Minimum Wage Pass-through to Wholesale and Retail Prices: Evidence from Cannabis Scanner Data

Abstract

A growing empirical literature finds that firms pass the cost of minimum wage hikes onto consumers via higher retail prices. Yet, little is known about minimum wage effects on wholesale prices and whether retailers face a wholesale cost shock in addition to the labor cost shock. I exploit the vertically disintegrated market structure of Washington state’s legal recreational cannabis industry to investigate minimum wage pass-through to wholesale and retail prices. In a difference-in-differences with continuous treatment framework, I utilize scanner data on $6 billion of transactions across the supply chain and leverage geographic variation in firms’ minimum wage exposure across six minimum wage hikes between 2018 and 2021. When ignoring wholesale cost effects, I find retail pass-through elasticities consistent with existing literature—yet retail pass-through elasticities more than double once wholesale cost effects are accounted for. Retail markups do not adjust to the wholesale cost shock, indicating a full pass-through of the wholesale cost shock to retail prices. The results highlight the importance of analyzing the entire supply chain when evaluating the product market effects of minimum wage hikes.

Keywords: Minimum wages, inflation, wholesale prices, retail prices, price dynamics, price pass-through.

JEL Classification: E31, J23, J38, L11, L81

1 Introduction

Minimum wage laws are a popular tool for combating poverty and reducing economic inequality.111Approximately 90 percent of countries worldwide have instituted some form of minimum wage (International Labour Organization, 2021). Yet, despite their pervasiveness, the question of ’who pays’ for the minimum wage—i.e. firms, workers, or consumers—remains hotly debated. The answer to this question depends in part on how firms react to the labor cost shock induced by the minimum wage.222Recent evidence suggests that in some settings, workers’ reactions to the minimum wage may also be important (see e.g. Ku (2022)). If firms reduce employment or non-wage compensation (e.g. vacation days or health benefits) for low-wage workers, then low-wage workers bear the brunt of the policy. If firms absorb the cost shock by reducing profits, then firms bear the cost of adjustment. Finally, firms may pass the labor cost shock on to consumers in the form of higher retail prices, in which case consumers pay for the minimum wage increase. Of these three margins of adjustment, the first has received the lion’s share of attention, and evidence on employment effects is conflicted.333See Neumark (2019) for a recent overview. The second channel has received less attention, but existing findings point to small profit effects (Draca et al., 2011; Harasztosi and Lindner, 2019). Instead, recent evidence indicates that the third channel—price adjustment—plays a key role. With the aid of high-frequency price scanner data, a small but growing empirical literature finds that firms pass the cost shock through to retail prices, which suggests that nominal wage increases from minimum wage hikes are partly offset by increases in the prices of goods and services (Renkin et al., 2022; Leung, 2021). While price scanner data exhibits unparalleled richness, however, it is largely confined to grocery, merchandise, and drug stores.444One way to overcome this limitation is to use internet-based pricing. Allegretto and Reich (2018), for example, exploit internet-based restaurant menus to study the effects of a 25% minimum wage increase in San Jose, California in 2013. They find an average price increase of 1.45%, indicating that most of the cost increase was passed on to consumers. As a result, less is known about minimum wage pass-through to prices in other sectors. Yet, retail scanner data carries an additional shortcoming in that it only conveys information on prices at the final point of the supply chain. In principle, minimum wage hikes may affect not only retail outlets, but firms higher up the supply chain as well. If upstream labor costs are passed on to retailers via wholesale prices, then retailers will face not one, but two cost shocks from a minimum wage hike. The first is the higher labor cost of the retailer’s own minimum wage employees—a direct effect. The second is higher wholesale prices—an indirect effect. To the extent that retailers pass both cost shocks on to consumers, retail price adjustment reflects both direct and indirect pass-through. The latter may even eclipse the former since in many retail settings the cost of goods sold (COGS) accounts for over 80% of retailers’ variable costs, and retail prices have been shown to be sensitive to even small changes in COGS (Eichenbaum et al., 2011; Nakamura and Zerom, 2010; Renkin et al., 2022). Crucially, retail scanner data cannot distinguish between these two forms of pass-through because the data only captures point of sale prices. Moreover, as pointed out by Renkin et al. (2022), reduced form regressions using retail scanner data and local variation in minimum wages only reveal the full (i.e. direct and indirect) pass-through to retail prices in the special case that retailers purchase predominantly from local wholesalers. If, instead, wholesale goods are highly tradeable (as with e.g. drugstores and general merchandise stores), then indirect pass-through to retail prices is absorbed by time fixed effects (Renkin et al., 2022).555If wholesale goods are highly tradable then a minimum wage hike will increase wholesale prices equally for stores everywhere (Renkin et al., 2022). In that case, estimates from retail scanner data only pick up direct pass-through effects, and hence, fail to capture the full effect of minimum wage hikes on retail prices. To assess the true impact of minimum wage hikes on real wages, it is therefore crucial to examine both direct and indirect pass-through to retail prices.

In this paper, I investigate the impact of minimum wage increases on wholesale and retail prices in the legal recreational cannabis industry. Cannabis is a major consumer market in the U.S. In 2021, sales exceeded $25 billion and cannabis was consumed by 42% of U.S. adults aged 19-30 and 25% of adults aged 35-50 (Patrick et al., 2022; Barcott et al., 2022). I focus on Washington state’s cannabis market because it is an ideal laboratory for studying minimum wage pass-through. Cannabis is one of the largest agricultural industries in the state and a major source of employment. Cannabis production is labor-intensive and wages are low at all points of the supply chain, meaning minimum wage hikes induce a sizeable cost shock for producers and retailers alike. In other markets, the distinction between upstream and downstream firms is often blurred by vertical integration, making it difficult to distinguish between pass-through at different points of the supply chain. In contrast, the cannabis supply chain comprises two distinct types of businesses: producers—who also serve as wholesalers—and retailers.666In this paper, I use the term ”wholesaler”, ”producer”, and ”producer-processor” interchangeably. This reflects the vertically disintegrated structure of the cannabis market and is described in more detail in section 2. Crucially, vertical integration is strictly prohibited, creating clearly defined vertical relationships between producers and retailers. Furthermore, the cannabis industry operates under statewide autarky, meaning producers and retailers are subject to the very same minimum wage hikes. This narrows the set of possible confounders by eliminating the influence of labor and product market shocks in other regions, with the result being an unusually clean set of labor cost shocks along the entire supply chain. Finally, rich scanner data provides a close-up of price dynamics for the universe of products at both the wholesale and retail levels. This enables straightforward estimation of direct and indirect pass-through using a reduced-form approach.777The data also bypasses reliability issues associated with internal firm prices. For example, Hong and Li (2017) argue that intrafirm prices may be vulnerable to accounting fictions for tax avoidance or record-keeping purposes.

To estimate minimum wage pass-through elasticities, I construct establishment-level price indexes using monthly scanner-level data on $6 billion of wholesale and retail transactions. I apply a difference-in-differences approach with continuous treatment that exploits geographic variation in minimum wage exposure for 1,192 wholesale and retail cannabis establishments over a set of predetermined minimum wage hikes between 2018 and 2021. Using separate producer and retailer panels, I first estimate direct pass-through elasticities for wholesale and retail prices under the assumption that the minimum wage only induces a labor cost shock. I find that a 10% increase in the minimum wage translates into a 0.77% increase in retail prices, consistent with existing literature (see e.g. Leung (2021)). Importantly, I also find that a 10% increase in the minimum wage corresponds to a 1.66% increase in wholesale prices, which confirms that retailers face a wholesale cost shock in addition to a labor cost shock.

I then investigate the relative importance of the labor and wholesale cost shocks to retail price pass-through. I am aided by unusually rich data on prices and quantities for the universe of retailers’ wholesale purchases. This allows me to construct a shift-share instrument quantifying each retailer’s exposure to the wholesale cost shock, which I use to separately identify direct and indirect pass-through to retail prices. Crucially, once the wholesale cost shock is accounted for, pass-through to retail prices more than doubles from 0.77% to 2.04% (from a 10% hike). This increase reflects a dominance of indirect over direct pass-through, with elasticities that are proportional to retailers’ wholesale and labor cost shares. The finding that, at least in the cannabis industry, the majority of retail pass-through stems from changes in retailers’ wholesale costs (i.e. indirect pass-through) rather than labor costs (i.e. direct pass-through) underscores the importance of examining the entire supply chain when investigating the effects of minimum wage hikes on retail prices.

Next, I study the role of markup adjustment in pass-through to retail prices. In particular, I show that retailers do not adjust markups to the increase in wholesale prices, indicating a full pass-through of the wholesale cost shock to retail prices.

One concern in the cannabis industry is that rules governing production capacity for producers have created an uneven playing field in which small producers operate on slim margins while large establishments enjoy a higher degree of market power (Washington State Liquor and Cannabis Board, 2021). This suggests that large producers may be able to absorb cost shocks along other margins (e.g. by adjusting profits) and thereby exhibit less price pass-through compared to smaller producers. I test this directly and find that pass-through elasticities monotonically decrease with the scale of production—and are zero for the largest producers—consistent with an increased ability of larger firms to adjust to the cost shock along other margins.

Finally, I examine other potential margins of adjustment to minimum wage hikes. I find no evidence of employment effects for retailers or producers, and I document no effect on cannabis consumption. The latter finding precludes demand-induced feedback as a mechanism through which minimum wage hikes affect retail cannabis prices.888There is some debate about the potential for demand-induced feedback from minimum wage hikes to retail prices. Using similar data and time periods, Leung (2021) finds evidence in favor of such an effect while Renkin et al. (2022) do not.

Taken together, my results highlight the importance of examining the entire supply chain—beyond the final point of sale—when investigating the price level effects of minimum wage hikes. Since minimum wage pass-through to retail prices attenuates the increase in real wages desired by policymakers, it is important to consider both direct and indirect pass-through when evaluating the efficacy of minimum wages as a policy tool.

I make three main contributions in this paper. First, I provide evidence that minimum wages affect retail and wholesale prices. While previous studies have estimated minimum wage pass-through to retail prices, to the best of my knowledge, pass-through to wholesale prices has not been studied before. Importantly, my results imply that retailers face a direct and an indirect cost shock from minimum wage hikes. Since wholesale costs typically dominate labor costs in retailers’ variable cost structure, measuring the indirect cost shock is crucial to understanding the total effect of minimum wages on retailers’ costs.

Second, I explicitly quantify direct and indirect pass-through effects. This allows me to compare their magnitudes and relate them to retailers’ wholesale and labor cost shares. Since data on wholesale costs are rarely available the literature does not distinguish between these two forms of pass-through, meaning it is generally not possible to determine whether previous estimates capture combined (i.e. direct and indirect) effects or direct pass-through only. To see this, note that it is common to estimate pass-through using a difference-in-differences model that relates store-level monthly inflation rates to the percent change in state-level minimum wages.999In such a setup, inflation in states with no minimum wage hike serves as the counterfactual for inflation in states with a minimum wage hike. Renkin et al. (2022) show that such a model delivers different pass-through measures depending on implicit assumptions regarding the nature of retailers’ wholesale purchases. If retailers predominantly purchase from local producers (e.g. as is the case with grocery stores), then reduced-form regressions from statewide hikes will capture both direct and indirect pass-through to retail prices. However, in industries with highly tradeable goods (e.g. drugstores and general merchandise stores), the wholesale cost shock is common across all states and indirect pass-through is absorbed by time fixed effects. In that case, reduced form estimates only reflect direct pass-through and fail to capture the full impact of minimum wages on retail prices, and hence, real wages. I overcome this issue by exploiting variation in the minimum wage bite at the industry-by-county level. Since cannabis retailers and producers belong to different three-digit industries, estimates of direct pass-through to retail prices are independent of wholesale cost effects. Moreover, full information on retailers’ wholesale transactions allows me to quantify retailers’ exposure to the wholesale cost shock, which in turn enables me to estimate indirect pass-through independent of direct pass-through.

Third, the literature on minimum wage pass-through focuses on restaurants, grocery, drug, and merchandise stores. By investigating pass-through to cannabis prices, I provide novel insight on firms’ margins of adjustment in a large agricultural market of growing importance.

This paper primarily relates to three strands of literature. The first is the small but growing literature on the product market effects of minimum wages, which until recently has centered on the restaurant industry (see e.g. Aaronson (2001); Allegretto and Reich (2018); Fougere et al. (2010)). Most closely related are two papers by Renkin et al. (2022) and Leung (2021), who use high frequency scanner data to study the impact of a large number of state-level minimum wage hikes on consumer prices in the U.S. Both studies employ difference-in-differences with continuous treatment and find full and more than full pass-through to grocery prices, respectively, but no effect on prices at merchandise stores. I deviate from these studies by adopting an identification strategy that exploits geographic variation in the minimum wage bite at the industry level. Since cannabis retailers and producers belong to different industries, this allows me to separately identify direct pass-through to retail and wholesale prices. My paper is a natural extension of Renkin et al. (2022), as they consider the possibility that minimum wage hikes induce a wholesale cost shock, but they cannot test for it because their data does not include information on wholesale cost. Instead, they calculate an upper bound for indirect pass-through using input-output tables under the assumption of full pass-through to wholesale prices. In contrast, I directly observe wholesale cost because my data contains prices and quantities for the universe of retailers’ wholesale transactions. I construct a measure of each retailer’s exposure to the wholesale cost shock and estimate indirect pass-through to retail prices using a reduced-form shift-share approach.

By leveraging full information on retailers’ wholesale costs, I also deviate from Renkin et al. (2022) in how I quantify the degree of cost pass-through.101010Since only a fraction of workers are affected by the minimum wage and since labor is only one contributor to marginal cost, a $1.00 increase in the minimum wage does not translate to a $1.00 increase in marginal cost. Therefore, minimum wage pass-through to prices is in and of itself not informative about the degree of cost pass-through. Renkin et al. (2022) divide the minimum wage pass-through elasticity by an estimate of the minimum wage elasticity of marginal cost, where the latter requires estimating the minimum wage elasticity of average wages. In contrast, since I observe the wholesale prices paid by each retailer—and hence markup over marginal input cost—I can directly test whether markups adjust to the wholesale cost shock. This provides a straightforward and precise method of quantifying the degree of cost pass-through. I find that markups do not adjust to the wholesale cost shock, indicating full cost pass-through to retail prices.

Second, the paper contributes to the literature on the transmission of cost shocks to firm pricing, much of which concerns exchange rate pass-through in specific industries (see Burstein and Gopinath (2014) for an overview). These papers typically combine separate wholesale and retail data sets and use structural models to infer pass-through of wholesale cost shocks to retail prices (see e.g. (Nakamura and Zerom, 2010; Bonnet et al., 2013).111111An exception is Eichenbaum et al. (2011) who use data on prices and costs from a single U.S. retailer and find that retail price changes largely reflect changes in wholesale cost. Hong and Li (2017) uses similar data to investigate the role of market structure on retail pass-through. In contrast, my data uniquely identify both parties to each wholesale transaction and allow me to trace each product as it moves across the supply chain. As a result, I can estimate indirect pass-through directly from the data using a reduced form approach. More generally, I add to the literature on the transmission of upstream cost shocks by extending it to the minimum wage context.

Third, the paper contributes to the small but growing literature that uses the cannabis industry to investigate topics in industrial organization. Most closely related are two papers that study the role of the market structure on cannabis firm pricing. Hollenbeck and Uetake (2021) consider the impact of cannabis license restrictions on retail market power while Hansen et al. (2022) examine how a change in Washington’s cannabis tax affected vertical integration among cannabis producers. I build on this literature by investigating the effects of minimum wages on cannabis pricing. In addition, I use scanner data from a newer administrative data software system that was introduced in early 2018. The newer data identifies products at the level of the stock keeping unit (SKU), which allows me to construct price indexes at a more granular level than was previously possible.

One issue with this type of analysis is the degree to which results from one industry can be used to infer pricing dynamics in other industries. I show that retail cannabis is remarkably similar to other industries studied in the literature. The variable cost structure for cannabis retailers is typical of grocery stores and other conventional retail settings, making the relative magnitudes of direct and indirect retail pass-through elasticities broadly applicable. Moreover, the price elasticity of demand—a key determinant of cost pass-through—has been shown to be similar for cannabis as for other industries studied in the literature (Hollenbeck and Uetake, 2021). Nevertheless, it is important to note that cannabis production is potentially more labor intensive than other agricultural industries due to the prevalence of small-scale indoor cultivation. Accordingly, the labor share of variable cost for cannabis producers is expected to be higher, and hence, the upstream labor cost shock induced by the minimum wage may be larger compared to other agricultural industries. Indeed, I chose to analyze the cannabis industry partly due to the labor intensive nature of cannabis cultivation, since identifying an upstream cost shock is a prerequisite for tracing pass-through of wholesale costs to retail prices.

This paper proceeds as follows. Section 2 describes the institutional context for the study. Section 3 details the data and the main empirical strategy. Section 4 presents direct pass-through estimates to wholesale and retail prices and discusses robustness checks. Section 5 investigates indirect pass-through to retail prices and compares them to the direct pass-through estimates from section 4. Section 6 further dissects pass-through by examining markups over marginal input cost and price effect heterogeneity. Section 7 investigates other possible margins of adjustment to minimum wage hikes including employment, productivity, and demand effects. Section 8 concludes.

2 Institutional context

2.1 The cannabis industry in Washington state

In November 2012, voters in Washington state approved the creation of a legal recreational marijuana market for adults 21 years and older.121212Cannabis production and consumption remains prohibited at the federal level. However, in August 2013, the United States Department of Justice announced that it would not interfere with state-level legalization as long as distribution and sales were strictly regulated by states. This effectively green-lit legalization for U.S. states. Cannabis has since become a major agricultural industry in the state. In 2020, retail sales topped $1.4 billion and the industry contributed $1.85 billion to gross state product, making it the fourth most valuable agricultural crop in the state behind apples, wheat, and potatoes but ahead of timber, cherries, and hay (Nadreau et al., 2020). Cannabis is an important source of employment as the sector supports approximately 18,700 full-time equivalent (FTE) jobs in Washington (Nadreau et al., 2020). This mirrors the growing importance of cannabis employment in the U.S. more generally, where, according to one industry report, cannabis employs more than 428,000 workers (Barcott et al., 2022).131313To add perspective, there are more cannabis workers than hair stylists, barbers, and cosmetologists combined (Barcott et al., 2022).

Cannabis labor

Several features of cannabis labor make the industry particularly well-suited for investigating the effects of minimum wage hikes. First, cannabis is primarily grown in small indoor facilities in a setting that is averse to mechanization and more labor intensive than outdoor cultivation (Caulkins and Stever, 2010). Most harvesting, drying, trimming, and packaging is done by hand, as this allows growers to produce higher quality buds that sell at a higher price point (Jiang and Miller, 2022). Second, wages in cannabis are very low—less than 1/3 to 1/2 of the statewide average wage—reflecting the low-skill nature of cannabis labor. Cannabis producers typically employ 1-2 ‘master growers’, who manage cultivation systems and oversee harvesting, along with a much larger number of low-skill workers who harvest, trim, and package cannabis. At the retail level, a service counter forms a physical barrier between customers and the products, and customers can only make a purchase with the help of a sales representative known as a ‘budtender’. Budtending requires no formal training and the job resembles low-skilled retail employment in other industries. As a result, establishments at all points of the cannabis supply chain have a high degree of minimum wage exposure. Appendix A describes labor and wages in cannabis in further detail.

The cannabis market structure

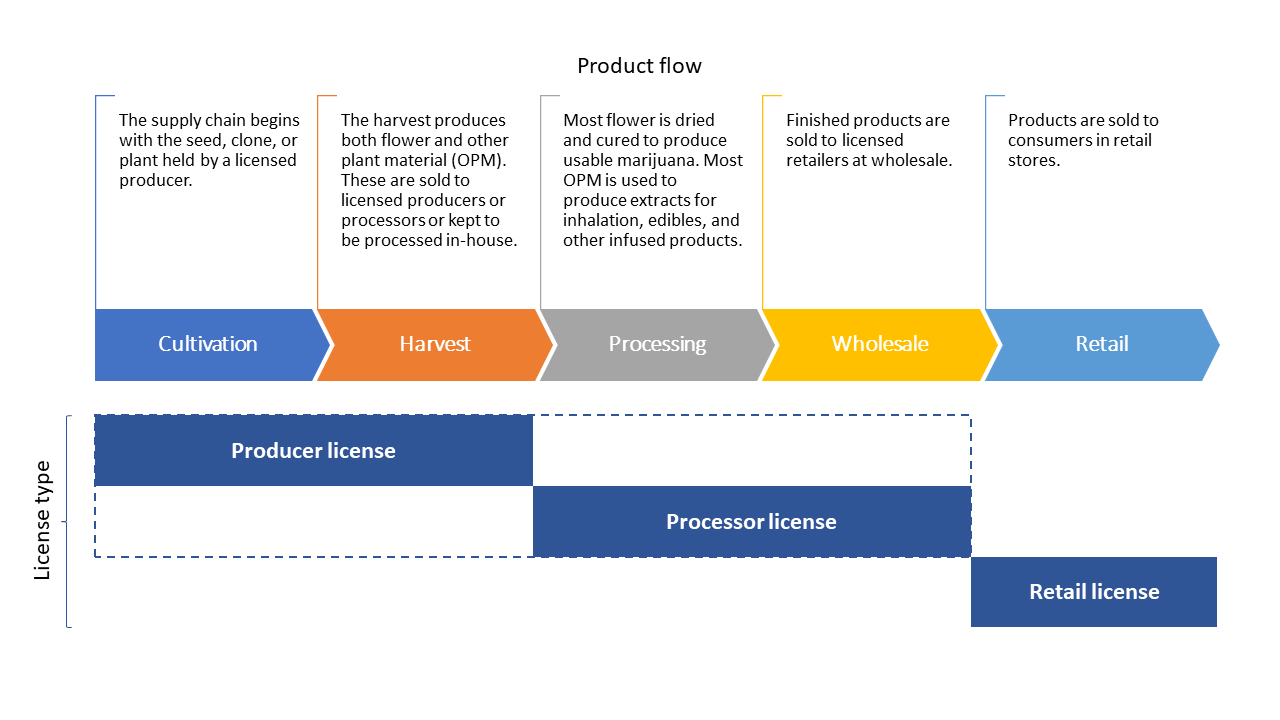

A defining feature of Washington state’s cannabis industry is its unique market structure, depicted in Figure 1. The industry is regulated by the Washington State Liquor and Cannabis Board (LCB) which offers three separate licenses for cannabis businesses, each representing a different stage of the supply chain. The first license is for producers and it allows an establishment to cultivate, harvest, and package cannabis to be sold at wholesale to other licensed producers and processors. The second license is for processors and it permits an establishment to purchase cannabis from producers and process it into derivative subproducts (e.g. concentrate, edibles, etc). While there is some overlap between the producer and the processor licenses, the key distinction is that processors cannot cultivate plants and producers cannot sell to retailers. The third license is for retailers; they are permitted to sell usable cannabis products in retail stores. A key stipulation is that producer and processor licenses can be held simultaneously but retailers cannot obtain either producer or processor licenses.141414Such ‘tied-house’ rules are a remnant of the early days of U.S. alcohol regulation. They were imposed by states to limit the market power of brewers and distillers and prevent monopolies from preying on consumers’ “worst habits” (Wallach, 2014). Washington state lawmakers adopted similar rules out of an abundance of caution and to increase the likelihood of legalization passing the state legislature (Wallach, 2014). As a result, the vast majority of upstream establishments own both producer and processor licenses and are commonly referred to as ’producer-processors’. Importantly, producer-processors may only sell cannabis to licensed retailers—they cannot sell directly to consumers. Retailers, moreover, can only sell to consumers. This creates a complete vertical separation between producer-processors on the one hand, and retailers on the other.

Another feature of the cannabis market is that it operates under statewide autarky. That is, retailers can only buy from producer-processors located in Washington state, and producer-processors can only sell to retailers in the state. This seals off the core of the supply chain from other U.S. states with legal recreational markets.151515The supply chain is not 100 percent sealed off, since consumers from other states can travel to Washington to purchase cannabis at retail stores, and producer-processors can purchase certain inputs such as grow lights, soil, and fertilizers from businesses in other states. As a result, producer-processors and retailers are subject to the same minimum wage hikes, and hence, the same set of labor cost shocks.

Before moving on, it is worth noting several points. First, since the number of establishments with only a processor license (as opposed to a joint producer-processor license) is very small, I drop these from my analysis.161616I keep establishments with only a producer license since these belong to the same industrial classification as producer-processors (see section 3). Second, I use the term ’producer’, ’producer-processor’ and ’wholesaler’ interchangeably throughout the paper to refer to upstream establishments. This reflects the dual role played by these establishments in the cannabis market since, besides being producers, they also act as wholesalers when viewed from the perspective of retailers. Third, since producers occupy the upstream portion of the supply chain, I assume that the minimum wage only induces a labor cost shock for producers—that is, the minimum wage does not affect material input prices for these firms. In principle, this assumption may not hold entirely and producers may be subject to minimum wage pass-through from their input suppliers. However, producer inputs like hydroponic systems, grow lights, and raw materials (e.g. soil or fertilizer) can be purchased from suppliers outside of Washington state, meaning minimum wage pass-through to producers’ input prices is likely small. Therefore, for wholesale prices I only estimate direct pass-through, whereas for retail prices I estimate both direct and indirect pass-through.

Notes: This figure depicts the flow of cannabis products, from left to right, as they move through the supply chain. Only licensed producers are permitted to cultivate and harvest cannabis plants; producers can only sell to licensed processors, who in turn are permitted to process products; only processors can sell finished products at wholesale to retailers; licensed retailers can sell finished products to end consumers. An establishment can jointly hold producer and processor licenses, so the overwhelming majority of upstream establishments hold both licenses (i.e. producer-processors). Retailers may not hold a producer or a processor license and vice versa. As a result, production and retail activities are legally separated.

2.2 The minimum wage in Washington state

Figure 2 summarizes the minimum wage hikes used in my main analysis. In November 2016, Washington voters approved a ballot measure to scale up the state minimum wage from $9.47 to $13.50 by the year 2020. The measure spelled out predetermined, stepwise increases for January 1st of each year, with an initial increase to $11.00 in 2017, then $11.50 in 2018, $12.00 in 2019, followed by the final increase to $13.50 in 2020. Then, starting January 1st, 2021, the minimum wage was to adjust with the federal Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) on an annual basis. Besides the state minimum wage, there are two cities in Washington state with a binding citywide minimum wage. The city of Tacoma’s minimum wage took effect in early 2016 with a predetermined schedule of annual increases designed such that the city and state minimum wages converged in 2020, with the latter binding for all subsequent years. Seattle’s minimum wage went into effect in April 2015 and contained two sets of hikes depending on whether an employer paid towards an individual employee’s medical benefits.171717Firms with over 501 employees are subject to a higher minimum wage than small employers. Since no cannabis business in Seattle has more than 500 employees, the large employer minimum wage does not apply. For employees earning $2.19 per hour in benefits (on top of their hourly wage), the minimum wage was identical to the state minimum wage except for a larger (predetermined) jump to $15 in 2021. In my main analysis, I assume that this is the schedule of hikes applicable to cannabis establishments in Seattle. However, in a series of robustness checks, I also consider the alternative schedule for employees earning less than $2.19 in benefits. In that schedule, the minimum wage increased more steeply and reached $15.75 in 2020, while in 2021 it adjusted according to a local CPI (this feature was written into the law in 2015). Due to the potential for reverse causality in that scenario, I drop Seattle establishments from the sample for the 2021 hike and find that results are unaffected (see appendix F for details).181818I also consider potential wage spillovers from Seattle to surrounding areas, in which case estimates for establishments in neighboring cities would also suffer from reverse causality in 2021. See appendix F for details. For both Seattle and Tacoma, the citywide hikes occurred on the same day of the year as the statewide hikes (January 1st).

Notes: The figure depicts the minimum wage hikes for the sample period in my analysis (August 2018 through July 2021). The state minimum wage applies to all cities except Seattle and Tacoma. Tacoma’s minimum wage converged with the state minimum wage on January 1, 2020. Seattle’s minimum wage is depicted under the assumption that employers paid at least $2.19/hour in benefits (the alternative schedule is depicted in appendix Figure 2(b)).

3 Data and empirical strategy

3.1 Price data

To monitor developments in the cannabis market, legalization came with stringent data reporting and sharing requirements for all licensed cannabis businesses. Producers and retailers are required to track every step of production from ‘seed to sale’ and they must regularly upload data feeds about plants, harvests, processing, transfers between businesses, and retail sales to the LCB. The data, which is usually reported weekly, contains detailed information on the price and quantity of each product sold by a producer-processor to a retailer, and the subsequent price and quantity of that very same product sold at the retail level.191919Compliance with seed-to-sale traceability is strictly enforced by the LCB. When a business is issued a violation, it can receive a fine, a temporary license suspension, or both. In cases of repeated violations, a license can be revoked by the LCB board. Given such strict enforcement, violations are uncommon. In 2021 for example, the LCB issued 66 violations among approximately 1,192 licensees. See: https://lcb.wa.gov/enforcement/violations-and-due-process The LCB switched providers for its traceability system in October 2017 and again in December 2021, creating two structural breaks in the price data. My sample period lies between these breaks and spans August 2018 through July 2021, a period that covers three statewide and three citywide minimum wage hikes (see Figure 2). I obtained the data from Top Shelf Data, a data analytic firm that ingests the raw tracking data from the LCB and matches it with additional product information. The estimation sample covers sales from 1,192 distinct retail and producer establishments and contains an industry-wide average of 31,800 unique retail products and 18,268 unique wholesale products per month (see Table 1). To give an example, a 1.0 gram package and a 2.0 gram package of Sunset Sherbert usable marijuana (dried flower) produced by Northwest Harvesting Co are treated as different products in the data.202020Similar to how wines can be distinguished by the grape (e.g. Riesling, Chardonnay, etc), cannabis comes in many strains, which is ’Sunset Sherbert’ in the given example. The LCB classifies products into 12 categories. As Table 1 illustrates, usable marijuana and concentrate for inhalation account for more than 80% of all retail sales. Another 14% of retail sales comes from solid edibles (chocolate bars, cookies, etc), liquid edibles (soda and other infused drinks), and infused mix (e.g. pre-roll joints infused with concentrates). The remaining categories make up less than 2% of total revenue; these are topical products (e.g. creams and ointments), packaged marijuana mix (e.g. pre-roll joints), capsules, tinctures, transdermal patches, sample jar, and suppository. Retailers are located in 37 counties while producers are located in 35 counties in Washington state (the state has 39 counties in total). Due to restrictions on the number of licenses a firm can hold, the vast majority are single-establishment firms. Over the entire sample period, the data contain $4.47 billion and $1.46 billion in retail and wholesale sales, respectively. Note that all retail cannabis sales are subject to a 37% excise tax, and retail prices and revenues reported in this paper are tax-inclusive. In contrast, there is no tax on wholesale transactions.

| (a) Sample totals | ||

|---|---|---|

| Retail | Wholesale | |

| Establishments | 500 | 692 |

| Units sold | 232,133,427 | 228,423,415+ |

| Distinct products | 172,688 | 147,273 |

| Total revenue | $4.47 billion | $1.46 billion |

| (b) Establishment monthly averages | ||

| Retail | Wholesale | |

| Distinct products | 471 | 55* |

| Revenue | $304,032 | $106,634 |

| Units sold | 15,844 | 16,735* |

| (c) Market share by product category | ||

| Retail | Wholesale | |

| Usable marijuana | 0.53 | 0.61 |

| Concentrate for inhalation | 0.31 | 0.28 |

| Solid edible | 0.07 | 0.03 |

| Liquid edible | 0.03 | 0.02 |

| Infused mix | 0.04 | 0.04 |

| Other | 0.02 | 0.02 |

Notes: This table displays summary statistics for the estimation sample. The sample period is August 2018 through July 2021. Panel (a) reports totals across all establishments and months in the sample. Panel (b) reports monthly averages at the establishment level. Sales from processor-only establishments are excluded. Sales between producer-processor establishments are included. Retail revenue is based on tax-inclusive prices. Panel (c) shows market shares for the product categories defined by the LCB. ”Other” includes any category with less than 1 percent market share. These are: topical, packaged marijuana mix, capsules, tinctures, transdermal patches, sample jar, and suppository. Sales from processor-only establishments are excluded. Sales between producer-processor establishments are included. Data source: Top Shelf Data.Data source: Top Shelf Data.

+ For producers, the LCB reports the unit weight for some product types (e.g. flower lots) in 1g units regardless of how the product is actually bundled. For such items, the number of units is the weight of the product in grams. As a result, the number of distinct products visible in the wholesale data is artificially low (since different unit weights are treated as a single product), and the number of units sold is artificially high.

Notes: The figures show the distribution of monthly establishment-level inflation rates for cannabis producerrs (Figure a) and retailers (Figure b) in the estimation sample. Data: Top Shelf Data, August 2018-July 2021.

To estimate pass-through elasticities I follow previous studies (e.g. Renkin et al. (2022); Leung (2021)) and define the dependent variable as the natural logarithm of the monthly establishment-level price index:

| (1) |

is the inflation rate for establishment in month ; is an establishment-level Lowe price index that aggregates price changes across product subcategories ; the weight is the revenue share of subcategory in establishment during the calendar year of month .212121As pointed out byRenkin et al. (2022), price indexes are often constructed using lagged quantity weights. Since product turnover is high in cannabis retail, lagged weights would limit the number of products used in constructing the price indexes. Thus, contemporaneous weights are used. To limit the potential impact of outliers, I trim inflation rates above the 99.5th and below the 0.5th percentile of the monthly distribution in my main specification (results are robust to keeping outliers). I describe the establishment-level price index in more detail in Appendix B.

3.2 Wage data

My identification strategy rests on the idea that minimum wage hikes affect establishments with a high share of minimum wage workers more than those with a low share. Since wages are not observable at the establishment level, I follow previous studies and use geographic variation in the minimum wage bite as a proxy (see e.g. Card (1992); Bossler and Schank (2022); Leung (2021); Renkin et al. (2022); Dustmann et al. (2022)).222222Firm-level wages are almost never observed in the minimum wage literature. An exception is Ashenfelter and Štepán Jurajda (2022). I define bite as the share of FTE workers in an industry-county earning below the new minimum wage two quarters prior to the hike. The industries are based on the North American Industrial Classification System (NAICS) which explicitly spells out classification for cannabis establishments of various types. NAICS 453 (”Miscellaneous store retailers”) captures all cannabis retailers since NAICS 453998 includes ”All Other Miscellaneous Store Retailers (except Tobacco Stores), including Marijuana Stores, Medicinal and Recreational” (US Census Bureau, 2017). NAICS 111 (”Crop production”) captures cannabis producers, since NAICS 111998 includes ”All Other Miscellaneous Crop Farming, including Marijuana Grown in an Open Field” and NAICS 111419 includes ”Other Food Crops Grown Under Cover, including Marijuana Grown Under Cover” (US Census Bureau, 2017).232323Recall that in addition to growing cannabis, most producers are also processors (i.e. producer-processors). Processing falls under NAICS 424 which includes as a subcomponent ”Other Farm Product Raw Material Merchant Wholesalers, including Marijuana Merchant wholesalers” (NAICS 424590). However, NAICS classifies an establishment based on its primary activity, meaning that a cannabis producer only belongs to NAICS 424 if its revenue from processing activities exceeds that of its own crop production (US Census Bureau, 2017). Table 1 shows that unprocessed ”Usable Marijuana” accounts for the majority of revenue for producers, indicating that they belong to NAICS 111. Further evidence comes from Jiang and Miller (2022), who show that when cannabis was first legalized, the establishment count for NAICS 1114 in Washington increased by a similar count as the number of producer cannabis licenses. Moreover, the state saw a proportional increase in the number of workers and the total wages paid in NAICS 1114 (Jiang and Miller, 2022). Figure 4(b) depicts the average industry-by-county bite in the sample period for the NAICS industries containing cannabis establishments.

By defining bite at the level of the three-digit industry, I assume that variation in wages at cannabis establishments resembles variation in the corresponding NAICS industries.242424In Appendix F, I construct an alternative bite variable at the five-digit NAICS level and show that my results do not depend on the chosen level of industrial classification. I document several facts to support this assumption. First, in Appendix A I show that average wages for cannabis retailers and producers are very similar to those in the corresponding NAICS industries.252525I also find that average wages are homogenous among the industries contained in the relevant 3-digit NAICS industries. Moreover, for both the cannabis industry and the NAICS industries, average wages are remarkably close to the wage floor imposed by the minimum wage.262626For producers, the gross average wage is 5%-10% above the minimum wage for the years 2018 to 2020, while for retailers it ranges from 15%-19% above the minimum wage. See appendix A. Thus, to the extent that the wage distributions differ between cannabis establishments and their NAICS industries, these differences should come from the upper part of the wage distributions rather than the lower part (since outliers are bounded from below by the minimum wage but unbounded from above). Furthermore, my regressions control for local labor market conditions (county-level average wage and unemployment) as well as establishment fixed effects, which implies that any remaining measurement error is likely to be random and will lead to conservative treatment effect estimates. Finally, the dynamic difference-in-differences framework allows me to closely examine treatment effect timing, meaning that for estimates to be biased, non-random measurement error would have to induce bias in the exact period that the minimum wage hike occurs, a scenario which I consider unlikely.

I obtained the bite data from the Washington Employment Security Department (ESD) which collects data on employment and wages in industries covered by unemployment insurance (about 95% of U.S. jobs).272727The ESD data feeds into the better-known Quarterly Census of Employment and Wages (QCEW), a federal/state cooperative program that measures employment and wages in industries covered by unemployment insurance at the detailed-industry-by-county level. A similar dataset has been used in the recent minimum wage literature (see e.g. Dube et al. (2016); Renkin et al. (2022); Leung (2021)). It is important to note that, while the treatment intensity varies across time and space in my sample, the timing of the treatment does not vary (i.e. no staggered treatment). Thus, the six minimum wage hikes (three citywide and three statewide hikes) in the sample period amount to three minimum wage events, each spaced 12 months apart.

Notes: The figure shows average minimum wage bite for counties in Washington state over three statewide minimum wage hikes spanning 2019-2021. Bite is computed as the share of FTE earning below the new minimum wage two quarters prior to the hike. The panel on the left shows bite for crop production (NAICS 111), the industry that includes cannabis producers. The panel on the right shows bite for miscellaneous store retailers (NAICS 453), the industry that includes cannabis retailers. Counties in grey indicate the data do not meet ESD confidentiality standards—these counties are not included in my analysis. Data source: Washington ESD.

4 Direct pass-through to wholesale and retail prices

In this section, I estimate direct pass-through to wholesale and retail prices under the assumption that the minimum wage hike only induces a labor cost shock.

4.1 Main identification strategy

To estimate direct pass-through to wholesale and retail prices, I employ a difference-in-differences specification with a continuous treatment. This strategy, which is commonly applied in the literature investigating the effects of minimum wage hikes (e.g. Card (1992)), identifies the effects of aggregate shocks through cross-sectional variation in the fraction affected (the “treatment intensity”).282828Other examples of this approach beyond the minimum wage literature are Lucca et al. (2019), who study the link between student loan credit expansion and college tuition, and Lindo et al. (2020), who investigate the effect of abortion clinic closures on abortion rates. The treatment intensity in my setting is the minimum wage bite variable constructed at the industry-by-county level. In contrast to a binary treatment, the continuous treatment setup identifies an average causal response parameter capturing the overall causal response of a small change in the minimum wage bite. Callaway et al. (2021) show that a key identifying assumption in this setting is no ”selection bias” among units with similar treatment intensities.292929This is in addition to the standard parallel trends assumption. This implies that conditional on a set of controls and fixed effects, inflation in counties with slightly lower minimum wage bite provides a valid counterfactual for inflation in counties with slightly higher bite.303030It is important to emphasize the local nature of the selection bias assumption: counties with vastly different minimum wage bite need not have the same potential outcomes. In appendix D, I describe the average causal response parameter in more detail and provide supportive evidence of the zero selection bias assumption.

Since firms may be forward-looking in their price setting, it is important to consider anticipatory effects that may cause price increases in the months leading up to the hike. Alternatively, firms may smooth price changes across several periods before and after a hike. The high frequency of the price data allows me to capture such dynamics, and I specify a nonparametric distributed lag model with leads and lags before and after each hike. Since the establishment-level price index and the minimum wage bite are first-differenced by construction, I specify the model in first differences. I estimate the following equation separately for retailers and producers:

| (2) |

Equation 2 relates the monthly establishment-level inflation rate, , to the treatment intensity in county , which is defined as the interaction between the percent change in the minimum wage applicable to establishment , , and the minimum wage bite in the industry-county that establishment belongs to, .313131For establishments subject to a citywide minimum wage, corresponds to the citywide hike. Note that does not contribute to the identifying variation and simply scales the bite variable (the main identifying variation) such that the estimated coefficients are interpretable as pass-through elasticities at a given .323232I show in appendix F that results are similar when is not scaled by . The vector of control variables, , contains the average wage and unemployment rate for county in the quarter of month . I include these to absorb variation in cannabis prices related to local macroeconomic factors that may covary with the minimum wage bite. Time fixed effects account for monthly industry-wide changes in cannabis prices. Since the identifying variation is at the county level, standard errors are clustered by county to allow for autocorrelation in unobservables within counties, as in Bertrand et al. (2004).

For a given minimum wage hike, the parameter measures the percent change in establishment ’s prices resulting from a percentage point increase in minimum wage exposure months after the minimum wage hike (or months before when is negative). Though inflation is the dependent variable, I follow previous studies and present the estimates as the effect of the minimum wage on the price level (see e.g. Renkin et al. (2022); Leung (2021)). I thus normalize the effect to zero in a baseline period months before each hike and report the cumulative treatment effect as the sum of at various lags: . The pre-treatment coefficients are reported in a similar manner with .333333Schmidheiny and Siegloch (2023) show that cumulative distributed lag coefficients are numerically equivalent to the parameter estimates from an event study design with binned endpoints. Since distributed lag coefficients measure treatment effect changes, one fewer lead has to be estimated compared to an event study specification. Thus, a 12 month event window requires estimating 11 distributed lag coefficients.

My approach resembles strategies that attempt to identify effects of aggregate shocks through cross-sectional variation in the fraction affected (see e.g. Bartik (1991); Lucca et al. (2019); Goldsmith-Pinkham et al. (2020)). This strategy is useful in the context of Washington’s cannabis market as it enables me to estimate pass-through despite the relatively small number of minimum wage hikes. Another advantage is that the estimated price level effects can be reformulated as pass-through elasticities at the average bite, allowing for direct comparison to elasticities found in the literature on minimum wage pass-through (e.g. Leung (2021); Renkin et al. (2022)).

An important consideration is the number of leads and lags to include in equation 2. One limitation is that minimum wage hikes occur in exact 12 month intervals, meaning event variables get highly collinear when is large. Another issue is that the establishment panel is not balanced, meaning that changes in the underlying sample may affect estimates when is large (Renkin et al., 2022). Therefore, in my baseline estimation I opt for a non-overlapping 12-month event window. While this may seem restrictive, I show in appendix F that treatment effects remain stable over a longer event window such that the 12-month event window adequately captures the short-run impact of the minimum wage on prices.343434This mirrors the results from Renkin et al. (2022) and Leung (2021), who find that firms adjust prices at most three months prior to an event and that effects plateau within 1-2 months after the hike (Renkin et al., 2022; Leung, 2021).

A central concern with this research design is possible reverse causality. Since the treatment intensity is the product of two variables, , the potential for reverse causality must be addressed for each of these variables in turn. would suffer from reverse causality if policymakers were to increase the minimum wage in response to local inflation (e.g. in an effort to keep real wages constant). This is clearly not the case with the statewide hikes in my sample, since they are either predetermined or linked to the CPI-W, a national—not local—price index.353535The city of Seattle has a citywide minimum wage that could be endogenous for some businesses for event 3 (January 1st, 2021). I address this possibility in Appendix F.4 and show that the main results are robust to dropping Seattle establishments for event 3. would suffer from reverse causality if county-level inflation drove wages. To account for this possibility, in a robustness check I include county fixed effects to absorb county-level differences in trend inflation.363636Note that the baseline specification controls for establishment fixed effects because both the treatment and outcome variables are first-differenced by construction. Moreover, the distributed lag specification allows me to closely examine effect timing so that to the extent that differences in inflation trends remain, these can be easily distinguished from treatment effects.

It is important to highlight that when estimated for retailers, equation 2 uniquely identifies direct pass-through to retail prices and avoids picking up indirect pass-through effects. To see this, note that two conditions must be jointly met for the direct pass-through estimates to be contaminated by indirect pass-through. First, retailers would need to purchase predominantly from producers located in the retailer’s own county. Second, the bite variable for retailers would need to correlate with bite for producers within each county.373737Importantly, both conditions must hold for the direct pass-through estimates to be contaminated by indirect pass-through effects. If the first condition is met but the second condition doesn’t hold, then the minimum wage effect on wholesale prices is part of the error term, but it is orthogonal to retail bite, and hence does not bias direct pass-through estimates. If the second condition holds but not the first, then producer bite and retail bite are not independent, but the minimum wage effect on wholesale prices in a given county has no impact on retail prices in that county since retailers don’t purchase from local producers. In appendix A, I show that the first condition does not hold since over 85% of retailers’ wholesale purchases are from producers located in other counties. Moreover, the within-county correlation between producer and retail bite is low: 0.18 (unconditional) and -0.03 (conditional on covariates). In other words, there is no systematic relationship between producer and retail bite, which implies that the second condition also does not hold.

One limitation is that my research design cannot distinguish between the effects of minimum wage legislation and implementation. If firms are forward-looking in their price setting, prices may adjust when a minimum wage hike is announced rather than when the hike actually takes effect.383838Renkin et al. (2022), for example, find that price effects occur primarily in the three months following the passage of minimum wage legislation rather than after the hike itself. The first two hikes in my sample period were announced in 2016, two and three years prior to implementation, respectively. Because my sample runs from August 2018 through July 2021, any price effects from that announcement fall outside of the sample window and cannot be estimated. For the third event, the magnitude of the hike was announced three months prior to implementation, meaning price effects at announcement can be directly observed using my event study framework. As detailed in appendix F.8, I find no evidence of price effects at announcement but large effects at implementation for both wholesale and retail prices. This indicates that cannabis establishments wait until the cost shock hits before adjusting prices even if they have full prior knowledge about the magnitude of the shock.

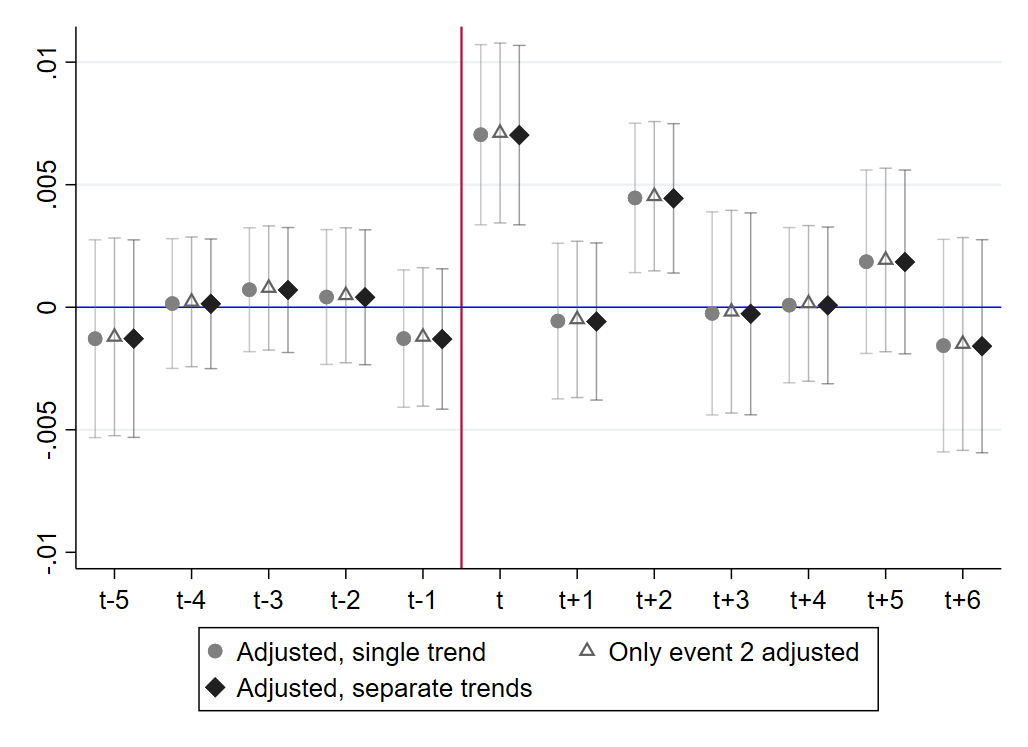

4.2 Direct pass-through to wholesale prices

I begin by estimating the direct effect of minimum wage hikes on wholesale prices and depict the results in Figure 5. In my preferred specification I include time FE but no county controls (results are robust to including controls). One question regarding the wholesale estimates is whether to control for a treatment-specific pre-trend since the baseline specification reveals a slight negative trend in the pre-treatment period. Though the trend is interrupted by a large and highly statistically significant treatment effect in the period that the minimum wage hike occurs, the contemporaneous treatment effect is slightly undone in subsequent periods as the pre-trend continues into the post-treatment period. Thus, while the trend does not mask the effect in period , failure to account for the trend changes the interpretation of the results over a longer time horizon.393939In appendix E I show that the pre-trend is entirely driven by event 2, a period corresponding to a wholesale supply glut and falling wholesale prices across the industry. It is therefore plausible that for event 2 unobserved confounders covary with treatment intensity and wholesale cannabis deflation. The trend persists despite the inclusion of county FE because county means are based on all three events and the trend is only present for a single event.

I apply two common strategies to control for the pre-trend, both of which yield similar results. First, I include region-time FE (i.e. interactions between time and region dummy variables) to account for regional economic trends that may covary with bite and inflation.404040The regions are based on the three major socioeconomic regions in Washington state, where each region includes a subset of counties. See Appendix F.9 for details. To the extent that unobserved time-variant heterogeneity is common within regions, region-time FE will control for the treatment-specific trend (Neumark et al., 2014).414141Unlike the baseline specification, I include county controls to further capture time-varying heterogeneity. Results are robust to including both county FE and controls or neither. This assumes that the proper counterfactual for inflation in counties with higher treatment intensity is inflation in counties with slightly lower treatment intensity located in the same region; that is, the identifying information comes from within-region variation in the treatment intensity.

Second, I apply the two-step procedure from Goodman-Bacon (2021) and re-estimate equation 2 using a trend-adjusted dependent variable. Specifically, I calculate the average of the distributed lag estimates (from equation 2) in the pre-baseline period and then extrapolate this pre-trend through the 12-month event window to obtain the treatment-specific linear trend . I then subtract the linear trend from the original dependent variable to get the trend-adjusted variable . As argued by Rambachan and Roth (2023), this assumes that the observable linear pre-trend is a valid counterfactual for the unobservable post-trend. I view this as a valid assumption since the mean observable post-treatment trend is -0.00074 (95% CI: -0.00218, 0.00070) which is nearly identical to—and not statistically significantly different from—the pre-treatment trend of -0.00077, (95% CI: -0.00213, 0.00059).424242In appendix E, I show that for all three specifications (unadjusted, trend-adjusted, region-time FE) the distributed lag coefficients are not statistically significantly different from zero for through , and the period treatment effects are large and not statistically significantly different from each other.

Figure 5 illustrates that the period treatment effects are large and statistically significant at the 1-5% level for all three specifications. At the average bite (17.20%), a 10% increase in the minimum wage corresponds to a 1.07% increase in wholesale prices with the unadjusted dependent variable; 1.21% for the trend-adjusted specification; and 1.40% with region-time FE. In the latter two specifications, the pre-treatment period shows no significant trend and the large contemporaneous inflationary effect is no longer undone by the continuation of the pre-trend into the post-treatment period.434343At higher lags, the price level effects from the specification with region-time FE are slightly lower than the trend-adjusted regression, but the difference is not statistically significant. Thus, it matters little how one controls for the trend, as the linear trend adjustment and region-time FE specifications both lead to a permanently higher wholesale price level effect.

Notes: The figure shows estimates from equation 2 under three different specifications: unadjusted, trend-adjusted, and region-time FE. The dependent variable is the establishment-level inflation rate for cannabis producers. The figure depicts cumulative price level effects () relative to the baseline period in . Cumulative effects are obtained by summing the distributed lag coefficients to lag as detailed in the main text. The figure shows 90% confidence intervals of the sums based on SE clustered at the county level. Data source: Top Shelf Data and Washington ESD, July 2018 to August 2021.

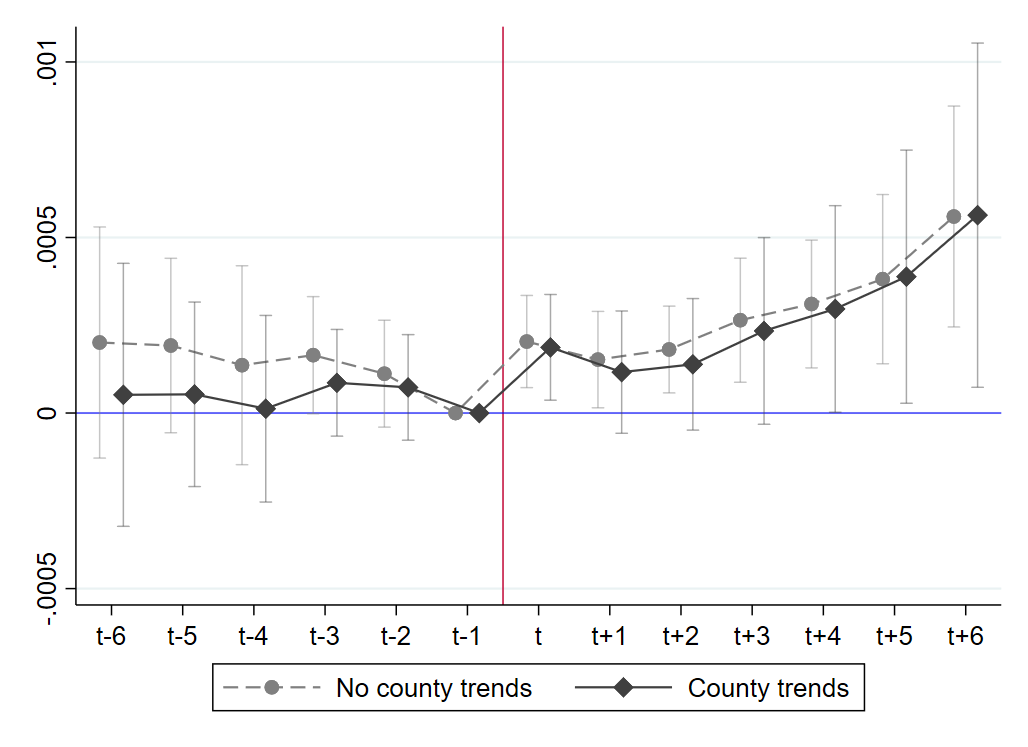

4.3 Direct pass-through to retail prices

Having obtained estimates for producers, I next estimate equation 2 for retail establishments. In my preferred specification for retailers, I include time FE and county controls (effect sizes are similar with county FE but estimates tend to be less precise at higher lags). Figure 6 illustrates that the effects for retailers differ from those of producers in several respects. First, effects for retailers show no pre-trend. Second, the treatment effect appears in , i.e. one period prior to that for producers, suggesting that retailers may be more forward-looking in their pricing than producers.444444This is consistent with the findings of Hollenbeck and Uetake (2021), who find that Washington’s cannabis retailers in have substantial market power and behave like local monopolists. Though producers’ market power has not been formally investigated in the literature, a common complaint among producers is their lack of market power compared to retailers (Washington State Liquor and Cannabis Board, 2021; Schaneman, 2021; Barbagallo, 2021). Given the earlier treatment effect, I normalize the baseline period in when calculating cumulative effects on retail prices. For retailers at the average bite (19.37%), a 10% increase in the minimum wage corresponds to a 0.64% jump in prices in period .

Notes: Estimates are from equation 2 with time fixed effects and county-level controls. The dependent variable is the establishment-level inflation rate for cannabis retailers. The figure depicts cumulative price level effects () relative to the baseline period in . Cumulative effects are obtained by summing the distributed lag coefficients to lag as detailed in the main text. The figure shows 90% confidence intervals of the sums based on SE clustered at the county level. Data source: Top Shelf Data and Washington ESD, July 2018 to August 2021.

4.4 Robustness checks

Alternative specifications

The results from the previous subsection stand up to a multitude of robustness checks. In Table 2, I present several variants of my empirical strategy for producers. I use the linear trend-adjustment as my preferred specification as this enables direct comparison to the indirect pass-through estimates later on (see section 5). Moreover, I normalize the baseline period in so that cumulative wholesale and retail results line up temporally. Note that changing the baseline period has no bearing on the estimated coefficients from equation 2 and simply amounts to a (downward) level shift in cumulative wholesale price level effects. For the baseline specification (column 1), I estimate equation 2 with time fixed effects but no controls. Column 2 shows that the estimated effects are virtually identical when including county-level controls. Column 3 shows that effects decrease slightly when county FE are included to capture price trends (since equation 2 is in first differences). Effect sizes are similar when the dependent variable is winsorized (column 4) or includes outliers (column 5) but standard errors tend to be larger in both cases compared to the baseline specification.454545Recall that I trim the top and bottom 0.5% of inflation per month in the baseline specification. Column 6 shows that results are unchanged when the bite variable is trimmed by 0.5%, indicating that the main results are not driven by treatment intensity outliers. Columns 7-9 show results when the dependent variable is not adjusted for a linear pre-trend. Column 7 shows price level effects when region-time FE are used to control for the pre-trend.464646In column 7 I include time-variant county controls as these should capture additional confounding differences in price trends during event 2. Results are robust to including county FE, omitting controls, and a variety of other specifications. See Appendix F. Column 8 shows that with no linear trend adjustment, effects for the baseline specification are statistically significant, though smaller, through , but effects are offset at by the continuation of the pre-trend. Column 9 shows an upward shift in effect sizes when the baseline period is set to one month before effects appear rather than two months before.

As Table 3 illustrates, retail price level effects are similarly stable across specifications. Column 2 shows that effect sizes do not depend on the inclusion of county controls; columns 3 and 4 show similar effect sizes with county FE and region-time FE, respectively. As with the wholesale regressions, retail price effects are not affected by winsorizing (column 5) or including outliers (column 6), though standard errors tend to be larger.

| Trend-adjusted | Unadjusted | ||||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

| Baseline | Controls | County trends | Wins-orized | Outliers | Trim-med bite | Reg.-time FE | Baseline | t-1 base | |

| 0.006*** | 0.006*** | 0.004** | 0.006*** | 0.005** | 0.006*** | 0.006** | 0.004** | 0.006*** | |

| (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | |

| 0.010*** | 0.010*** | 0.006** | 0.010*** | 0.010*** | 0.010*** | 0.009** | 0.007** | 0.009*** | |

| (0.003) | (0.003) | (0.003) | (0.003) | (0.004) | (0.003) | (0.004) | (0.003) | (0.003) | |

| 0.009*** | 0.010*** | 0.005 | 0.010*** | 0.010*** | 0.010*** | 0.006 | 0.005 | 0.007** | |

| (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | (0.003) | |

| 1.0e-07 | -2.0e-04 | 0.003 | 1.0e-07 | 2.0e-07 | 2.0e-07 | 1.0e-04 | 0.003 | 0.005* | |

| (0.003) | (0.003) | (0.003) | (0.004) | (0.004) | (0.003) | (0.003) | (0.003) | (0.003) | |

| 14,777 | 14,777 | 14,777 | 14,932 | 14,932 | 14,735 | 14,777 | 14,777 | 14,777 | |

| Time FE | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Controls | NO | YES | NO | NO | NO | NO | YES | NO | NO |

| Store FE | YES | YES | NO | YES | YES | NO | YES | NO | NO |

Notes: The dependent variable is the establishment-level inflation rate for cannabis wholesalers, adjusted for a bite-specific trend as detailed in section 4.2. The listed coefficients are the sum of the distributed lag coefficients , months after the minimum wage hikes, relative to the normalized baseline period in . The distributed lag coefficients are estimated from equation 2. The control variables in (2) are the monthly unemployment rate and monthly average wage, both at the county level. (3) includes price trends at the county level. (4) uses a winsorized dependent variable (99% windsorization). (5) does not trim or winsorize the dependent variable. In (6) the bite variable is trimmed by 1%. In (7) the dependent variable is not trend-adjusted but region-time FE are included; county controls are included to further account for time-variant confounders. (8) shows the baseline specification when the dependent variable is not adjusted for a linear pre-trend. In (9) the dependent variable is not trend-adjusted and the normalized baseline period is one month before to the hike rather than two months before. Standard errors are clustered at the county level and are shown in parentheses. ∗ , ∗∗ , ∗∗∗ . Data from Washington ESD and Top Shelf Data, July 2018-August 2021.

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| Baseline | No controls | County trends | Reg.-time FE | Winsor-ized | Outliers | Trim-med bite | |

| 0.003** | 0.003** | 0.003* | 0.003* | 0.003** | 0.004** | 0.003** | |

| (0.001) | (0.001) | (0.002) | (0.002) | (0.001) | (0.002) | (0.002) | |

| 0.004** | 0.003** | 0.003 | 0.004** | 0.004** | 0.005** | 0.004** | |

| (0.002) | (0.001) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | |

| 0.005** | 0.004** | 0.005* | 0.006** | 0.004* | 0.005 | 0.005** | |

| (0.002) | (0.002) | (0.003) | (0.002) | (0.002) | (0.003) | (0.002) | |

| -6.0e-04 | 2.0e-04 | -0.001 | 1.0e-04 | 5.0e-04 | 0.001 | -8.0e-04 | |

| (0.001) | (0.0009) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| 14,044 | 14,044 | 14,044 | 14,044 | 14,189 | 14,189 | 13,963 | |

| Time FE | YES | YES | YES | YES | YES | YES | YES |

| Controls | YES | NO | YES | YES | YES | YES | YES |

| County FE | NO | NO | YES | NO | NO | NO | NO |

| Region-time FE | NO | NO | NO | YES | NO | NO | NO |

| Trimmed | YES | YES | YES | YES | NO | NO | NO |

| Winsorized | NO | NO | NO | NO | YES | NO | NO |

Notes: The dependent variable is the establishment-level inflation rate for cannabis retailers. The listed coefficients are the sum of the distributed lag coefficients , months after the minimum wage hikes, relative to the normalized baseline period in . The distributed lag coefficients are estimated from equation 2. The baseline specification in (1) includes as controls the monthly unemployment rate and monthly average wage, both at the county level. (2) excludes county controls. (3) controls for county-level price trends. (4) includes region-time FE but not county FE. (5) uses a winsorized outcome (99% winsorization). (6) does not trim or winsorize the outcome. In (7) the bite variable is trimmed by 1%. Standard errors are clustered at the county level and are shown in parentheses. ∗ , ∗∗ , ∗∗∗ . Data from Washington ESD and Top Shelf Data, July 2018-August 2021.

Further robustness checks

Besides testing different specifications, it is also important to consider the institutional assumptions underlying identification in my research design. In this section, I discuss these assumptions and the implications of them being violated. I report results from these additional robustness checks in appendix F.

First, since Washington’s primary crop harvesting season is in Q3—the same quarter that the bite variable is calculated—it is important to ensure that seasonal labor fluctuations do not cause endogeneity in the bite variable. Therefore, I check whether results change if the bite variable is based on Q4 wages, i.e. outside of the main harvesting season. As appendix Tables F1 and F2 illustrate, results are robust to using this alternative bite variable.

I also consider the possibility that firms may not fully comply with the new minimum wage. If that were the case, the bite variable would not accurately measure minimum wage exposure since higher bite would not translate into a larger cost increase for firms. To account for such non-compliance, I redefine the bite variable as the difference between bite two quarters before and one quarter after the hike,

| (3) |

This effectively nets out non-compliance at the county level. Appendix Tables F1 and F2 show that results are robust to this alternative bite variable.

An obvious concern is that policymakers may set minimum wage policy according to local price trends. If that were the case, then the treatment intensity would be endogenous due to reverse causality. Luckily, this concern does not apply to the statewide hikes in the sample since they are either predetermined (events 1 and 2) or linked to a national price index (event 3). However, the city of Seattle has a citywide minimum wage that could, under certain circumstances, be endogenous for some businesses in event 3. In Appendix F.4, I consider the scenarios under which Seattle’s minimum wage could be endogenous and show that the main results are unchanged when Seattle establishments are dropped from the sample for event 3.

Next, to ensure that my results are not driven by market entry or exit, I restrict the sample to establishments that are present at least 10 months for a given 12-month event. Results are robust to using this more balanced sample.

Since the establishment-level price indexes are constructed using annual product and subcategory weights, the weights change at the same time as the minimum wage hike. To ensure that effect sizes are not an artifact of this weighting scheme, I use alternate weights based on a fiscal year starting in July and ending in June each year (i.e. six months offset from the weights in the baseline model).474747For the weights to cause endogeneity, the change in product and subcategory revenue shares within an establishment would need to covary with bite. Results are unaffected by this alternate weighting scheme.

Next, I set the treatment intensity equal to the minimum wage bite itself to show that results do not rely on interacting bite with the size of the minimum wage hike.

It is also important to test whether the results are impacted by the level of industry classification used to measure minimum wage bite. Therefore, I construct an alternative bite variable based on 5-digit NAICS codes to show that the main results do not depend on the level of industrial classification used.484848Though based on a more detailed level of industry classification, the alternate bite variable contains measurement error of a different sort, meaning it is not apparent that it is a better measure of minimum wage exposure. See appendix F for details.

5 Indirect pass-through to retail prices

Since producers occupy the upstream portion of the supply chain, the pass-through estimates from equation 2 provide a complete measure of wholesale price adjustment in response to minimum wage hikes.494949In practice, producers may also be subject to minimum wage pass-through from their input suppliers. However, producer inputs like hydroponic systems, grow lights, and raw materials can be purchased from suppliers outside of Washington state. Therefore, minimum wage pass-through to producer input prices is likely small. To simplify the analysis, I do not consider indirect pass-through for producers. For retail prices, however, equation 2 only estimates direct pass-through and therefore fails to capture indirect pass-through. Thus, an analysis based solely on equation 2 may not reflect the full impact of the minimum wage on retail prices. To capture both direct and indirect effects, I estimate the following equation for retailers only:

| (4) |

In contrast to equation 2, equation 4 contains not one, but two treatment variables. The first, , is identical to that from equation 2 except that the index replaces to emphasize that the bite corresponds to retailer . The second treatment variable is indirect bite, , a shift-share instrument that measures the weighted average minimum wage exposure of the producers that retailer purchases from.505050Shift-share (or ”Bartik”) instruments are common in the empirical literature. For recent examples, see e.g. Jaravel (2019); Hummels et al. (2014); Xu (2022). I discuss and provide supportive evidence for instrument validity in appendix D. is calculated as follows:

| (5) |

Here, is the size of the minimum wage hike for producer ; is the average share of retailer ’s wholesale expenditures going to producer from through , i.e. in the months leading up to the hike; and is the minimum wage bite for the industry-county that producer is located in.515151Note that a retailer and a producer located in the same county will have different bites since they belong to different three-digit industries. Thus, the first term in equation 5 measures the average minimum wage hike for the set of producers that retailer purchases from, while the second term measures the average bite for that same set of producers.525252One could instead directly interact producer expenditure share, hike size, and producer bite as follows: . Results are virtually identical under this definition of indirect bite. However, the advantage of averaging before interacting (as in equation 5) is that the coefficient can be interpreted as a pass-through elasticity. It is worth emphasizing that contains no time index and is therefore fixed for each retailer-producer-event. In practice, retailers may react to the increase in wholesale prices by recalibrating their wholesale bundles (e.g. by substituting out of high pass-through products), in which case would change from month to month. However, allowing to vary within an event could result in reverse causality since a retailer’s wholesale substitution patterns may reflect its own inflation. Defining as the average expenditure share from through avoids this endogeneity, particularly since the results from the previous section indicate that wholesale price effects do not emerge until . In other words, the expenditure shares are based on a time frame prior to the emergence of the wholesale cost shock.

As an alternative to the indirect bite variable in equation 5, one could use producers’ geographic proximity as an instrument for retailers’ exposure to pass-through to wholesale prices. This assumes that retailers purchase more from producers located nearby than those further away. However, I find little evidence supporting this assumption. Instead, a large share of retailers’ wholesale purchases are from producers located in other parts of the state (see appendix A), which suggests that a distance-based instrument is unlikely to capture retailers’ exposure to pass-through to wholesale prices.