A new economic and financial theory of money

Abstract

This paper fundamentally reformulates economic and financial theory to include electronic currencies. The inspiration for this work has been the advent of electronic currencies that span the gambit from blockchain based coins such as Bitcoin and Tether, to centralized currencies such as PayPal, Zelle, and Venmo. The valuation of the electronic currencies will be based on macroeconomic theory and the Fundamental Equation of Monetary Policy, not the microeconomic theory of discounted cash flows. Hence, the value of a potential financial investment will be its long-term contribution to the social aesthetic of sustainable economic activity, rather than the short-term exploitation of society via profits. The view of electronic currency as a transactional equity associated with tangible assets of a sub-economy will be developed, in contrast to the view of stock as an equity associated mostly with intangible assets of a sub-economy. The view will be developed of the electronic currency management firm as an entity responsible for coordinated monetary (electronic currency supply and value stabilization) and fiscal (investment and operational) policies of a substantial (for liquidity of the electronic currency) sub-economy. The risk model used in the valuations and the decision-making will not be the ubiquitous, yet inappropriate, exponential risk model that leads to discount rates, but will be multi time scale models that capture the true risk. These multi scale risk models will be used to make better investment decisions, operationally manage the businesses, and control the currency supply both over the short-term through arbitrage trading and over the longer term through investment. The decision-making will be approached from the perspective of true systems control based on a system response function given by the multi scale risk model and system controllers that utilize the Deep Reinforcement Learning, Generative Pretrained Transformers, and other methods of Generative Artificial Intelligence (genAI). This will be contrasted against current private financial investment, and uncoordinated governmental monetary and financial practices. Finally, the sub-economy will be viewed as a nonlinear system with both stable equilibriums that are associated with short-term exploitation, and unstable equilibriums that need to be stabilized with active nonlinear control based on the multi scale system response functions and genAI. The later is associated with long-term maximization of social aesthetic enabled by electronic currencies. This will lead to the connection to religious philosophy. There is a choice of the future (equilibrium or religious eskaton) of the sub-economy that is made by the electronic currency management firm by how it manages the sub-economy. By choice of the electronic currency, an entity of the economy is choosing its future – equilibrium, or eskaton; that is religion. Therefore, there are two types of religions – religions of maximum social aesthetic which require active nonlinear genAI control using electronic currencies, and the current religions of maximum exploitation which require resistive control using interest.

I Introduction

The recent ubiquitous adoption of electronic currency, whether that be centralized currencies like Zelle, PayPal and Venmo, or peer-to-peer currencies like Bitcoin and Tether, has created an opportunity to reform our economic, banking and financial systems. It is an opportunity to reform them from ones based on short-term greedy, profit motivated exploitation; to ones based on long-term virtuous, economic activity motivated benevolence (that is improvement of the social aesthetic 111This paper coins the phrase “social aesthetic”. What is meant by the social aesthetic is the beauty or desirability of the society. This encompasses the society having a vibrant economy with full employment, to the society having a beautiful sustainable environment. or good). In order to realize this reformation, the theory of economics, banking and finance must be rehabilitated and extended to fundamentally include electronic currency.

The approach that we will take to developing this economic theory, that fundamentally includes electronic currency, is borrowed from the physical sciences. The example that we will build upon is the relationship of the “uber theory” of Einsteinian relativistic dynamics to the “subordinate theory” of Newtonian classical mechanics. As is normally the case, Sir Issac Newton developed the subordinate theory of classical mechanics first in the late 17th century, inspired by an apple falling from a tree. This was a very useful predictive theory that served the physics community well for over two hundred years. In the later part of the 19th century, there emerged phenomenon and measurements that were not explained by classical mechanics. In the early part of the 20th century, Albert Einstein developed relativistic dynamics, inspired by communication from a moving train. It was shown that classical mechanics was obtained in the limit that the velocity was much less than the speed of light. This condition is satisfied for a very large class of motions. The problems with the theory came as the motion of photons and electrons about the nucleus were being examined in more detail. The relationship of these two theories are shown in Fig. 1.

Let us now examine the current state of economic theory. There is first the subordinate theory of microeconomics. This is based on a local view of individuals and corporations, both private entities, that are motivated by profit. This is called capitalism. The Chicago School of economics lead by Milton Friedman also advocated that the private entities should be free to pursue this maximization of profit with minimal governmental regulation, and that government should leave as much as possible up to the private sector. The profit is measured by the Net Present Value (NPV) of exponentially Discounted Cash Flows (DCF) (Allen et al., 2011). This can be written as

| (1) |

where is the discount rate, is the reward or cash revenue (technically, inbound cash flows less investment or abbreviated as simply revenue), are the costs or cash expenses (technically, outbound cash flows or abbreviated as expenses), and is the cash profit (technically, free cash flow or abbreviated as profit), so that NPV is the Discounted Cash Flow (DCF) less investment (). Do note that our use of the words revenue, expenses, and profit are different than those of accrual based accounting. Although the terms are technically different, they are morally equivalent. NPV can now be identified as the short-term profit. Equation (1) is also the definition of Discounted Cash Flow as , where . DCF is therefore the upper limit or constraint on investment . The limit will be dependant on the cash flow profiles and , and the form of . The scaling of DCF, in an informative limit, is given in Sec. XXI as Eq. (156).

Meanwhile there was developed the uber theory of macroeconomics. This is based on a global view of the economy. It is underpinned by the Fundamental Equation of Monetary Policy given by (Baumol et al., 2020)

| (2) |

where GDP (Gross Domestic Product) is the amount of economic activity, is the money supply, and is the velocity of money. From this it can by shown that the value of the currency, , is given by

| (3) |

where is the savings or temporal multiplier of the primary entities of the economy, and is the revenue of the primary entities of the economy, and is the effective economic network multiplier. The goal of the sovereign should be to maximize the socially aesthetic economic activity.

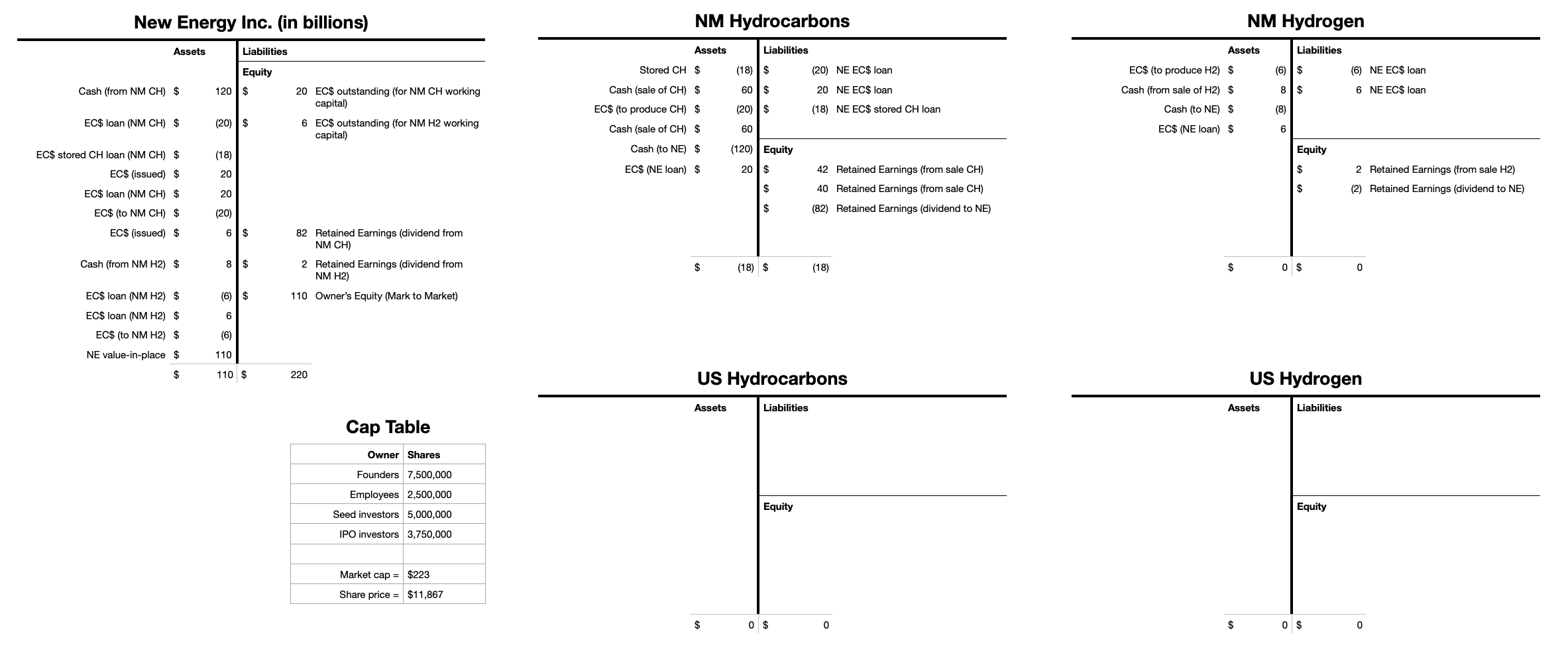

Microeconomic theory and macroeconomic theory were developed independent of each other, and a weak attempt was made to understand the relationship between them, unlike the strong attempt made in the physical systems example shown in Fig. 1. Inspired by the television series Stargate and Mr. Robot, we will proceed by identifying macroeconomics as the uber theory. We propose that, not only the sovereign, but all sub-economies and entities should be motivated to maximize the value of currencies that are relevant to them (those currencies in which they economically transact). With the advent of electronic currencies, there now can be currencies for each sub-economy whether that be regional, industry-based or both. The relationship of these currencies to each other defines a graph of the economy, and the monetary and fiscal policy of the individual currencies give economic control knobs matched to the structure (mathematically, the topology) of the economy. Instead of a constrained maximization of an entity’s DCF or NPV (that is, short-term profit) with the constraint of , the entity should be motivated to maximize the long-term virtuous economic activity of the whole economy with the constraint of not inflating the value of the currency (that is ). This economic theory will be discussed in more detail in Sec. III, Sec. VII, Sec. VIII, Sec. IX, and Sec. X with an example of how it works given in Sec. XII (details of which appear in App. A). The practical new Ubuntu business model resulting from this economic theory, replacing the conventional debt based business model, is described in Sec. XIII.

It is very instructive to understand the relationship of the subordinate microeconomic theory to this uber macroeconomic theory. It can be shown that if a local approximation in terms of both the business graph (direct transactions) and time (months to a few years) is made to the economic system, the financial dynamics can be reduced to that of a random walk or diffusion. This gives an exponential model of the financial dynamics (risk) that leads to a constrained maximization of DCF or NPV, replacing a constrained maximization of virtuous . That is a maximization of

| (4) |

with the constraint

| (5) |

where is the random step size in the business graph, and is the time step. This relationship is shown in Fig. 2. A more specific quantification of the approximation is given in Sec. VII.

Unlike the approximation that leads to classical mechanics from relativistic mechanics, the local approximation of the financial dynamics is rarely satisfied, leading to catastrophic consequences. This approximation is fundamentally introduced as an additional resistive term to control and stabilize the economic system, but dominates the true economic system response. These consequences will be discussed in detail in Sec. II. This issue with the application of physical science and mathematics to the social sciences and economics was identified by Murray Gell-Mann, a Nobel prize winning physicist best known for his work on quantum chromodynamics and quarks. During the latter portion of his career he became interested in complex systems, but quickly realized that there was a problem about how the theory was being developed. “Science was so often badly applied. Pretending that they could analyze and understand the most complex of processes, decision makers had embraced a kind of narrow rationality that took into account only things that are very easy to quantify. Lost in the calculations were factors like beauty or diversity or the irreversibility of change. The results have been disastrous. With anything hard to quantify set equal to zero, a highway can be driven straight through a neighborhood or through a rare wilderness because there is no reliable quantitative measure of damage to set against the increased cost of running the road around the outside.” (Johnson, 2000) What is even worse in the case of financial dynamics is that what is quantified is not quantified correctly.

What has been set up is a classic game theory situation. The local, short-term, greedy optimization of profit (that is NPV) is leading to a minimization of the global, long-term, virtuous economic activity (that is ). This is called the Nash Equilibrium.

We return now to the concept of economic conservatism embodied in the seminal work of Milton Friedman and summarized in the book “Capitalism & Freedom” (Friedman, 1962). Like Friedman advocated, Government Inc. should be limited to matters of the common good like defense, education, social security, public infrastructure and resources, the arts, fundamental research and healthcare. There should be freedom, not only of sub-economies, but of Government Inc., labor, intellectual property and law. This will be discussed in more detail in Sec. XV. Friedman was right that freedom is essential. Freedom is how the leaders of the sub-economies are ultimately held accountable. Free people will move from a sub-economy with a poor leader to a sub-economy with a good leader. The problem comes with capitalism being based on the short-term maximization of profits. The fact that it is left up to the private sector (the second ingredient of capitalism) is common to what we are proposing. It would be best if Government Inc. is private with government executives and congressional representatives serving on the board. The change that is being proposed is to move to “Communism & Freedom”, where we are talking about a private sector communism where the virtuous economic activity (that is the common good) is maximized. It is very similar to existing economic cooperatives, but with a currency for the economic cooperative.

The rest of this paper is organized as follows. The view of electronic currency as a transactional, stable, low risk equity (much like a checking account, associated with tangible assets), and of stock as a complementary, volatile, high risk equity (much like a savings account, associated with predominately the intangible assets) is discussed Sec. IV. The origin of the quantum field nature of financial systems, and the way the quantum field nature influences how the electronic currency management firm manages and observes the sub-economy, are discussed in Sec. XI. How to manage the sub-economy is discussed in Sec. V, how to tax the sub-economies for the public good is presented in Sec. XIV, the view of the sub-economy as a nonlinear system is explored in Sec. VI, the resilience of this economic system to economic collapse is discussed in Sec. XVI, what currencies currently exist and their characteristics are put forward in Sec. XVII, the interactions of sub-economies are explained in Sec. XVIII, the relationship of electronic currency to religious philosophy is explained in Sec. XIX answering the question “why is crypto a religion?”, the inspiration for this work is given in Sec. XX, and finally the conclusions are presented in Sec. XXI.

II Catastrophic consequences of the invalid economic localization

This section will start by examining the local diffusive approximation resulting in Eq. (4) and Eq. (1), what it really means, how it becomes embedded in our economy, and why it is not a valid approximation for many cases, especially for infrastructure and other long-term capital assets. The primary economic consequences of using this approximation will then be explored, followed by the secondary economic consequences, and finally the effects on the fabric of society.

The local diffusive approximation for financial dynamics is better known as the Fokker-Planck approximation in physical kinetics (Nicholson, 1983; Lifschitz and Pitajewski, 1983). It is also equivalent to a random walk or stochastic diffusive process. In finance, it is the approximation that leads to the Black-Scholes equation (Black and Scholes, 1973; Hull, 2000). The underlying assumption is that the movement in the quantity, whether that be position, velocity or value, takes place by many small random steps. To move an appreciable distance, many small steps need to be taken. Specifically, to move a distance , where is the step size, steps need to be taken. The evolution is governed by the Fokker-Planck equation

| (6) |

where is the probability, is the collision rate or dissipation rate or coefficient of dynamic friction or discount rate, is the mean squared size of the step or the collisional cross sectional area, is the frequency of the system as a function of or the drift frequency, is the square root of the drift cross section, is the quantity being diffused (e.g., action, economic activity, price, velocity, and position), and is the diffusion coefficient. This equation evolves to the equilibrium distribution

| (7) |

where is the Hamiltonian or energy as a function of with units of (if is physical action, then has units of energy), , and is a constant temperature with units of . It will be shown in Sec. VII that , , and . So what is identified by the temperature , or the random kinetic energy, of a heat bath or an external physical system, is proportional to the 2/3 root of the diffusion coefficient of a random walk or diffusive process. For financial dynamics the diffusion coefficient, , is called the volatility (which is the metric of risk), where is the price of the commodity. Equation (6), when is substituted for , is the Black-Scholes equation of quantitative finance.

This assumption is made because it dramatically simplifies the general problem from the difficult to solve Hamilton-Jacobi-Bellman equation (Eq. (37)), to an easily solvable partial differential equation (Eq. (6)) with a closed form, time independent (stationary), equilibrium solution given by Eq. (7). It is simple as foretold by Murray Gell-Mann.

While there are some physical systems that satisfy this assumption, that is not true of most economic systems. This is especially true when it comes to major infrastructure projects, long-term capital assets like real estate, petroleum, mining, and energy. These assets do not have legs and are not running around like drunken sailors. The invalidity of this assumption was evidenced by the failure of Long-Term Capital Management (LTCM), the first trading firm to employ the Black-Scholes equation.

Unfortunately this assumption can not be escaped in our current financial systems. It is fundamentally embedded in our economic, financial and banking systems. It is baked-in by the US Federal Reserve Bank when it loans currency at a prime interest rate, by the US Treasury when it sells T-bills as bonds with coupon payments, by banks when they issue loans with interest, by stockholders when they demand dividends or simply value the stock using DCF analysis, and by corporations when they issue bonds.

The consequences of this invalid assumption are truly catastrophic. The primary economic fallout is a significant under investment in the future economic growth and sustainability, businesses and economies not being well operated such that they dramatically under perform by factors of ten or more, and realized performance of businesses and economies that never meets projected expectations. Secondary fallout includes the “Research Valley of Death” and the “Innovator’s Dilemma” (Christensen, 2000), as the long-term value of research is not captured, the natural development of exploitative and inefficient monopolies, and the failure of debt-leveraged private equity. The failure of debt-leveraged private equity is the failure of the debt-based economy in miniature. Private equity is not investing enough in their acquisitions, and are running their acquisitions inefficiently without enough inventory and savings, and consequently they find that their acquisitions do not meet their expectations of performance.

The effects on our social fabric are even more devastating. The driving force of greed, that is short-term exploitation of others, pits identities against one another in a race to the bottom. It leads to the rise of dictators, monarchs, fascism, authoritarianism, and monopolists; and the compensating fall of the general population and their savings (wealth). The result is a social stratification that breeds animosity and a strong desire for retribution and recompense. The ultimate result is social revolution, discrimination, white supremacy, antisemitism, misogyny, and wokeness (political correctness and anti-discrimination) – a social war between the haves and the have-nots, amongst the haves, and amongst the have-nots. People view everything as a zero sum game, so that if someone else is hurt that must be a personal gain even though that might be actually be a personal harm. In general, it increases the mental stress on individuals.

These are the conditions that Frederick Engels described in 1845. “The most important social issue in England is the condition of the working classes, who form the vast majority of the English people. What is to become of these propertyless millions who own nothing and consume today what they earned yesterday? The industrialists grow rich on the misery of the mass of wage earner, but prefer to ignore the distress of the workers.” (Engels, 1845, 2003) A more recent example, the transition of the United States from the large government economy started in the 1930s with the New Deal and reaching its zenith in the 1960s (based on a currency, with government spending based on the social good), to today’s nearly pure, unregulated “Capitalism & Freedom” starting in the 1970s and 1980s, is well chronicled by Andersen (2021). This book describes increased economic inequality as evidenced by the Gini number. The United States has moved from roughly equivalent to Canada in the more highly developed half of nations, to the most unequal rich country and to a place amongst the developing countries, better than the Congo and Uruguay but worse than Haiti and Morocco. The average US worker now has almost no savings, living “hand to mouth”. As to quality of life, despite paying between two to three times as much for healthcare per capita than any other highly developed country, the average life expectancy is three to five years less. Before 1980, the cost and life expectancy were both equivalent to other highly developed countries. This is the exploitation of labor, a consequence of the invalid local risk assumption.

III Theory and valuation of electronic currencies

In this section, the economic theory forming the basis for monetary and fiscal policy of managing a sub-economy based on an electronic currency is developed. Equivalently, this can be viewed as extending current macroeconomic theory, and the theory of banking and finance to include electronic currency. Simply stated, this brings the global perspective of maximization of virtuous economic activity to the locality. It will be built from scratch, starting with mathematical fundamentals. The reduction of this theory to common microeconomic constructs based on Discounted Cash Flows (DCF) and Net Present Value (NPV) (Allen et al., 2011) will be presented. Finally, the practical implications of using this new theory will be contrasted to the use of current microeconomic theories of banking and finance (Ritter et al., 1989).

We start by assuming that a sub-economy saves its revenue at a constant rate, , so that

| (8) |

where is the amount of savings or the supply of the electronic currency, is the primary revenue of the sub-economy, is the currency velocity or the savings turnover rate, is the savings turnover time or savings multiplier, and

| (9) |

is the ensemble and long time average revenue of the primary sub-economy expressed as a functional integral over the distribution functional and time. Equation (8) can be summed or integrated to give

| (10) |

which can be rewritten as , the fundamental equation of monetary policy.

We now recognize that the primary sub-economy will spend a large fraction of this revenue, and it will be become the revenue of the second level of the economy. The second level of the sub-economy will spend a large fraction of its revenue, and so on. The total amount of savings will be

| (11) |

where is the level of the sub-economy. Assume that the fraction of the revenue that is spent is a constant

| (12) |

where is the economic multiplier. The total revenue can now be written as

| (13) |

The total amount of savings can be rewritten as

| (14) |

where we define the effective dimensionless savings multiplier as

| (15) |

This can be manipulated to give

| (16) |

where

| (17) |

is the effective savings multiplier, and

| (18) |

is the effective economic multiplier. Equation (16) is what we call the fundamental equation of electronic currency valuation. The relationship to the value of the electronic currency can be seen by writing

| (19) |

where is the value of the electronic currency, and are the number of units of the electronic currency in circulation. So,

| (20) |

Let us now propose that the electronic currency management firm should maximize the value of the electronic currency, , as given by Eq. (20). This is in the interest of its stakeholders – the holders of the electronic currency. Equation (16) is made up of four parts.

The first is the economic multiplier given by . This is a measure of how advanced and specialized the economy is (that is whether it is a first or third world economy, or how economically independent or how efficient individuals are). Maximization of this term drives one to a first world, more efficient and dependant economy. The electronic currency management firm, while it can influence this over the longer term, does not have a lot of direct influence on this parameter.

It does have a very direct influence on the second term, the savings multiplier , through the board level control of its subsidiaries. The electronic currency management firm has a significant, yet indirect influence, on the third term, the dimensionless savings multiplier , as will be discussed in Sec. V. Given that , , this third term,

| (21) |

with the electronic currency management firm striving to make it as close as possible to 1. The initial value is regionally and culturally dependant. Currently it is much less than one since most businesses and people live “hand to mouth” with little savings.

The increase in both directly and indirectly controlled savings has several benefits. It enables a significant increase in the revenue as will be shown in App. A, and eliminates supply chain issues like happened recently with the recovery from the COVID shutdown, by encouraging much higher levels of inventory (that is a form of savings). It also allows leadership to focus on operational excellence not financing, employees to focus on performance not paying debt. It eliminates cash flow problems, and reduces the stress on individuals. The savings give financial inertia to the system, allowing the electronic currency management firm to more effectively stabilize the system, that is reduce the fluctuations, volatility and risk of the system. Another way of looking at the benefits of savings is by recognizing that the financial system has individual fluctuations that are large. The sub-economy needs enough savings to respond to these large fluctuations.

The fourth term, the revenue, is a direct metric of economic activity.

If the electronic currency management firm needs to print new currency for investment to generate more virtuous economic activity, it should make that investment when

| (22) |

or

| (23) |

where is the increase in revenue coming from the investment financed by issuing in new electronic currency, and is the increase in monetary demand net of the investment, . Note that the costs do not appear explicitly in this investment criteria (a small fraction of the costs appear in the required investment), unlike the constraint where all the costs appear explicitly as in Eq. (1). The revenue will be adjusted so that it includes all non-monetary value and/or mitigated costs to society. This will be implemented as a tax on undesirable activities or a subsidy of desirable activities. If the non-monetary value and/or mitigated costs are felt by members outside of the sub-economy, there should be a taxation of the members outside of the sub-economy for undertaking undesirable activities and investment of the proceeds from that taxation into the sub-economy, that is a subsidy of the desirable activities, by the government. Note that if the tax is sufficiently large, the government or the currency management firm will never have to collect the tax. The undesirable activities will not be undertaken.

We now turn your attention to the operational management of members of the sub-economy. Pose this problem as a constrained optimization (Chiang, 1984). Maximize the electronic currency demand, , subject to the constraint , where , is the time period of the investment, are the yearly revenues of the member of the sub-economy as a differentiable concave function of a parameter , and are the yearly expenses of the member of the sub-economy as a differentiable convex function of a parameter . The Lagrangian is

| (24) |

The Kuhn-Tucker conditions are

| (25) |

and

| (26) |

These conditions give the following following equations for the optimum point

| (27) |

and

| (28) |

which can be solved for

| (29) |

and

| (30) |

or

| (31) |

Now, identify the two boundaries given by the conditions and . Using Eq. (31), find that and , and using Eq. (28), find that and . Finally, summarize the solution for the different values of . It is not possible for to be greater than . If

| (32) |

For ,

| (33) |

where

| (34) |

and for ,

| (35) |

The electronic currency management firm will want to maximize in order to maximize the value of the currency, so that . Therefore, the solution is given by Eq. (32). For a well managed currency, . For instance, the example given in App. A has , and , so that and . This is close to being a revenue maximizing firm with and , which is not much less than since

| (36) |

for the example given in App. A. In contrast, if the local approximation is made, the value of the currency is still maximized by using Eq. (32), but the non-local business network and time effects are neglected. The effective economic multiplier will approach 1, and the savings multiplier will approach 0. For Target Energy Inc., the typical firm operated with the local assumption discussed in App. A, and . This gives , so that – a profit, not revenue, maximizing firm.

The functional integration over the distribution given by the functional in Eq. (9) is how the risk model enters this theory. This is what could be approximated by the Generative Pretrained Transformer (GPT) (Radford et al., 2018; Vaswani, 2017; Li et al., 2022), a Generative Adversarial Network (GAN) (Goodfellow et al., 2016), the Mallat Scattering Transformation (MST) (Glinsky and Maupin, 2023; Glinsky, 2024a), or the Heisenberg Scattering Transformation (HST) (Glinsky, 2024b, c, 2023, d, e), all forms of Artificial Intelligence (AI) (Hastie et al., 2009; Sugiyama, 2015; Goodfellow et al., 2016). In the case of the local approximation, it is approximated by solving the diffusive Black-Scholes equation given in Eq. (6). There are also more simple approximations that can be made that respect the low risk and long-term nature of many financial situations.

Starting with the equation for , Eq. (9), and substituting the solutions to the Black-Scholes equation, Eq. (6), into it, one can derive the expression for NPV given in Eq. (1). It will be shown in Sec. VII and Sec. IX how a constrained optimization of the expression for given in Eq. (9) leads to the optimization of NPV given in Eq. (1), when a dominate diffusive risk model is superimposed on the conservative financial dynamics of a sub-economy.

The dramatic difference between using the true distribution functional of Eq. (9) and the distribution function of Eq. (6) is demonstrated in Fig. 3. In this figure the HST and the methods of AI are used to conditionally generate the distribution based on the historical behavior of the oil price (as will be explained in detail in Sec. VII). Note the discounting of the value of the next business cycle by the local approximation, so that no inventory would be amassed to take advantage of the next market upswing. Also note how poor the simulations using the local approximations are – that is how bad the approximation is.

In contrast to all of the advantages outlined in this section to optimizing , optimizing the NPV explicitly focuses on the short-term, due to the exponential term, and on profits, greed or exploitation due to the term. When ancillary profit is made by the sub-economy optimizing , profit is not the objective. The customer is paying forward, not being exploited. The profit is re-invested to improve the product, so that the next time that the customer buys the product, it is better.

The preceding simplified example of constrained optimization demonstrates a stark difference between the status quo which uses the local approximation with the resulting exponential risk, and the proposed economic theory of this paper which optimizes sustainable economic activity. Despite this, the practical situation demands a more sophisticated approach which includes the complete conservative stochastic system response. The problem needs to be approached as a formal exercise in control of a complex system to optimize a functional given a model of the complex system. Additionally, the system needs to be controlled to stabilize the optimal equilibrium and to minimize fluctuations about the equilibrium. The method of choice is a solution of the Hamilton-Jacobi-Bellman equation (Goldstein, 1980; Kalman, 1963)

| (37) |

where is the reward given a state of the system, is the force equation or the constraint equation of the system given the state of the system and the co-state (canonically conjugate momentum or action) of the system, and

| (38) |

is the expected value of the system starting from state at time (that is, the time integrated reward over the stochastic trajectory , or functional of ). For the economic theory of this paper, the reward given the state of the sub-economy is , where is the primary revenue of the sub-economy under control per time, is the effective economic multiplier, and is the primary savings multiplier of the sub-economy under control. This is the increase in the monetary demand .

In Sec. VII, it will be shown how to solve Eq. (37) using the HST and the methods of AI based on either simulations of the system or observations of the system, driven by an external force . The solution will be the fiscal (investment and operational) and monetary policy that will locally maximize , but needs to be stabilized and cooled since local maximums are unstable equilibriums. The reward that is optimized can be modified to take into account other benefits or costs to society, such as sustainability and beauty, by applying a conservative economic control force . Furthermore, the application of the economic force (arbitrage trading) to stabilize the system equilibrium and minimize the fluctuations about the system equilibrium can be done in a similarly direct feedback manner by applying a force given in Eq. (99). It also can be done by applying a ponderomotive and diffusive force , given in Eq. (100), that is not dependent on knowing the state of the system. More details of these control forces can be found in Sec. VII.

If instead of the true model of the system, the diffusive model of Eq. (6) is used and applied to solve Eq. (37), it can be shown that the equilibrium optimum policy is to optimize the NPV of Eq. (1) and to invest with terms of debt repayment. This is equivalent to the profit maximization of the previous constrained optimization, instead of a revenue maximization. It should be noted that the local NPV maximization leads to a significant reduction in the long-term economic activity and even long-term profits. This greedy, local optimization when the system does not have exponential risk (that is diffusive dynamics), leads to very poor strategy (that is, policy). It would be like playing chess with no regard for the long-term effects of the next move. One would never sacrifice a piece to improve the long-term prospects of winning. One would only consider what pieces could be captured or lost with the next move or two. It also would be like playing PacMan with a strategy to swallow the next cherry as quickly as possible with no concern to whether that path leads to being consumed by a ghost in the near future.

IV Tangibility of assets vis-a-vis equity

We now examine where and how electronic currency appears on the balance sheet and what that means for it as a derivative security. First we need to discuss the concept of tangible and intangible assets.

Tangible assets, as an accounting construct, are associated with the cash that has been spent to acquire or construct them. For a building that would be the purchase price or cost of construction. For intellectual property that would be the purchase price, licensing fee, or the cost of the research and development. Since accounting is focused on the cash flows and valuation derived from discounted cash flows, the story ends here.

For the theory that we are presenting, the story must be extended to include intangible assets. Before more recent accounting “‘reforms” this appeared on the accounting books as a goodwill asset associated with concepts such as brand value and value-in-place. Value-in-place comes from the fact that the building is built, employees are on-the-job, properly educated and trained, and assimilated into the culture of the business, that is they know how to get things done. For intellectual property it is the know-how and the show-how. This value is subjective and is only valued when the business is sold, raises equity investment through a stock offering, or has a stock that is traded on a public exchange. The intangible value is the difference between the book value (that is the cost of construction) and the market capitalisation or sales price.

Electronic currency appears on the liability side of the balance sheet (see the example given in App. A). But, it is not a short-term liability like an accounts payable or a loan – it is an equity, like owner’s equity and retained earnings. The terms of the loan are like that of cash raised through a stock offering. It is repaid when, if, and how much it can be. It also can be viewed, like stock, as an ownership of the business by the holders of the currency. The difference is in the rights of the equity, and the resulting assets on which the value of the equity is based. A close examination of the accounting example in App. A finds that the electronic currency equity is associated only with tangible assets, while the stock equity is associated with predominately intangible assets. (It only is associated with an amount of tangible assets equal to the amount of cash that was raised through stock offerings.) Since the intangible assets are more speculative, ephemeral and simply fickle, they will exhibit larger fluctuations than the tangible assets and are therefore more risky. The intangible assets will track the growth of the business, while the tangible assets will have a more modest growth rate determined by the efficiency of the investment in creating demand for the currency. Therefore the currency equity will have less risk (made even lower by the active value control), and less return than the stock equity. This is shown graphically in Fig. 4.

The business can take advantage of a significant demand and resulting price increase in the stock price. This is a way of the market telling the business that it needs to grow more quickly. The business should increase its liquid reserves by raising cash through a stock offering, then issuing electronic currency and increasing the amount of investment into the sub-economy.

In summary, electronic currency is like a checking account where transactional savings, that is working capital should be kept. Stock is like a savings account for long-term savings that will have larger returns, but also larger risk (that is fluctuations).

V Management of sub-economy

The electronic currency management firm needs to approach its role as a true fiduciary of the sub-economy. The adoption and use of the electronic currency by the sub-economy for transaction and saving depends on: (1) transparency, (2) reserves, (3) accountability, and (4) stability.

First, with respect to transparency, the electronic currency will need to have online, real-time reporting. This will include the full accounting books of the electronic currency management firm and its subsidiaries and companies that it holds a significant ownership interest. Highlighted will be important financial metrics like reserves (cash, inventory, capital assets, and electronic currency), electronic currency supply, and investment valuations. A part of this will be detailed stochastic financial models of projected business performance, including potential acquisitions. Not only the models will be made available, but the software, so that investors can re-evaluate the financial models with their own assumptions. A benefit of this will be crowd sourcing the financial models and the model assumptions. Sunlight is the best disinfectant for fraud, and essential to hold the electronic currency management firm accountable and trusted – “trust but verify” as arms negotiators say.

Second, the electronic currency management firm will need to commit to minimum cash and capital reserves. This will include encouragement of savings by its subsidiaries, employees, suppliers and other members of the sub-economy. There are several ways that this can be done. They can range from explicit control of subsidiaries by investing sufficient electronic currency (then controlling use through the board of directors), paying suppliers and employees in electronic currency, establishing capital savings accounts for employees (that vest over time and can only be spent on capital assets like homes and education), paying off existing student debt and mortgages (vesting over time), having put options that are super-glued to electronic currency savings of the employee or supplier and cash reserves of the electronic currency management firm (effectively insured deposits of the electronic currency), operating a bank with both insured deposits of cash and electronic currency, and having taxation for public infrastructure programmed into the electronic currency as a transaction tax.

Via the prospectus that is part of an Initial Public Offering (IPO) of the electronic currency management firm, the commitment to reserves and savings can be made, along with the commitment to hyper-transparency. Therefore, the electronic currency management firm will be held both criminally and civilly accountable if it does not live up to those commitments. This is done to build investor confidence in both the stock of the electronic currency management firm and the electronic currency.

The last attribute of stability leads to a very rich discussion that will occur in Sec. VI. This is based on a Generative Artificial Intelligence (genAI) control system incorporating a multi scale, topological model of risk (i.e., the financial system response). This will be done via arbitrage trading by the electronic currency management firm (that is, buying and selling of the electronic currency on the open market using its cash reserves). On the longer term, the electronic currency management firm will buy companies, resources, and labor in recessionary periods and sell companies and resources in inflationary periods. The current practice of using bonds is a poor control system that immediately reduces the currency supply (anti-inflation) but is a commitment to future inflationary coupon payments. The same is true of central bank loans that immediately increase the currency supply (anti-recession) but is a commitment to future recessionary loan repayments. Both bonds and loans are exploitative in motivation and not matched to the risk of the sub-economy.

Without these safeguards, it is both very easy and tempting for the sovereign to focus on the local optimization of economic exploitation. This manifests via a lack of transparency (through propaganda, destruction of education, censorship, Lügenpresse, destruction of freedom of speech and press), lack of ability to replace the leadership, lack of ability to emigrate to another country, and sole governmental control of currency.

The fiscal investment management of the sub-economy must be coordinated with the monetary management. Investments need to evaluated with the advanced genAI multi-scale models of risk and with operational decision analysis, that is operational management of the sub-economy, done with the same genAI risk models and metric of virtuous economic activity. This is not the case today. Governments have uncoordinated fiscal investment policies that are based on political, not financial considerations. Businesses are managed based on local metrics of financial exploitation.

The criteria on which investments should be made is whether the demand for the electronic currency that the investment will create is greater than the investment, as shown in Eq. (22). The electronic currency management firm can then electronic currency leverage the funds that it has in reserves by issuing new electronic currency to make the investment. This ensures a future growth in the value of the currency, and that the sub-economy will not be paying for the investment through inflation, effectively an inflation tax. This is in contrast to issuing debt, which exploits the sub-economy and leads to sub-optimal levels of investment and economic performance of the sub-economy.

The fact that there are many sub-economies matched to the structure (topology) of the economy (both regionally and industrially) and that the sub-economies are individually managed, leads to further optimization. What is good for one sub-economy is not good for another. Having more control knobs (degrees of freedom) allows for a much better optimization. The result will be short-term stabilization and long-term growth of the economy as a whole.

VI Sub-economy as a nonlinear system

In this section, we will approach the understanding of a financial system as a nonlinear system like Complexity Economics (Farmer, 2024) does, and the financial and monetary policies as a problem in nonlinear systems control. We start this discussion by referring to Fig. 5, which is a representative contour plot for a physical system (Kuzmin et al., 2004). It also can be looked at as a topography map. This map has two basins with basin centers indicated by the o-points, and one saddle point (mountain pass) between the basins indicated by the x-point. There are strong exploitative thermal forces that will take a sub-economy to the o-point once in the respective basin. They are also what are called stable equilibriums. The discipline of nonlinear dynamics refers to these o-points or stable equilibriums as attractors. This is in contrast to the x-point, which is the point that the sub-economy descends to from the mountain, but it is not a stable equilibrium so that as it is approached the sub-economy will fall into one of the exploitative basins. The discipline of nonlinear dynamics refers to these x-points or unstable/metastable equilibriums as semi-attractors (that is half attractor and half repeller). Semi-attractors first attract the trajectory to them, but once reached repel the trajectory away from them. These unstable equilibriums are the desirable states from a social aesthetic perspective as shown in Fig. 6. They need an active control system, though, in order to stabilize them. This is like stabilizing an inverted pendulum with a vibrating saw as shown in Fig. 7 (Kapitza, 1951a, b; Landau and Lifshitz, 1976). Stabilization is the construction of a small alpine valley at the mountain pass where it is easiest to do. The electronic currency management firm needs to vibrate the market with its arbitrage trading to stabilize the system. The technical problem is in identifying the natural frequencies of the system. For instance, when one flies a plane, one must take into account that it takes several seconds for the plane to respond. If one tries to make corrections faster than this, one will over-correct and cause the plane to go out of control. The issue with financial systems is that they have many natural frequencies, in fact an infinite number. The electronic currency management firm needs to use innovative genAI technology that will control the financial system at all the natural frequencies. Details of how this is done are given in the US Patent Application, “Systems and Methods for Controlling Complex Systems” (Glinsky, 2024f) and discussed in Sec. VII. Current control systems only have a single time scale, and often have catastrophic phase lags built in that destabilize the system like proof-of-stake systems (e.g., New Ethereum) and the buying and selling of bonds by a central bank (e.g., US T-bills and British GILTs).

Note that the electronic currency management firm will want to buy the electronic currency, using its cash reserves, when the price is less than the equilibrium price to increase the demand and therefore the price, and sell the electronic currency when the price is more than the equilibrium price to increase the supply and therefore decrease the price. That is, it will buy low and sell high – a money making financial heat engine. Mother nature rewards doing what she wants. The essential tricks are sensing what the equilibrium is and doing it on multiple time scales. It is all about topological discovery of the financial system response and equilibrium, then topological manipulation to control and stabilize the financial system (Glinsky, 2024d, e). This is not the case today.

The effectiveness of this control system is demonstrated in Fig. 8. A realization of the uncontrolled oil price, as simulated by the HST, is compared to the same system controlled using the concepts discussed in this section based on the multi-scale topological understanding of the financial system dynamics.

VII Solution of the Hamilton-Jacobi-Bellman equation

The fundamental mathematical problem in economics is the constrained optimization (minimization) of an economic value or action functional (Chiang, 1984)

| (39) |

where is the reward or revenue or potential energy or potential economic activity given the state of the economic system, and is the evolution parameter, commonly time. The optimization is constrained by a force equation

| (40) |

This problem is normally approached using the method of Lagrange multipliers by forming the Lagrangian

| (41) |

where is the Lagrange multiplier or co-state of the system or action. The Lagrangian can be re-written as

| (42) |

where so that

| (43) |

The next step is to form the value or action functional

| (44) |

and use the calculus of variations to set giving Lagrange’s equation of motion for the path that minimizes the action

| (45) |

The system can also be analyzed from the Hamiltonian perspective by making the Legendre transformation

| (46) |

where and . The equations of motion are now Hamilton’s equations of motion

| (47) |

and

| (48) |

If the motion is deterministic, the method of characteristics can be used, in what is commonly called Pontryagins Maximum Principal of Control Systems (Kalman, 1963).

The approach that we take is the canonical transformational approach (Arnold, 1989; Lichtenberg and Lieberman, 2010) that results in the Hamilton-Jacobi-Bellman (HJB) equation (Goldstein, 1980; Kalman, 1963). This method does not rely on the method of characteristics so that it can be applied to systems that are not integrable, that is stochastic. This approach finds a canonical transformation generated by the value functional so that the transformed Hamiltonian is zero, giving transformed coordinates that are constants in . The resulting equation is

| (49) |

or more specifically

| (50) |

giving

| (51) |

and

| (52) |

The value functional is called Hamilton’s Principal Function and can be written as

| (53) |

Because the Hamiltonian is not dependant, the value functional can be written as

| (54) |

where is called Hamilton’s Characteristic Function and can be written as

| (55) |

where

| (56) |

| (57) |

and

| (58) |

The equations of motion for the transformed coordinates are

| (59) |

and

| (60) |

with solution

| (61) |

and

| (62) |

To add external forces, that do not change the conservative nature of the system, we analytically continue the Hamiltonian and make the canonical transformation and . The complex analytic Hamiltonian is now given by

| (63) |

so that there are two orthogonal sets of motion, one for (conservative motion generated by and parameterized by group parameter ) with equations of motion

| (64) |

and

| (65) |

and one for (the motion generated by and parameterized by group parameter ) with equations of motion

| (66) |

and

| (67) |

where

| (68) |

so that

| (69) |

When the Hamilton-Jacobi-Bellman equation given in Eq. (50) is solved in this analytically continued extended phase space, the transformed analytic Hamiltonian is given by

| (70) |

or

| (71) |

where

| (72) |

and

| (73) |

The equations of motion for the conservative motion, with group parameter , are

| (74) |

and

| (75) |

and the equations of motion due to an external force doing work on the system, with group parameter , are

| (76) |

and

| (77) |

with differential solution

| (78) |

and

| (79) |

where . The finite solution is

| (80) |

and

| (81) |

where

| (82) |

It should be noted that after a significant amount of time has elapsed (), uncertainty in the value in will cause the motion to become stochastic. Not only will the value of be not known, even the number of cycles of temporal period will not be known. The value of will simply be uniformly distributed from 0 to .

The form of the imaginary part of the Hamiltonian in Eq. 71

| (83) |

is quite interesting. Optimal control as done in genAI with Deep Q-Learning (DQN) (Mnih et al., 2015) is based on parametric estimations of a Q-function

| (84) |

where is the state, are the actions to be taken, and are the parameters of the estimator. What is at the kernel of DQN is the action of the group with infinitesimal generating function and associated group parameter . This will be discussed in more detail in Sec. X.

Given this theory, we move on to the practical application of it to control the system. This application will use the concepts of Artificial Intelligence (Hastie et al., 2009; Sugiyama, 2015; Goodfellow et al., 2016), as interpreted by Glinsky (2024d, e). First, construct a dataset by either doing an ensemble of simulations of the system or by observing the system. It will be assumed that the system has a small number of dimensions. Most of the systems of interest present themselves in the domain of collective fields that are elements of a Hilbert space not with a small number of components. How to de-convolute from the domain of the collective motion, the field , to the domain of the individual, , (that is from a Hilbert space to ) using the Heisenberg Scattering Transformation (HST) and a Principal Components Analysis (PCA) will be discussed at the end of this section. This transformation can be done because the collective acts as one, because of the correlation or synchronization specified by the S-matrix given in Eq. 91, which are the derivatives of the analytic Hamiltonian of the individual.

Start by doing an ensemble of simulations or measurements on the system of interest. It is helpful to apply an external force to the system being simulated or observed to sample phase space more efficiently. A good choice would be a dissipation or a random diffusion which samples phase space well, as the system gradually relaxes to the stable equilibriums. It is also good to apply an external force that is constructed to keep the dynamic trajectory in the vicinity of the unstable local maximums, that is stabilizes the unstable equilibriums. The set of variables that should be recorded are , in addition to variables that are related to the state and the co-state .

Given the dataset, train a neural network with an architecture that matches the structure of the solution to the HJB equation to estimate: (1) the decoding of the and coordinates into the and coordinates that are the solution to the HJB equation as well as the encoding of and to and , (2) the value function that generates these canonical transformations and is related to the imaginary part of the analytic Hamiltonian as shown in Eq. (83), (3) the mapping of to the real part of the analytic Hamiltonian , (4) the frequency , (5) the policy and (6) the analytic advance of and given in Eqns. (79) and (78). Multi Layer Perceptrons (MLPs) (Goodfellow et al., 2016) are used to approximate some of the functions. The derivative functions are calculated by back propagating the MLPs. This architecture is shown in Fig. 9. It is important that Rectified Linear Units (ReLUs) are used as activation functions in the MLPs because the MLPs are approximating analytic functions which are maximally flat but do have a limited number of singularities where the derivative is discontinuous. MLPs with ReLUs are very good at doing this since they are universal piecewise linear approximators with discontinuities in the derivative.

There is a non-trivial detail in this training step. Although one has the inputs (, , ) and outputs (, ), what is ? For a conservative system with no external force being applied , but that is not the case with this dataset. The solution is to use the decoder to estimate , using the target outputs as an input to estimate , as shown in Fig. 10. If this workflow is being used to train a surrogate where the external force is part of the dynamics that is being modeled, a model for the external force needs to be estimated using an MLP so that , as shown in Fig. 11. If the force is resistive, diffusive friction , where . In this case, Rayleigh’s Dissipation Function can be defined

| (85) |

so that

| (86) |

You could view the estimation of as an estimation of Rayleigh’s Dissipation Function where

| (87) |

The solution of the system dynamics has the conservative force of the uncontrolled system, where is the reward optimized by the uncontrolled system. The dynamics can be modified to optimize a desired reward . In order to do this, calculate the conservative control force (that is the incremental action, ) that needs to be applied to change the reward that is optimized. Estimate , then calculate the control force

| (88) |

where and

| (89) |

which is found by back propagating the derivatives in the MLP. The system needs to be simulated or observed again, this time applying the control force, but not including that control force in the calculation of . The neural network needs to be fit again, with this new dataset.

One now has a solution of the HJB equation that has estimated the analytic Hamiltonian . The next step is finding the equilibriums or where

| (90) |

Given the function estimated in the workflow shown in Fig. 9, can be found with a high performance root finder, both stable and unstable equilibriums. The equilibrium policy can then be estimated as and the equilibrium value as . One now has estimated the which are viewed different ways by different technical disciplines. These are: (1) the ground states of quantum field theory (Weinberg, 2005), (2) the attractive manifolds of nonlinear dynamics (Lichtenberg and Lieberman, 2010), (3) the emergent behaviours and self organizations of complex systems (Gros, 2015), (4) the Taylor relaxed states (Taylor, 1986) and BGK modes (Bernstein et al., 1957) of plasma physics, (5) the poles and branch cuts of control theory and complex analysis (Nehari, 2012), and fundamentally (6) the homology classes of the topology of the dynamic manifold or the geometry of the physics (Frankel, 2012). The equilibrium values need not be points. They can be manifolds with rich topography, that is algebraic structures, if .

Knowing is equivalent to knowing the analytic function . is the solution of Laplace’s equation given the boundary . The motion on the dynamical manifold is simply geodesic motion generated by the action whose Taylor expansion coefficients are given by the S-matrix (Landau, 1959; Cutkosky, 1960; Chew, 1961)

| (91) |

The analytic function specifies the geodesics of the motion generated by with group parameter , and the geodesics of the adjoint motion generated by with group parameter . The complete motion is generated by the Weyl-Heisenberg group on extended phase space with Lagrangian or Poincaré one form , symplectic metric or Poincaré two form , complex group parameter , complex analytic Hamiltonian or complex group infinitesimal generating function , and group action or finite group generating function , where and – a complex Lie Group. Note that the complex finite group propagator is

| (92) |

Therefore, if the motion is conservative, the propagators are

| (93) |

and

| (94) |

the later being the well known field theory expression for the propagator. If the motion is not conservative,

| (95) |

is unchanged and

| (96) |

The important distinction to make is that is changing with , not the forms of and . Even if the motion is not conservative, it is still constrained to the manifold with the algebra of on .

It is interesting to note that at the equilibrium points the external forces can not change the system’s energy because and for all .

Now to the solution to the general problem of control. First, it might be necessary to change the reward or potential economic energy function from to using of Eq. (88). This is improving the geometry by changing the location of . The trick is identifying . This can be done by learning the solution to the HJB equation and , that is the energy or economic activity and the canonical generating function. The solution can be harvested for , but more importantly for .

There are two types of , that is equilibriums where

| (97) |

Refer to Fig. 12. Those that are stable equilibriums where

| (98) |

that is local minimums. At some of these points , , and . Nothing further needs to be done in this case of a stable equilibrium. Just put the system close to the stable and the system will oscillate about it gradually approaching due to naturally occurring interactions with an external heat bath, that is the economy external to the sub-economy. These stable equilibrium points are referred to as attractors or o-points. They are the Nash Equilibriums to which the system will naturally descend as it minimizes the value or action functional. Do note that the local minimization of the economic action to accomplish the task (doing the task in the most efficient manner) is leading to a global minimization of the value.

There are also unstable equilibriums where , that is local maximums. These unstable equilibriums are also known as saddle points or x-points or semi-attractors that first attract the trajectory to them with the system staying near them for a long time since (a meta stable state). But, eventually the system will start to move away from the semi-attractor, being repelled away from it. The trajectory will eventually approach and be attracted back to the semi-attractor or might approach and be attracted to another semi-attractor (or several other semi-attractors) before being repelled by the last semi-attractor and returning to the first semi-attractor. An example of a set of two semi-attractors could be a bull and a bear market. These saddle points will need to be stabilized by application of an external force, then cooled by an external thermal force, otherwise the trajectory will evolve into the basin of attraction of a stable attractor and eventually relax to that attractor. While small amounts of energy are needed to move from semi-attractor to semi-attractor, a significant amount of energy is needed to move from one attractor to another attractor or semi-attractor. One needs to climb out of the basin of attraction or potential well, that is climb back up to the mountain pass (saddle point) out of the basin before descending into another basin. When these semi-attractors are stabilized, there is still a local minimization of the economic action to efficiently accomplish the task, but the sub-economy is kept at a global sustainable maximum.

The stabilization and cooling of the saddle points can be done directly via an external feedback force

| (99) |

where and , and is the dominate spectral frequency or the ground state frequency . This is difficult to do because both (which is oscillating rapidly about ) and must be known or measured. It is much better to apply the ponderomotive equivalent and random walk equivalent

| (100) |

where , (so that the ponderomotive force is large but the motion is small) and is a random of size taken every . This external force is not dependant on or , just the time invariant mapping generated by of and , and the functional transformation iPCA+iHST of and or as will be discussed later in this section.

The ponderomotive force can be intuitively understood. The economic system is vibrated more when it evolves in a undesirable direction, and is vibrated less when it evolves in a desirable direction. The system does not like to be vibrated, so a conservative ponderomotive potential is established that leads to a ponderomotive force away from the undesirable states and towards the desirable states.

What the stabilization force has done is to modify and fortify the topology by adding one x-point and one o-point at the location of the original x-point. It has left the o-point where the original x-point was and moved the two x-points out, sandwiching the o-point. This has turned the mountain pass into a high mountain valley. This is shown in Figs. 12, 13, and 14. Note that the Nash Equilibrium at is the point of severe economic depression, the Nash Equilibrium at is the point of economic recession, and the unstable equilibrium at is the point of economic prosperity. It is hard to stimulate an economy from an economic recession to economic prosperity since , but it is very hard to stimulate an economy from a severe economic depression to economic prosperity since . Also note that if the economy is not stimulated enough, so that , the economy will fall back into the recession or depression.

A very profound structure has been put on the dynamics by the sympletic, that is canonical, structure. This symplectic structure can also be viewed as underlying toroidal topologies or cylindrical geometries of extended phase space or . The underlying analytic function will be specified by two types of singular points in the vector field: (1) o-points that are stable local potential energy (that is reward) minimums, and (2) x-points that are unstable local potential energy (that is reward) maximums. The motion is geodesic motion with a metric of the value or action, that is to say the motion takes the path of minimum action (value or rewards or least economic activity or most efficient way to achieve the objective). This asymmetry in stability induces a direction to time and a irreversibility to the motion. The system will relax to states of minimum, not maximum, total energy (that is action or value). This fact can not be altered. What can be altered is the dynamics (topology) so that the state of maximum global (that is total) energy is a state of minimum global energy. Since the Nash Equilibriums are the states of minimum global energy, the topology must be modified so that the global energy maximums are global energy minimums, that is Nash Equilibriums. The topology is modified and fortified by application of the conservative stabilization force. The control force of Eq. (88) enhances the geometry by changing the location of these new desirable Nash Equilibriums. This theory recognizes that systems fundamentally minimize costs, but one person’s costs are the another person’s rewards. In a game, to maximize personal rewards, the game must be played (that is modified) to maximize all players rewards. If the game is played to greedily minimize personal costs, that is to minimize all player’s rewards, personal rewards will be minimized – the unmodified Nash Equilibrium. This is viewing the system as a zero sum game instead of a “rising tide floats all ships” situation. The same is true of negotiations. The best result is a win-win solution, not a win-lose solution. The win-lose situation is really a lose-lose situation.

From the perspective of the electronic currency management firm, the fiscal (investment and operations) and monetary policy has two parts. The first is changing the economic potential or reward to include all benefits and costs to society through application of a control force . The second is stabilizing the economic equilibrium (that is fiscal and monetary policy ) and reducing the economic fluctuations about the equilibrium by applying a stabilizing force, or more likely , through arbitrage trading.

The stabilizing and cooling force is constructed to “fine” any malicious attempt to excite the economic system for financial gain such as a “pump and dump” scheme. Since the controller knows , it will sell high as the malicious entity is pumping and will buy low as the malicious entity is dumping.

Another way of looking at this is that the controller has modified the dynamics to make the equilibrium a ground state. An external system can only excite the conservative sub-system, putting energy into the sub-system. The controller then de-excites the sub-system back into the ground state, taking energy out of the sub-system. The net result is a flow of energy from the external system to the controller – a heat pump of energy from the external system to the controller. The concept of the “pump and dump” is a very interesting and deep subject that is discussed in detail in Sec. VIII.

The problem with current attempts to control complex systems is not knowing what reward the system is naturally optimizing, and not knowing the equilibrium point of the system optimizing (equivalently the equilibrium value or the equilibrium policy ). Knowing both and are essential to controlling the system to optimize and to be stable with minimum fluctuations about the equilibrium where the objective is optimized. The conservative force that must be applied is and the external stabilizing and cooling force is . A simple way to state this is that the controller needs to know what to control about. In this case, it is and or . For the ponderomotive control with , current attempts at control do not know the canonical transformation generated by or the characteristic spectrums that need to be applied to the fields, as will be discussed next in this section.

The inputs (which includes controls) and outputs of the control system may not be and , but functions for inputs and functions for outputs. A straight forward addition can be made to the workflow as shown in Fig. 15. An MLP that approximates the functions and should be added before the control system, and another MLP that approximates should be added after the control system.

Now to the postponed, but important issue, that the system does not present itself in the low finite dimensional dynamical state and canonically conjugate momentum or co-state of the individual, but as an infinite dimensional field and its canonically conjugate field momentum of the collective (Glinsky, 2024d, e), where is the base manifold or space with metric . Another way of looking at this is that nature presents itself as a convoluted form of the dynamical variables that needs to be de-convoluted or decoded into the dynamical variables. It is very common that and , but could be as sophisticated as and (that is relativistic dynamics on space-time). The transformation from the infinite dimensional Hilbert space with coordinates to the finite dimensional space with coordinates , has been an ongoing challenge to physics and complex system analysis. It has manifested itself as the renormalization challenge to physicists that was first addressed by Ken Wilson (Wilson, 1971) and has been the subject of two Nobel prizes. Paul Dirac felt that renormalization is “not a logical mathematical process” (Dirac, 1982). There have been recent developments on this subject that have approached renormalization as a logical mathematical process, culminating in the Heisenberg Scattering Transformation (HST). The HST is a closed form, specified Convolutional Neural Network (CNN) or Wavelet Conditional Renormalization Group (WC-RG) (Marchand et al., 2022) which is a transformation from canonical -field phase space to with coordinates . When combined with the specification of the analytic function or the equilibrium points (topological homology classes) , it is a Generative Pretrained Transformer (GPT) (Li et al., 2022), and when further deployed as a controller it is a Deep Reinforcement Learning (DRL) (Bertsekas and Tsitsiklis, 1996; Sutton and Barto, 2018; Yoon et al., 2021; Wang et al., 2021; Mnih et al., 2015). The HST will be used as a pre-processor, and the inverse HST (iHST) will be used as a post-processor to the previously discussed analysis, as shown in Fig. 16. A detailed discussion of the relationship of our optimal control methodology to DRL can be found in Sec. X, where particular attention is paid to practical differences between our optimal control methodology and DRL.

Details of the HST can be found in Glinsky (2024b). The equation for the HST is

| (101) |

where

| (102) |

and

| (103) |

is the wavelet transform where are a normalized, orthogonal, localized and harmonic (that is coherent states) such that

| (104) |

and

| (105) |

The functions and are the Mother and Father wavelets that satisfy the Littlewood-Pauley condition.

The motion, at this point, has been transformed into the space of all possible local complex spectrums (that is, all possible solutions to the renormalization group equations). This expansion or domain can be interpreted several different ways in addition to as solutions to the renormalization group equations. It can be interpreted as Heisenberg’s S-matrix expansion, as the -body scattering cross sections, as the -body Green’s functions, and the Mayer Cluster Expansion. This is why it has been called the Heisenberg Scattering Transformation. It captures the -body correlation structure of the collective motion. This correlation synchronizes the collective motion so that the collective acts as one. Motion of the system (or variation in ) will be confined to a -dimensional complex linear subspace of the individual motion with basis vectors easily identified by a Principal Components Analysis (PCA). The are the solutions to the renormalization group equations for the field theory with Lagrangian functional . They are also the Taylor expansion coefficients of the action, that is the S-matrix () given in Eq. (91). The motion is projected onto this complex linear sub-space with complex coordinates .

The connection of the HST detailed in Eq. (101) to CNNs can be seen by identifying the iterative deep convolutional structure of the product, the nonlinear activation function , and the pooling operation . The HST followed by the PCA projection to also can be interpreted as the Wigner-Weyl transformation done right (Case, 2008; Wigner, 1932; Weyl, 1950).

It should be noted that the HST followed by the PCA projection to , leads to an analytic with a few discontinuities , in contrast to the original field which is normally very discontinuous. Not making the HST has led to a mathematical industry of diffusive regularizations of the HJB equations called viscosity solutions (Bardi et al., 1997). Unfortunately, the viscosity solutions are based on regularizing the solution by superimposing a diffusive model of risk as will be shown in Sec. IX. The result is an optimization with the diffusive risk plus the true conservative sub-system risk. Since is analytic, and will be very continuous, except for a few points – no regularization is needed. Regularization has been an important part of renormalization in the historical way that it has been done in physics, based on the original ideas of Ken Wilson. The second Nobel Prize was for dimensional regularization by t’Hooft and Veltman (1972) (the first Nobel Prize went to Ken Wilson). The use of the HST in the renormalization regularizes the solution as it reduces the dimension by collecting all the singularities at a few points of the analytic .

What is the solution to the HJB equation given by and , or more practically by , and ? These coordinates are the Reduced Order Model (ROM) of AI.

A fundamental confusion has been thinking that is when it is not. Whereas which typically has equal to 2 to 8 dimensions with stochastic (non-integrable or chaotic), yet differentiable, Hamiltonian (governed by ) dynamics characterized by a few singularities ( or topological homology classes), is a convolutional projection of these Hamiltonian dynamics and singularities onto an infinite dimensional Hilbert space. What are simple isolated singularities on are spread throughout the Hilbert space. This has lead to renormalization procedures that have had to be regularized to collect the singularities into the homology classes of the underlying topology. A has been formally identified in models such as the three dimensional Lorenz system (Lorenz, 1963), but despite this there has continued to be confusion on how a seemingly one scalar field model can be so discontinuous.

Given the theoretical structure developed in this section, the theoretical origins of the diffusive force can be elucidated. First we need to take a closer look at the approximations that are made in the derivation of the Fokker-Planck equation. There are three scales in the problem: (1) the collision scale that will be identified by the subscript , (2) the drift scale identified by the subscript , and (3) the system ground state scale identified by the subscript . These scales are illustrated in Fig. 17. The frequencies or times, and have the following ordering

| (106) |

or equivalently

| (107) |

and

| (108) |