.909 | ||

| 1 | 2.95041 | 31.8517 | 3.75372 | 746.459 | ||

| 1.5 | 4.19843 | 23.7357 | 3.84507 | 748.233 | ||

| 2 | 6.13874 | 15.7484 | 3.9114 | 748.608 | ||

| 2.5 | 9.19582 | 9.4846 | 3.96141 | 749.061 | ||

| 3 | 14.0854 | 5.26192 | 4.00036 | 749.327 | ||

| 3.5 | 22.0249 | 2.71928 | 4.03151 | 749.486 | ||

| 4 | 35.1087 | 1.32035 | 4.05697 | 749.581 | ||

| 4.5 | 56.9807 | 0.606458 | 4.07815 | 749.634 | ||

| 5 | 94.0523 | 0.264957 | 4.09606 | 749.657 | ||

NIG: normal inverse Gaussian — PLL: profile log-likelihood

| type I | PLL | |||||

| 0 | 0.304774 | 50.5501 | 5.21772 | 752.733 | ||

| 0.1 | 0.321949 | 48.3428 | 5.26152 | 752.507 | ||

| 0.2 | 0.341336 | 47.5163 | 5.34882 | 752.06 | ||

| 0.3 | 0.362624 | 47.2887 | 5.4522 | 751.546 | ||

| 0.4 | 0.385726 | 47.3793 | 5.56273 | 750.975 | ||

| 0.5 | 0.410649 | 47.664 | 5.67699 | 750.398 | ||

| 0.6 | 0.437445 | 48.0803 | 5.79359 | 749.811 | ||

| 0.7 | 0.466199 | 48.594 | 5.91194 | 749.224 | ||

| 0.8 | 0.497011 | 49.1848 | 6.03186 | 748.614 | ||

| 0.9 | 0.530001 | 49.8404 | 6.1533 | 748.005 | ||

| 1 | 0.565299 | 50.5528 | 6.27632 | 747.39 | ||

| type II | PLL | |||||

| 0 | 0.304774 | 50.5501 | 5.21772 | 752.733 | ||

| 0.1 | 0.324226 | 50.3274 | 5.30404 | 752.302 | ||

| 0.2 | 0.344917 | 50.1521 | 5.39414 | 751.851 | ||

| 0.3 | 0.366924 | 50.0249 | 5.48823 | 751.379 | ||

| 0.4 | 0.39033 | 49.9464 | 5.5865 | 750.885 | ||

| 0.5 | 0.41522 | 49.9176 | 5.68916 | 750.367 | ||

| 0.6 | 0.441685 | 49.9393 | 5.79643 | 749.825 | ||

| 0.7 | 0.469821 | 50.0124 | 5.90855 | 749.257 | ||

| 0.8 | 0.499731 | 50.1382 | 6.02574 | 748.663 | ||

| 0.9 | 0.531519 | 50.3179 | 6.14824 | 748.041 | ||

| 1 | 0.565299 | 50.5528 | 6.27632 | 747.39 | ||

| type III | PLL | |||||

| 0 | 0.304774 | 50.5501 | 5.21772 | 752.733 | ||

| 0.1 | 0.316506 | 49.8956 | 5.27563 | 752.433 | ||

| 0.2 | 0.331647 | 50.6222 | 5.38789 | 751.857 | ||

| 0.3 | 0.349699 | 51.6632 | 5.51481 | 751.21 | ||

| 0.4 | 0.370556 | 52.6039 | 5.64265 | 750.562 | ||

| 0.5 | 0.394296 | 53.2529 | 5.76595 | 749.939 | ||

| 0.6 | 0.421103 | 53.5212 | 5.88255 | 749.352 | ||

| 0.7 | 0.451243 | 53.3751 | 5.99177 | 748.805 | ||

| 0.8 | 0.485048 | 52.815 | 6.09357 | 748.297 | ||

| 0.9 | 0.522912 | 51.8624 | 6.18827 | 747.826 | ||

| 1 | 0.565299 | 50.5528 | 6.27632 | 747.39 | ||

PLL: profile log-likelihood

*

*